If you want to combine the stability of large-cap stocks and the growth potential of mid-cap stocks in a single portfolio, a stable performer from the ‘large- and mid-cap’ category should be your go-to option. Canara Robeco Emerging Equities is among the top performers in this relatively new category of mutual funds (MFs) that was created after SEBI recategorised them in 2018.

In its earlier avatar, Canara Robeco Emerging Equities was a pure mid-cap fund (launched in 2005). Since 2018, the fund has handled its revised mandate skillfully, and sustained its track record of above-average performance over the years. Large- and mid-cap funds are required to invest at least 35 per cent each in large-cap and mid-cap stocks.

Investors with an investment horizon of at least five years can consider SIP in this scheme.

Performance

Canara Robeco Emerging Equities has outperformed its peers over the past several years. It is rated four-stars under bl.portfolio Star Track MF Ratings.

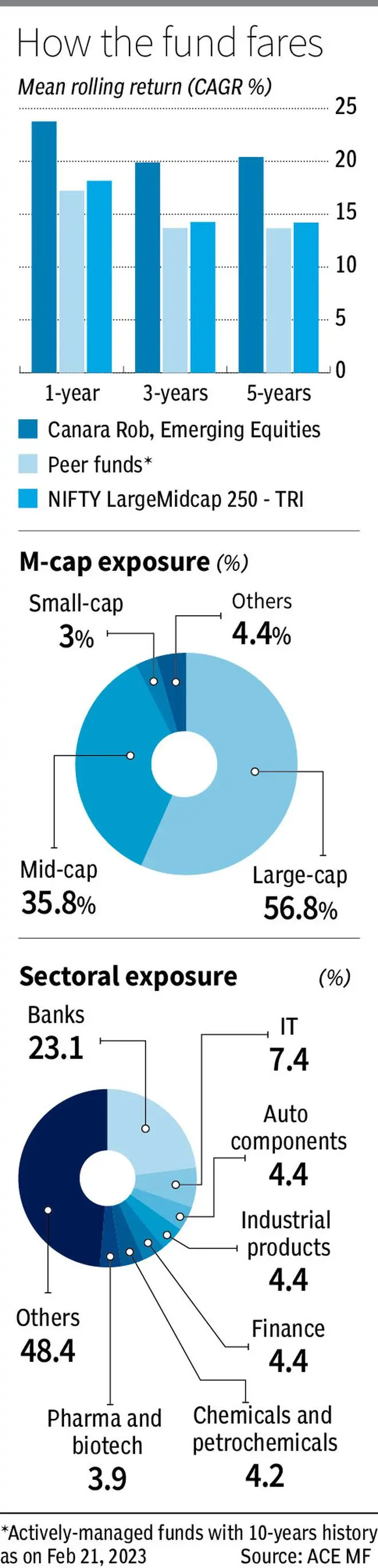

While the past one-year period has seen the fund underperform, on a a rolling return basis it boasts of good performance over three- and five-year period, especially when compared with peers (see table).

On a point-to-point return basis (ended February 21), the fund has either matched or done better than the large- and mid-cap category and S&P BSE Large Mid Cap TRI in three-, five-, seven- and 10-year periods. Over long-term period (five, seven and 10 years), the fund’s alpha over category and the aforementioned benchmark ranged between 70-80 basis points (bps), 260-340 bps and 500-770 bps.

In the last three years, Canara Robeco Emerging Equities has also managed downsides well, courtesy its downside capture ratio (DCR). A DCR of 92.9 per cent for the scheme implies it has fallen less during periods when the benchmark index fell and also the category average (96.7 per cent). This can come handy during negative return periods.

The scheme has also captured more of the upside (UCR of 97.6 per cent) during good times in the same period compared with category average (94.6 per cent). As a large- and mid-cap fund, Canara Robeco Emerging Equities has rewarded investors more for the risk being taken, as evident from its sharpe ratio (three-year monthly) of 0.19, which is higher than category average and in line with similar-sized peers.

Portfolio details

In the past three years, the scheme has typically allocated 48-60 per cent of assets to large-caps (56.7 per cent currently) and 32-44 per cent to mid-caps (35.8 per cent currently). Higher large-cap exposure provides better buffer against sharp market falls. The risky small-cap allocation has been kept within 2-5 per cent (3 per cent current).

The fund prefers robust growth-oriented businesses with competent management at reasonable valuations — blend of growth and value styles. It has consciously stayed away from running after certain market spurs, and is willing to let go of benefits that may come with following herd mentality.

In terms of sectoral calls, the fund has maintained its top preference for banking (23.07 per cent) as it has bet on big private sector banks, select PSBs and NBFCs. There is a 400-basis point increase for banking compared with one year ago. Software exposure, at 7.37 per cent, is second biggest sectoral allocation, but that has been cut from around 10 per cent about a year ago. Finance sector allocation has been cut sharply. Pharma exposure at 3.87 per cent also has seen 100-bp cut. The fund upped exposure to consumer durables, industrial products, industrial capital goods, hotels, pesticides and transportation compared witha year ago. This rejig gives the fund a nice blend of high-beta upside as well a low-beta protection element.

The fund continues to maintain a diversified portfolio of 50-60 stocks. The scheme’s top holdings include HDFC Bank, ICICI Bank, Infosys, SBI, RIL, Axis Bank, Max Healthcare, UltracTech, UNO Minda, Cholamandalam, HUL, BEL, IHCL and Bajaj Finance. It has modest concentrations in its top-three sector exposure and top-10 stocks than peers and category average, which is an advantage in terms of lowering risk. The fund also follows stringent risk control measures such as maintaining liquidity of the portfolio such that at least 60 per cent of it can be liquidated within seven working days.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.