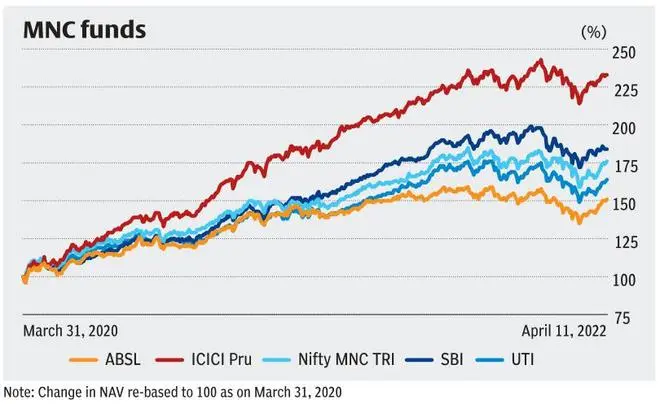

MNC companies listed in India come with an aura owing to high return ratios, strong balance sheets and bench strength in management and product line-up. But since Covid-lows in March 2020, the broader Nifty50 index (104 per cent absolute return) outpaced the thematic index Nifty MNC (68 per cent).

But since March 2020, ICICI Prudential MNC Fund (129 per cent) and SBI Magnum Global Fund (83 per cent) have outperformed the MNC index, showing some strength in the theme. Aditya Birla Sun Life (ABSL) MNC Fund with 47 per cent returns and UTI MNC Fund (58 per cent) though, have lagged the index. The long-term performance across five years also places the funds similarly (except ICICI which has only two-year vintage) - ABSL and UTI funds have lagged the index and the SBI fund has matched the index returns. But most importantly, the index itself has lagged bellwether indices in past five years.

As domestic companies across pharma, FMCG and auto/auto ancillary competed on the domestic turf for a higher share of the market, Nifty MNC index valuations declined from a high 35 times (trailing) in mid-2015 to 28-30 times. Facing slower growth, the risk undertaken by domestic companies in 2015-20 is probably paying dividends currently compared to earlier periods.

How they choose MNC stocks

The benchmark index Nifty MNC comprises 30 stocks where the foreign promoter shareholding is more than 50 per cent. ABSL MNC and UTI MNC funds also follow a similar definition, but replace 50 per cent number in the index with ‘majority’ shareholding requirement. This allows companies essentially managed by foreign promoters even without 50 per cent shareholding into the portfolio – Bayer Cropscience and Fortis Healthcare, for instance.

ICICI Pru MNC and SBI MNC funds have a much broader investible universe. SBI includes companies with more than 50 per cent turnover from outside of India and foreign-listed companies, in addition to foreign ownership. ICICI MNC fund invests in companies with global operations, which may or may not be listed in India. This results in exposure to international companies such as Netflix, Alphabet and Microsoft in SBI’s case and Anheuser Busch Inbev and domestic IT and pharma majors in ICICI’s portfolio.

Essentially, global market performance is also captured by ICICI and SBI, in addition to only domestic performance of foreign companies captured in ABSL and UTI MNC funds.

Fund performance

A study of the performance of funds from the Covid market lows of March 2020 to December 2021, throws up interesting insights. December 2021 has been taken as the end date as it was during this phase that the performance of the funds deviated from the index by at least 2 per cent on quarterly returns basis. In recent times, the deviation is not wide.

ABSL MNC Fund underperformed post-Covid, returning 45 per cent in the period between March 31, 2020, and December 31, 2021, against the benchmark which delivered 62 per cent in the same period. In the period, FMCG and consumer durables holdings including, Gillette, HUL, and Hitachi, impacted the fund performance. The weight reduced by 4 per cent from 17 per cent in March 2020 to 13 per cent by February 2022. Even amongst the top three weights, Honeywell Automation, Pfizer and Bayer Cropscience, only the latter was able to deliver index-beating returns. The lack of IT firms in the mix impacted returns.

In the same period and following a largely similar mandate as the ABSL MNC Fund, UTI’s MNC fund fared better - 55 per cent in the period from March 31, 2020 to December 31, 2021. Its bets on Maruti Suzuki and Ambuja Cements returned generously along with an increasing position in Mphasis as well. The other FMCG holdings of Britannia and Nestle also fared comparatively better than ABSL’s FMCG picks. Still it could not outdo the benchmark index.

The recovery period from July 2020 to June 2021 is when ICICI and SBI’s MNC funds outperformed, returning 57 per cent and 44 per cent respectively, against the index’s 31 per cent returns in the period. This rally for ICICI Fund was aided primarily by the rotation of IT companies in the period - Infosys, Wipro, Tech Mahindra, Oracle Financial Services, and Cyient. In addition to Maruti Suzuki, industrial holdings in Cummins, Metals holdings in Hindalco and Vedanta also contributed significantly to the outperformance. FMCG Holdings from Nestle and Colgate-Palmolive did not figure in the top holdings, avoiding a drag on performance. Even global companies such as Amazon.com, Bank of America and Anheuser Busch figured in ICICI MNC portfolio. Similarly with SBI’s MNC fund, the presence of Alphabet, Microsoft and Netflix in SBI’s portfolio along with Divi’s and Dr Reddy’s from pharma space have driven the outperformance more than FMCG holdings which did figure in the top holdings.

Going by the February 2022 portfolio holdings of the four funds, ABSL and UTI continue to hold ownership-based MNCs in industrials, pharma/chemicals and FMCG stocks. SBI Fund has increased the weights of international tech stocks, Microsoft, Netflix and Alphabet, while ICICI MNC fund has reduced domestic IT weights.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.