It is a well-known fact that MNC stocks listed in India offer an interesting mix of good management, technological edge, high utilisation of capital, strong balance sheet and established brands. But in the last one-, three- and five-year periods, MNC stocks have under-performed large-caps (Nifty 100). Given the current market scenario, if MNC stocks play catch up, investors should bet on a well-performing MNC fund, with a proven ability to cap downside risks.

Investors with medium-risk appetite seeking to buy a compact portfolio of large- and mid-cap focused stocks, with a dash of overseas equity, can consider SBI Magnum Global Fund. One of the oldest running thematic equity schemes, this 28-year offering has a track-record of stable performance. While the MNC fund category performance has been a tale of contrasting fortunes since Covid-lows in March 2020, SBI Magnum Global has held steady even as some peers found the going tough.

Strategy and performance

SBI Magnum Global aims to provide investors with opportunities for long-term capital appreciation through an active management of investments in diversified portfolio comprising primarily of MNC companies. It defines as those with major shareholding is by a foreign entity, Indian companies having over 50 per cent turnover from regions outside India or foreign-listed companies.

The fund invests minimum of 80 per cent within the MNC space. It has the flexibility to invest up to 20 per cent outside the MNC space. Currently, domestic equities account for 76.2 per cent and overseas equities 18.1 per cent and the rest is in cash. The fund follows a bottom-up approach to stock-picking and chooses companies across sectors or market capitalisation.

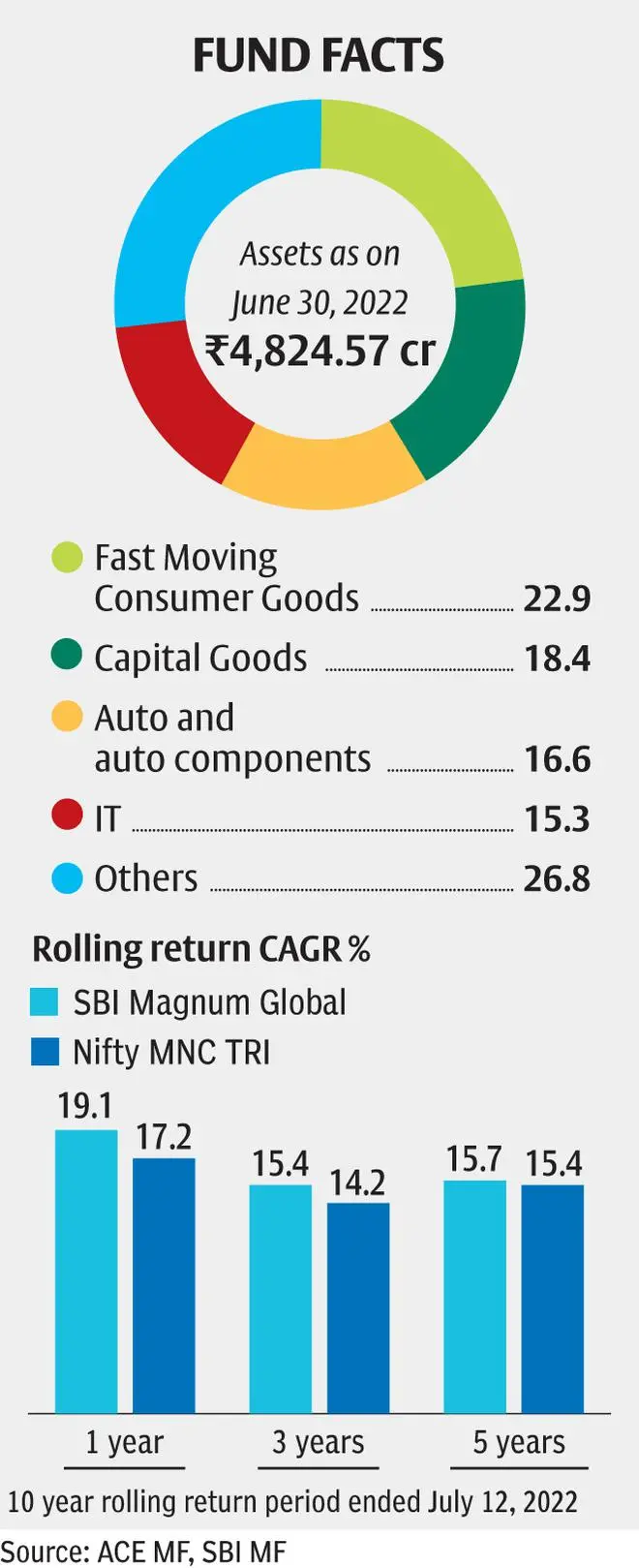

MNC (Nifty MNC TRI) stocks in the last one-, three- and five-year trailing periods have underperformed the broader market. Even in such an environment, SBI Magnum Global has held its fort. Over a decade ended July 12, on a one-year and three-year rolling basis, the fund has beaten its benchmark over 60 per cent of the times (highest among peers) with average returns at 19.07 per cent and 15.39 per cent, respectively.

In terms of downside capture, the fund boasts one of the lowest ratios (79 per cent) compared to 96 per cent for ABSL MNC Fund and 98 per cent for UTI MNC Fund. Alongside, the fund has the lower beta (0.84) as well as standard deviation (16.3) compared to other MNC fund-peers. These risk metrics shore up the fund’s credentials as one with reasonably lower volatility as well as one with a track-record of delivering more predictable returns over time.

Portfolio

SBI Magnum Global currently has a 24-stock portfolio, the most compact among all the MNC funds. Top-10 stocks, including Maruti Suzuki, P&G Hygiene, Grindwell, Schaeffler and SKF, account for 53.5 per cent of assets.

Currently, 22 per cent is in large-caps, 38 per cent in mid-caps, 16 per cent in small-caps and the balance in others, as per ACE MF data. Over the last 12 months, the fund has halved its large-cap exposure, while allocating more to mid-caps and small-caps. At the same time, it hasn't pivoted to a mid-cap heavy portfolio like ABSL MNC Fund (70 per cent).

The fund's top holding is Maruti Suzuki, which is expected to benefit from return of product lifecycle that will drive market share recovery, while strong demand, improving supplies and stable commodity prices propel margin improvement.

FMCG stocks HUL and Nestle, which together make the fund's biggest sector weight, are expected to post price-hike led revenue growth, going forward. The MNC fund's other key sectoral plays are capital goods, auto and auto components, and information technology. If inflationary pressures moderate, domestic growth prospects may not be as bleak with signs of recovery in the residential real estate sector as well as in the manufacturing sector. This can bode well for capex recovery plays.

Compared to MNC category peers, SBI Magnum Global has a higher allocation to consumer staples, capital goods, services and metals/mining. The fund appears less bullish on healthcare compared to peers such as ABSL MNC and ICICI Pru MNC.

In terms of overseas stocks, the fund has 3-7 per cent allocation each to Nvidia, Microsoft, Netflix and Alphabet.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.