Small-cap schemes are all the rage with mutual funds these days. As a category, the assets under management (AUM) in small-cap funds have zoomed nearly 65 per cent in the past one year to ₹1.68-lakh crore as of June 2023.

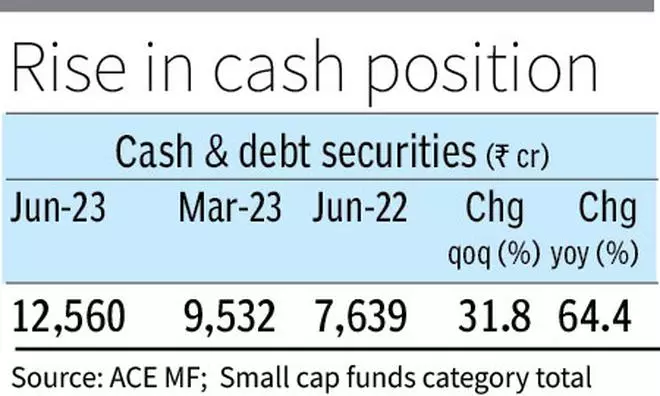

For perspective, the S&P BSE 250 Small Cap TRI is up about 20 per cent in the last one year and about 21.2 per cent in the past three months. In the recent April-June 2023 quarter alone, small-cap funds have received an inflow of ₹11,000 crore and over ₹5,472 crore in June alone. Cash in small-cap funds is at ₹12,560 crore as of June 30 – up 31.8 per cent q-o-q and 64.4 per cent y-o-y.

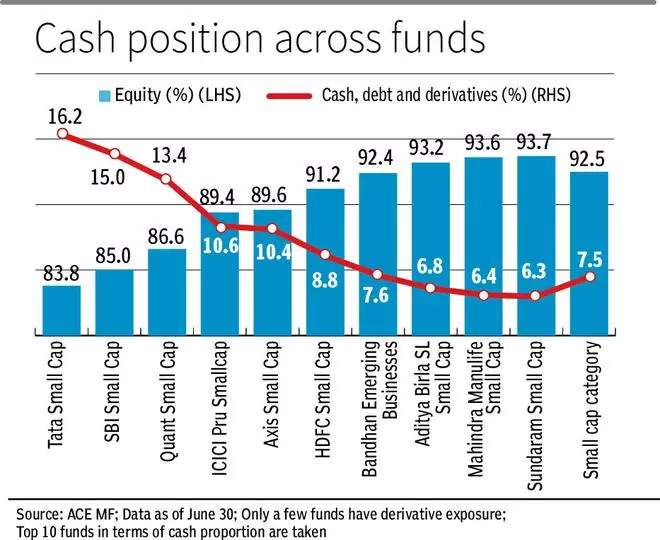

Even as investors pump in cash into small-cap schemes, the fund managers hold cash, debt securities and derivatives (futures) to the tune of 10-15 per cent of several small-cap fund portfolios.

Here’s more on why cash is being moved gradually in the small-cap space by fund managers.

Illiquidity, valuation concerns

It is not that fund managers expect a drawdown in small caps. Apart from the well-understood aspect about illiquidity in the small-cap segment, there are factors such as lack of opportunities and valuation concerns.

R Srinivasan, CIO-Equity of SBI Mutual Fund and the manager of SBI Small Cap says, “We are finding it tough to deploy funds in ideas where we are reasonably comfortable on the risk-return trade-off. While we still have a long list of conviction ideas that we are happy to buy at these levels, the liquidity in these stocks is poor.”

Tata Asset Management’s Senior Fund Manager Chandraprakash Padiyar also emphasises slow deployment of cash. He says, “The small-cap segment by nature is relatively more illiquid where it is prudent to deploy cash gradually to maintain long-term risk reward.”

Fund managers also want to be very prudent while deploying cash, so that the right ideas are bought into. “In exuberant markets such as what we have today, we need to be more disciplined and work harder to find opportunities and deploy money. Periodically, the cash balance may seem high,” says ICICI Prudential Mutual Fund’s Harish Bihani, a senior fund manager. In the recent run-up in small-cap stocks, valuation concerns too have prevented small-cap funds from going all out to buy companies in the segment.

Also read: How to mine for small-cap stocks

Says Shreyash Devalkar, Senior Equity Fund Manager, Axis Mutual Fund,“B2B businesses, which trade at higher valuations, find higher representation in mid-and-small segments. B2B businesses must be evaluated critically for sustainability of earning growth trajectory seen recently.”

Further, the idea of staying true-to-label and not straying too much into mid and large-caps has been a factor.

Bihani says, “We will invest in niche mid and large-cap names which aren’t represented well in the small-cap universe. However, those will be few and far between.”

While only a few funds have derivative exposure, SBI Small Cap holds 7.24 per cent of its portfolio in Nifty Index Futures.

Srinivasan was of the opinion that having Nifty Futures was like buying the market.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.