With corporate credit offtake slowing, retail loans have been the go-to product for banks just before and during the pandemic. When the pandemic was wreaking havoc on jobs and incomes, there were also worries about a bubble brewing in the consumer credit space.

But data from RBI’s latest Financial Stability Report (FSR) show that, while delinquencies haven’t ballooned, banks are beginning to turn more selective with retail loans - reducing approval rates and focusing more on prime borrowers.

Selective on borrowers

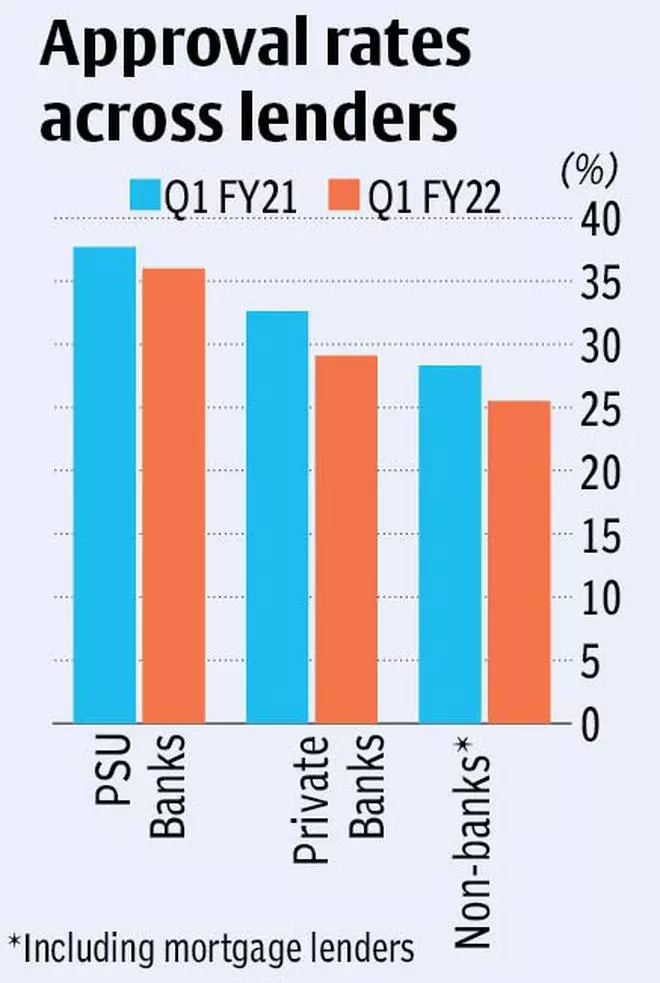

Data in the FSR sourced from credit bureaus show that while there is strong retail appetite for borrowings, bankers are approving fewer loans from retail applicants compared to a year ago. Private banks tightened approval rates at a faster pace, the rate falling from 32.6 per cent in June quarter (Q1) of FY21 to 29.1 per cent in Q1 FY22. For PSBs, approval rates have dipped from 37.7 per cent to 36 per cent, a 170 basis points moderation.

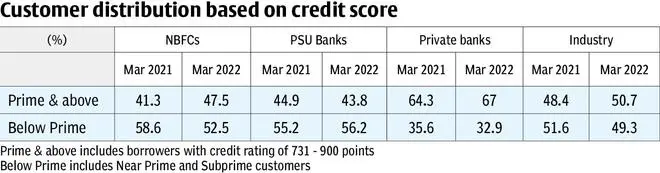

Banks have also been tilting their retail loan mix in favour of prime, prime plus and super prime customers with high credit scores, while pulling back on sub-prime customers. The share of prime and above customers, as a proportion of total credit active customers for banks, has risen from 48.4 per cent in March 2021 to 50.7 per cent in March 2022. Private banks and non-bank financial companies (NBFCs), in particular, seemed to have tightened their credit practices, while PSBs haven’t turned very strict on borrowers’ credit scores yet (see table).

Bankers say that this tightening could be on account of banks’ worries about the impact of rate hikes on retail borrowers and its impact on delinquencies. With RBI pushing for external benchmark-linked loans, the transmission of rate hikes to borrowers is now quicker. A survey in the FSR shows that 43.6 per cent of aggregate bank loans were linked to external benchmarks by March 2022 compared to just 9.3 per cent in March 2020. Private banks have higher exposure to such floating rate loans, with over 60 per cent of their loan books linked to floating rates.

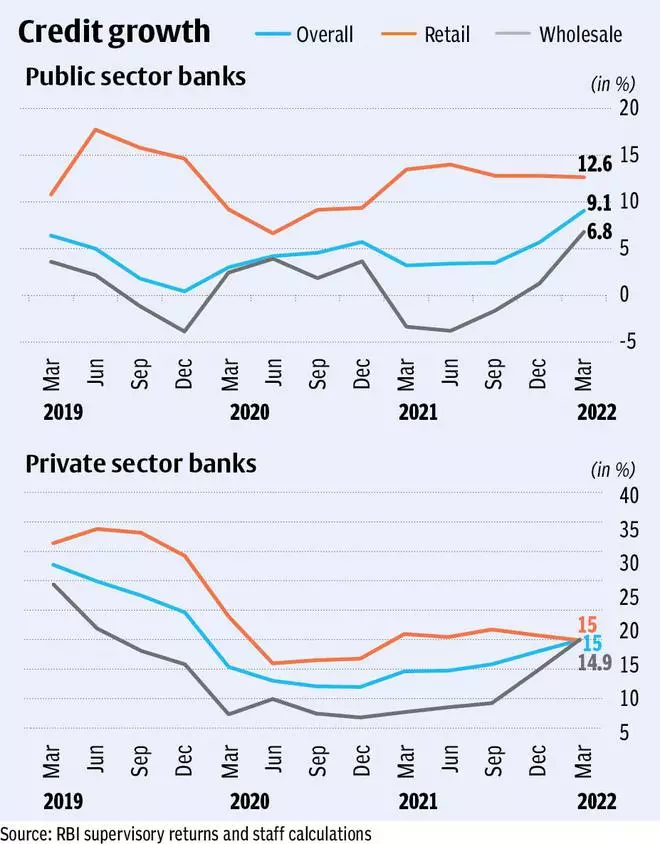

“In anticipation (of rate hikes), private banks took the foot off the pedal on retail loans since December 2021, as repricing them would be a challenge vis-à-vis corporate loans,” observed a banker. This trend is expected to continue until repo rates normalise. In fact, the pull-back of private banks in the retail space reflects in their loan growth, which has halved from over 30 per cent in FY19 to 15 per cent in FY22. However, PSBs who joined the retail party only since FY18, are still going strong on the retail segment. Their retail loan growth has increased from 10 per cent in FY19 to 12.6 per cent in FY22. Incremental credit growth for both PSBs and private banks from corporate loans has been catching up with consumer loans.

Elevated NPAs

The FSR points to a big improvement in the overall asset quality of the banking system, with aggregate gross NPAs down from over 9 per cent in FY19 to 5.9 per cent in FY22. Stress in wholesale loans (loans above Rs 5 crore) has seen the sharpest fall, with gross NPAs moderating from 14 per cent in FY19 to 7.7 per cent in FY22. Retail loans have seen some moderation in NPAs, but not at the same pace.

At 4.1 per cent gross NPAs in March 2022, retail loan NPAs remain about 110 basis point above pre-pandemic levels in March 2019. While corporate loans haven’t seen much restructuring during the pandemic, 2.4 per cent of retail and MSME loans respectively have undergone restructuring under RBI’s Covid guidelines. While private banks fare better with just 1.4 per cent of their advances restructured, PSBs have been more liberal in accommodating their borrowers, their restructured book at 3.4 per cent.

Going by these trends, PSBs have more reason to turn cautious on retail loans, as they have a higher proportion of borrowers with low credit scores and also seem to be sitting on a higher share of the restructured book. But that said, given that much of their earnings growth has been driven by lower provisioning costs in recent times, trouble in the retail loan space could disrupt the positive earnings trajectory for all banks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.