MRF, the largest tyre manufacturing company, is the first company in India to breach ₹1,00,000 per share milestone. Globally, every index will have a set of companies which do not dilute their shareholding leading to such big numbers — Berkshire Hathaway’s Class A shares trading at $5,09,000 per share in New York stock exchange or ₹4.2 crore per share, is an example.

The reason for such a large ‘ticket’ size has to do with equity share dilution or, in this case, the absence of it. Fresh share issues, bonus, splits, and conversions may or may not increase share capital but increase the shares outstanding and hence lower the share price. Not surprisingly, the number of shares outstanding for MRF has not increased from 2005 to now and is at a constant at 42.4 lakh shares.

Also read: MRF Q4 net nearly trebles, pays ₹169 a share

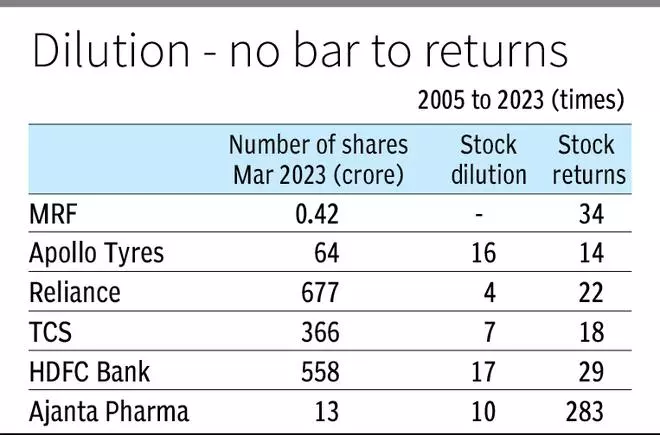

In comparison, Apollo Tyres’ shares outstanding increased to 63 crore shares from 3.83 crore in this period, but with 60 per cent of market capitalisation of MRF. Apollo Tyres shares outstanding have thus increased by a factor of 16 times.

For perspective, Reliance Industries has increased share count by 4 times in the same timeframe and TCS, by by 7 times. HDFC Bank, with a constant need to raise capital, has had share count increase by 17 times since 2005 .

Implications for retail investors

First, it is worth nothing that share dilution (and hence lower share price) and share price returns are not essentially corelated. Reliance Industries with 4 times dilution has returned 22 times from March 31, 2005 until now and HDFC Bank with 17 times dilution has returned 29 times.

MRF, which has not diluted so far has returned 34 times in the period compared to industry peer Apollo Tyres which returned 14 times. A typical multibagger, Ajanta Pharma diluted by a factor of 10 times and has returned 283 times in the period.

Secondly, if retail shareholders will have to shell out ₹1 lakh to invest in one share of MRF now, it implies that MRF may end up taking 10 per cent or more of an investor’s equity portfolio if the size of the portfolio is below ₹10 lakhs. This can imply concentration risk in the portfolio.

But if the investor’s portfolio size is much larger, MRF will be just another stock in the holdings and may not be anything special. That said, with a historically low dividend yield track record, ( latest dividend yield of only around 0.18 per cent), dividend investors will have to look for capital appreciation essentially.

Three, lower share price does not necessarily drive higher retail participation. While total public and others shareholding for MRF has declined from 35 per cent in March 31, 2005 to 23 per cent in March 31, 2023, even for Ajanta Pharma, the retail shareholding has come off from 29 per cent to 7 per cent now.

All the other companies with share dilution mentioned above have seen lower retail participation by 100-200 basis points in the period. This implies that the lower participation should be ascribed to other factors and not lower share price. MRF promoter share meanwhile has stayed constant at 27 per cent.

MRF’s valuation

Finally, coming to the valuation, MRF can be a bit of an expensive stock in its peerset, as it trades at 26 times FY24 earnings compared to the peer range of 16-18 times. However, this valuation is not because of the share price alone. Even compared to peers, MRF’s premium valuation can be ascribed to its ‘industry leader’ status rather than its ‘high priced’ status.

MRF was trading at an average of 20 times one-year forward earnings in the last 10 years. Supported by a revival in the auto cycle and better replacement demand, the valuations improved to 30 times forward earnings from late CY22 to early CY23 and only recently corrected. The expected improvement in raw material costs aiding improvement in EBITDA margins to 15 per cent range in FY24 from 11 per cent currently is also baked into current valuations.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.