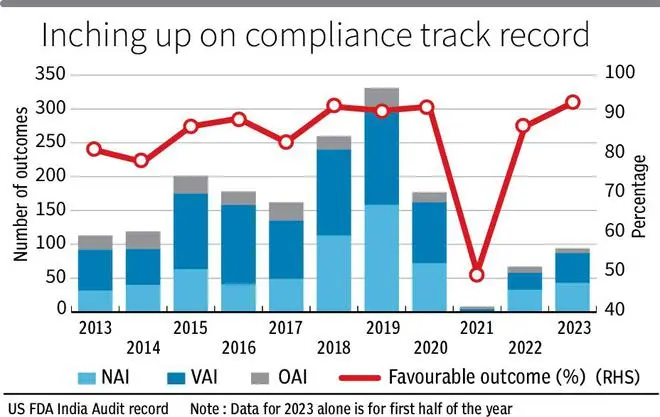

Despite the US market accounting for a third of revenues, Indian pharma companies have not experienced an increase in favourable outcomes from USFDA audits.

But this could be changing. In the first half of 2023, about 93 per cent favourable outcomes have emerged, on a base of 94 visits. This ratio averaged at 83 per cent in the last decade. USFDA audits typically result in either favourable outcomes NAI (No action indicated) and VAI (Voluntary action indicated) or an unfavourable outcome-OAI (Official action indicated), which is later followed by warning letter.

A portion of Nifty Pharma’s 15 per cent recovery YTD can be attributed to lower overhang of plant issues impeding launch plans. Even recent stock returns point to a period of improved expectations on this front. Nifty Pharma, after the post-Covid run-up, declined 20 per cent from October 2021 peaks to December 2022 low and thereafter, has recovered 15 per cent to date. A portion of the recovery can be attributed to lower overhang of plant issues impeding launch plans, driving earnings or multiple expansion.

Also read: G20 offers immense potential for Indian pharma industry: Pharmexcil chief Uday Bhaksar

That said, the compliance rate in India has room for improvement. USFDA inspections in the US in the last five years average at 2,400 per year, with a favourable outcome ratio of 96 per cent.

Who’s improved?

Currently, Aurobindo Pharma joins Dr. Reddy’s and Zydus Lifesciences in reporting better compliance record. During 2020-22, Aurobindo facilities witnessed two warning letters, several OAIs and 10 to 14 observations per visit. However, as of Q4FY23, one API unit (out of eight) of Aurobindo had received a warning letter, and all eleven of its formulation units received a VAI classification. But with a wide array of plants, Aurobindo’s compliance risk remains. A recent inspection of the API unit in Anakapalli resulted in four fresh observations and remains to be seen how it may be classified by US FDA.

Zydus Lifesciences ’ nil observations at Ahmedabad this year and a VAI classification for Moraiya last year significantly decreases compliance risk. Previously, a warning letter to Moraiya in 2019 resulted in launches being held back. Similarly, for Dr Reddy’s , frequent compliance failure at the Srikakulam and Duvvada units had impacted launch plans for more than three years for the company. Both the facilities have been clear in the last one year.

Assuming a 2-year inspection frequency mandated by the FDA, the recent clearance paves way for reduced compliance risks in the medium-term for facilities that have been cleared.With a 2-year inspection frequency for FDA, the fresh clearance paves way for lower compliance risk in medium-term for cleared facilities.

However, other players have not had it easy.

Overhang for some

Sun Pharma’s Halol unit received import alert early this year and a temporary halt in exports to the US from Mohali (acquired as part of Ranbaxy acquisition). The company’s shift to specialty revenues though, limits the impact of such classification for Sun as it moves away from generic production.

Lupin reported six favourable outcomes in the last two years. But with its key plants under the lens currently, the impact on operations will be significant. Pithampur (10 observations in March 2023), Manideep (8 observations in November 2022), and Tarapur (warning letter in September 2022) will also cost the company more than ₹150 crore a year in remediation related costs which can be contained significantly on clearance.

Cipla’s gAdvair, which should net the company more than $30-50 million per year, may be held back till it clears observations received in February on its Pithampur unit (eight). Its Goa plant, which has an OAI status, doesn’t help either. Glenmark Pharma reported three warning letters in the last nine months for Baddi , Monroe and Goa plants, making US recovery an uphill task.

Also read: Indian pharma industry embracing digital transformation, joins global “lighthouses”

These companies have made investments to keep up with evolving USFDA standards. Plant restructuring to overcome Nitrosamine impurities is an indicator. But with a strategy that is heavily invested in the US, compliance track record should elevate to consistently higher levels for all companies.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.