The top five gainers of the week from the BSE 500 index were Suzlon Energy (27 per cent), Mazagaon Dock (23 per cent), Tata Teleservices (22 per cent), Torrent Power (22 per cent) and Hindustan Aeronautics (18 per cent).

The Sensex and Nifty-50 reported gains of 0.1 per cent and 0.2 per cent, respectively, last week. Of the major indices, BSE Capital Goods gained the highest at 5 per cent, followed by BSE Power (3.4 per cent). Most sectors ended in green. BSE IT and BSE Teck led the losses, declining 2.5 per cent and 2.1 per cent respectively, followed by BSE FMCG, which declined by 1 per cent.

The fundamental reasons underlying the rally in the top three stocks in the week.

Suzlon Energy

The stock gained 27 per cent in the last week, following the results announcement. The company crossed the milestone of installing 20GW of wind energy capacity, spanning 17 countries in six continents. This places the company in a leading position to gain from future wind energy installations, internationally and in India. The Centre is targeting 500 GW of non-fossil fuel-based capacity by 2030, of which 100 GW should be from wind energy – more than double the current installed capacity. This implies close to 8 GW of installations annually, which should support high utilisation of capacity. Suzlon Energy reported an order book of 1.5 GW as on May 2023, and it aims to retain 25-30 per cent market share in new installations domestically. The company also commercialised its 3 MW turbine platform during the year.

The company also reported an improved balance sheet. As of March 31, 2023, net debt stands at Rs 1,180 crore, which is a 90 per cent reduction from three years ago. The company returned to profitability after a gap of six years in FY23 and expects to maintain an 8-9 per cent operating margin in the future.

Also read: Renewable energy. Suzlon bags 99-MW wind energy project from Vibrant Energy

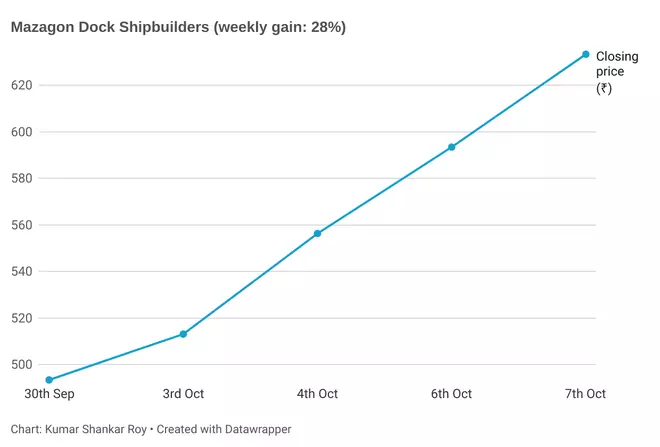

Mazagaon Dock

The Central Government company gained 23 per cent last week, following its results and strategic announcements. It reported 37 per cent YoY revenue growth in FY23, a 400 bps improvement in EBITDA margins, to report a 83 per cent YoY growth in PAT.

The company has a strong order book of ₹38,755 crore, which is five times the revenue reported in FY23, and the company expects to maintain 8-10 per cent revenue growth on the higher FY23 base for FY24. The delivery schedule includes two P15B Destroyers.

The company also inked an MoU with Thyssenkrupp Marine Systems for the manufacture of non-nuclear submarines. The German company would provide consulting, engineering and design for the project, while Mazagaon Dock would manufacture the same. This is aimed at Indian Navy tenders for submarines, with a deal size north of ₹43,000 crore.

Tata Teleservices

BSNL’s late foray into 4G services is expected to boost the company’s prospects. The company stock gained 22 per cent in the week. The momentum started from Wednesday when the Union Cabinet approved a revival package of ₹89,047 crore for the roll-out of 4G/5G services, starting with the latter.

Tata Teleservices being a telecom equipment vendor is expected to gain from the transformation. The telecom vendor space is attractive right now with China-based Huawei and ZTE not receiving the trusted source certification. BSNL issued a purchase order to Tata Consulting Services for installation of 1 lakh 4G sites. The ₹24,500-crore contract to the group company is expected to rub off on the prospects of Tata Teleservices, supporting the rally in the past week.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.