The past years have been transformational for speciality chemicals players, and the narrative in Q4FY23 results points to continued growth in some areas, while challenges are emerging in a few areas. Capex plans continue to be on the higher side, supported by past capex bearing results. New product lines and categories are being added across companies, but some existing lines may face volatility in the short term. We have analyzed the fourth quarter results of the five largest companies in the sector for a consolidated view.

Demand for value-added products

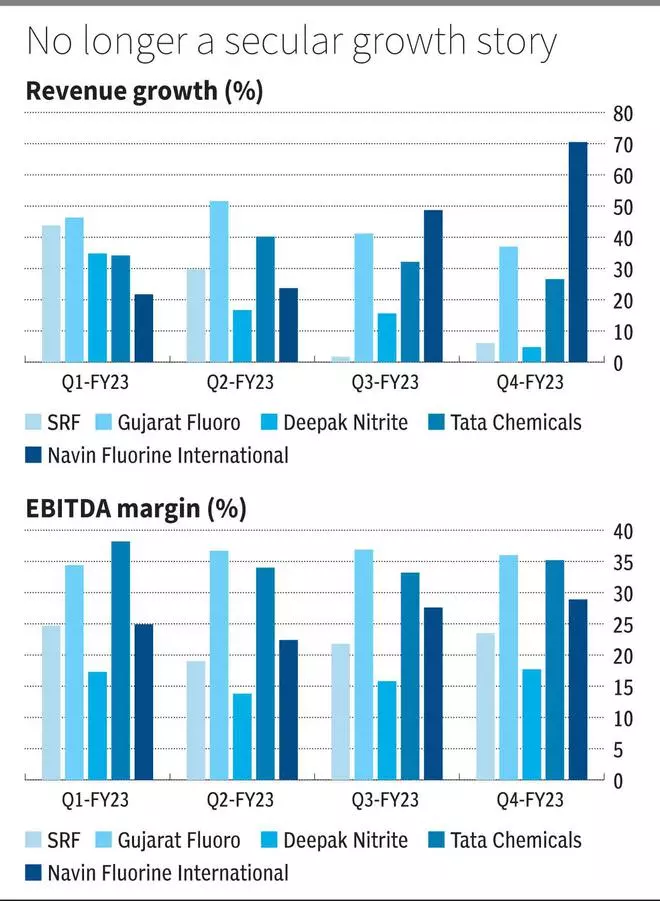

The big five – SRF, Gujarat Fluorochemicals (GFCL), Deepak Nitrite, Tata Chemicals and Navin Fluorine – in order of market capitalization, have reported divergent revenue growth ranging from 5 to 70 per cent YoY in the fourth quarter. In SRF and Deepak Nitrite, which reported lower revenue growth, the main segments (speciality chemicals and phenols, respectively) continue to deliver double-digit growth with weakness in other segments, resulting in 5-6 per cent YoY growth on a consolidated basis.

Value-added products, including refrigerant gases, contractual products and downstream applications, reported strong demand visibility. Refrigerant gases gained from shortage-related price hikes in the past. But as developed markets phase out production and consumption, global demand for the same from Indian manufacturers should sustain. Companies offering contractual development (CDMO) – SRF and Navin, reported operationalising client/product-specific plants with visibility of continued additions into the future. Flourine-related chemistries spanning SRF, Navin and GFCL continue to have strong demand visibility.

On the contrary, industry-specific, commoditised product lines – textiles, packaging for SRF, dyes/pigments for Deepak Nitrite, consumer discretionary for Atul and Aarti or even generic agrochemical/pharma intermediaries manufacturers, reported a weak demand environment. High-interest rates, channel stocking or inventory rationalisation could be seen as a reason. While volume growth may be positive, pricing may remain weak through FY24. This should moderate consolidated margins in the short term from earlier higher levels.

Capex remains secularly high

Speciality chemicals, a capex-driven narrative, continue to be in a high investment mode. GFCL has added fluoropolymer lines and expects a significant contribution from FY25. The company is investing ₹1,000 - ₹1,500 crore per fiscal in FY22-24, and the capex will be focused on fluoropolymers. SRF will be operationalising its first line of fluoropolymers in H2FY24 and is eyeing products further down the line. New dedicated lines for advanced intermediaries in agrochem and pharma will be added along with new-age products for SRF. Navin expects a higher run rate of existing CDMO plants and expects to add furthermore. All three companies will add higher capacity for refrigerant gases, potentially leading to overinvestment in the space if the volume growth does not pan out (companies are confident of demand strength, though).

Deepak Nitrites is also eyeing capex of ₹2,500 crore over the next three years, which should improve its phenols business-related downstream applications and backward integration. Similarly, Tata Chemicals which also operates at the base chemicals level, plans on ₹2,000 crore capex for the next three years, which should improve soda ash, sodium bicarbonate and silica capacities. Similar to complex fluoropolymers of other companies, Tata Chemicals base products are also eyeing a multifold growth in solar, electric vehicle, fuel cells and other new age applications for growth in demand. On the other hand, capex plans of companies reliant on commoditised products, which are facing a short-term slowdown in demand, may face lower returns from invested capital if the slowdown extends beyond the short term.

The valuation range of the sector is wide, starting from 23 to 46 times FY24 earnings (excluding Tata Chemicals, which trades at ten times owing to its basic chemicals nature). The higher-than-market range (18-20 times FY24 earnings for Nifty) is owing to the capex mode the companies are in. We recently recommended investors accumulate SRF. Earlier, we also recommended investors buy GFCL stock when trading at₹2,770. The stocks are trading at reasonable multiples given growth prospects (23 times for GFCL and 30 times for SRF), operate at the upper end of the value chain, and invest in the right areas (away from consumer discretionary space facing lower demand). But one must constantly monitor the ‘new demand’ from Europe, import replacement, and new clients/products to justify the valuation range.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.