It’s that time of the year when taxpayers feel overwhelmed by the thought of filing their tax returns. While those who are a bit tax savvy can amble along the Income Tax (IT) department’s portal, that may not be the case with a large majority of people, even if the portal has become more taxpayer-friendly over the years.

What’s the way out then, you ask? Enter ERIs or e-Return Intermediaries. ERIs are software-enabled platforms that are authorised to file ITRs on behalf of taxpayers online. Quicko, Clear, TaxBuddy, myITreturn, EZTax and Tax2win are some of the ERIs. These ERIs claim to make tax filing a walk in the park with just three simple steps: Autofill -> Review -> e-File. Are these platforms for you? Should you go with them? Let’s explore.

Convenience

Since these are online platforms, they offer taxpayers the comfort of doing their taxes at home. The UIs (User Interfaces) of these platforms are aesthetic, contemporary and welcoming. And most of them offer the convenience of mobile apps. Paying taxes now is easier than ever with apps such as Quicko’s Glyde enabling income tax payment using India’s ubiquitous payment method – UPI.

All a taxpayer has got to do is have the following in hand before initiating the process on the platforms — PAN, Aadhaar card, bank statements and Form 16. These documents are sufficient in most cases for individuals earning a salary. In case a taxpayer has capital gains from sale of shares and mutual funds, these platforms have tied up with leading brokers. On authorisation by the taxpayer, data from the broker’s servers will be requested and populated in the income tax calculations automatically. So, it could be handy to choose an ERI who has a tie-up with your broker.

Wide gamut of services

ERIs offer a rich array of services, integrated with the process of return filing. These include assistance in choosing a regime that will be beneficial for the taxpayer and choosing the appropriate ITR form automatically according to the taxpayer’s income profile. The ERIs cater to the entire spectrum of income profiles — right from simple salary income to the intricate F&O income and income from foreign assets. End-to-end hand-holding is assured, with e-verification too happening on the platform itself. Platforms such as TaxBuddy go a step further and offer free notice handling services, if at all the IT department shoots one to the taxpayer after the filing of ITR on TaxBuddy’s platform.

There are two kinds of filing that a taxpayer can opt for on these ERI platforms. One is the DIY kind and the other is assisted filing, where the taxpayer will be guided by experts on the platform. These experts are professionals with expertise in the field of taxation, including Chartered Accountants. The taxpayer can schedule a virtual meeting with an expert and receive advice or get her ITR reviewed for accuracy.

Additionally, the ERIs extend value-added services, such as assisted payment of advance tax and investment planning for tax deductions such as life insurance premium and NPS (National Pension Scheme). A taxpayer can purchase life and health insurance, tax saver deposits, ELSS mutual funds and even contribute to NPS on Quicko’s platform itself.

Pricing

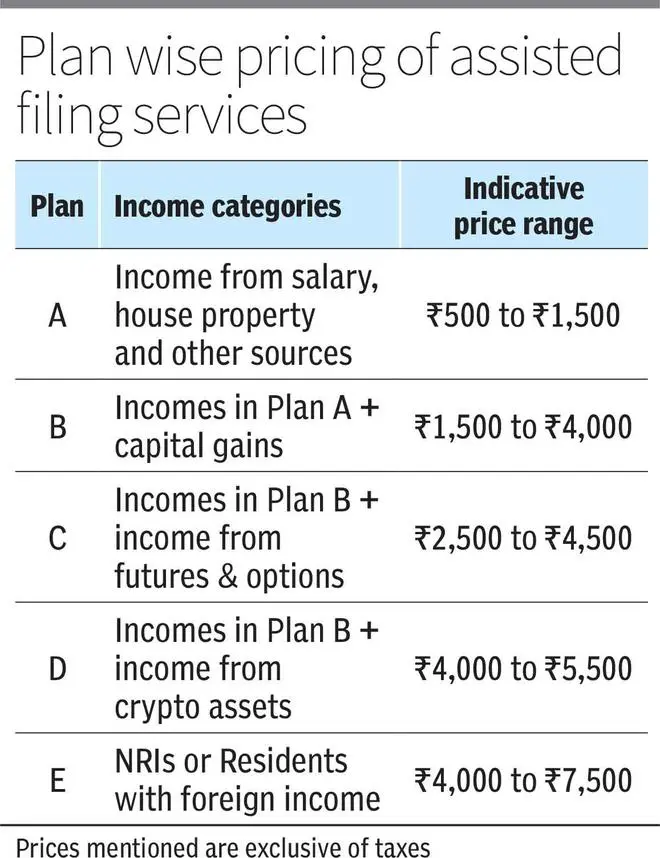

The prices of these services are pocket-friendly too, costing the taxpayer, in some cases, as low as a cab ride. DIY filing starts from a modest ₹200 and goes up to ₹1,600, depending on the income profile. There are platforms that offer DIY filing for free, too. Assisted filing with experts costs a bit more (see accompanying table).

Literature

Taxpayers who are curious, inquisitive and who intend to do their taxes on their own aren’t left high and dry either. Almost all these ERI platforms have a YouTube channel that hosts a plethora of Tax Filing: 101 and ‘How to’ videos. There are not only videos on how to use their platform, but also others explaining how to navigate the IT department’s portal for various needs. Videos that deal with explainers on personal finance concepts can also be found. Besides, the websites of these ERIs host blogs and FAQs.

Data security

Obviously, ERIs deal with gigabytes of sensitive financial data of millions of taxpayers. Hence it is important to check whether the systems of these platforms carry a reasonable degree of sophistication, when it comes to data security and privacy. Privacy policies of most ERIs promise the taxpayers that their data would not be sold or shared with third parties. ERIs do invest adequately in the security of their systems and servers. They meet industry standards and boast of ISO certifications. Clear’s systems, for instance, have been subjected to multiple VAPT Audits (Vulnerability Assessment and Penetration Testing).

The bottom line? While parting with your tax rupees can be hard, filing ITRs with ERIs may not be so.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.