One needs to build a large corpus through one’s working life so that an equally-long retired life can be spent without any financial hardship. The commitment to such plans, stretching over decades, can be hard to maintain without a firm grasp of the various factors involved. Here’s what you need to know about accumulating for retirement by factoring in your individual risk appetite.

Life expectancy

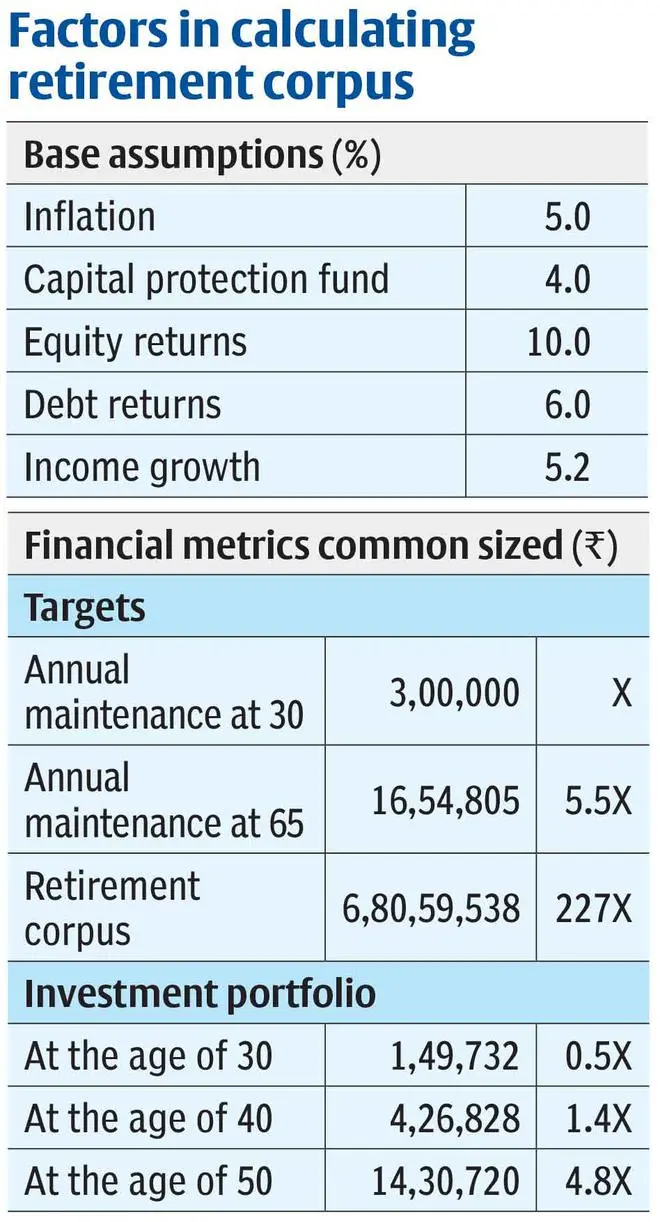

The maintenance amount required in 20-40 years can be calculated by applying inflation to that amount. The typical maintenance amount of ₹3 lakh (X) per year (₹25,000 per month for a 30-year-old) will translate to ₹16 lakh by the age of 65, if inflation is assumed to be 5 per cent per year. At an inflation of 6 per cent, it will be 7.7X (₹23.1 lakh) and 3.9X (₹11.8 lakh) at 4 per cent inflation.

This is just the annual maintenance and still not the retirement corpus. To generate 5.5X (₹16 lakh) every year from the age of 65 to 100 years, which should pay out at an inflation rate of 5 per cent, from a fund that generates returns of 4 per cent per year (-100 bps to inflation, conservatively), the retirement corpus should be 227X (₹6.8 crore). By having invested 227 times current annual maintenance after 35 years in a low-yield bond, the 30-year-old can survive his/her retirement’s 35 years, given inflation stays below 5 per cent.

One can assume a shorter life expectancy of 90 years, which lowers the required fund to 156X (₹4.7 crore), but retirement planning has to err on the side of longevity as the main risk is outliving the fund.

The current annual maintenance amount (₹3 lakh) at the heart of all the assumptions does not include housing and insurance costs, which should be arranged by the individual. The 227x would be similarly applied to current-year rentals and a lot more to spare for meeting medical emergencies, if not done so. The current dispensation, inclined towards not owning a house, egged on by various financial industry experts, might prove prohibitively expensive at retirement. Similarly, one should have tied down a comprehensive health insurance and completed waiting periods with accumulated bonuses by retirement.

Building the corpus

Just as compounding inflates the corpus to 227x times on retirement day, one should employ the same compounding to generate such funds during one’s iworking life. Compounding needs time to work its magic, hence the general refrain on investing is to start early. The investment avenue itself can be divided into equity and debt, with base assumption of returns at +500 bps/+100 bps premium over inflation from equity and debt respectively.

Over long stretches, equities have provided low double-digit returns and debt investment should provide a premium over inflation. But the critical aspect is the split of investment between the two. Assuming an aggressive 90/10 equity/debt split at the age of 30 and slowly moving towards an exact reversal of allocation by age of 65, and with the above-mentioned returns, the 30-year-old should invest 0.5X (₹1.5 lakh) every year into his/her portfolio to generate the retirement corpus of 227X (6.8 crore) by the age of 65.

Assuming components of annual income as maintenance, savings and 40 per cent allocation to housing, insurance and others, the portfolio allocation of 0.5X would translate to 20 per cent savings rate. The above also assumes income growth at 20bps above inflation or 5.2 per cent. The high growth in equity, high proportion in equity and increasing income, hence savings, are generating such compounding effects. If one invests entirely in equity or entirely in debt all through the build-up phase, the investment at age of 30 would be .4X (₹1.15 lakh) or 0.86X (₹2.6 lakh) per annum. But one is extremely risky and the other sub-optimal for any risk profile. One should ideally be placed between the two extremes, and according to personal risk aversion.

If the same 30-year-old decides to start retirement planning by age 40, with a similar equity-debt split, the required investment amount (to generate 227X by 65) would increase to 1.4X (₹4.27 lakh). By missing a decade of investment returns, the portfolio would demand a higher outlay of 35 per cent savings (assuming same annual maintenance at X or ₹3 lakh). At the age of 50 the portfolio required moves to 4.8X (₹14.3 lakh) or 50 per cent savings rate.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.