Sankaran wanted to check if he could afford his daughter’s dream of pursuing PG in US/Europe and how it would mpact his finances.

Sankaran, aged 54, will be retiring in the next 4 years. He had been following a financial plan to achieve his goals for the last 12 years. Most of his high-priority goals stand adequately funded on review. His daughter Sanjana was doing her 3rd year B Tech in Chennai. She wanted to pursue MS in US/Europe after completion of undergraduation. Sankaran was keen on supporting this particular goal. The earlier plan had no place for this goal and funding was directed towards his daughter’s marriage, instead. He did not foresee any requirement to fund PG education abroad.

With her passion for latest technologies and developments, Sanjana had a good chance to get admission for her Masters. We estimated the cost to be ₹50 lakh for a 2-year course. She would need additionally ₹25 lakh for her initial expenses and stay and meal plan for two years in the US. If she opted for Europe instead, the cost would come down by ₹15 lakh. As she favoured the US over Europe for higher studies because of better employment opportunities, it became necessary to work for a total current cost of ₹75 lakh.

Sankaran had been funding Sanjana’s marriage goal for close to 10 years and had ₹40 lakh across multiple instruments mapped to the goal. He wanted to check if he could afford her PG without disturbing his retirement plan. He was willing to reorient the marriage fund to PG needs. His financial assets towards marriage goal were found to be valued at ₹28 lakh out of ₹40 lakh and he was saving ₹50,000 per month through mutual funds, in addition.

With a savings o₹50,000 per month along with a portfolio valued at ₹28 lakh, he was found wanting with respect to the PG goal. After introspection, the following suggestion was given.

“Sanjana to opt for an education loan for ₹50 lakh. The first-year disbursement should be ₹30 lakh and the balance in the subsequent year. Education loans have a total tenure of 10 years including the course years and a moratorium period of 6 months. Hence, for the first 30 months, Sankaran needs to take care of just the interest payment. Sanjana also agreed to repay the educational loan by herself after completing her studies.”

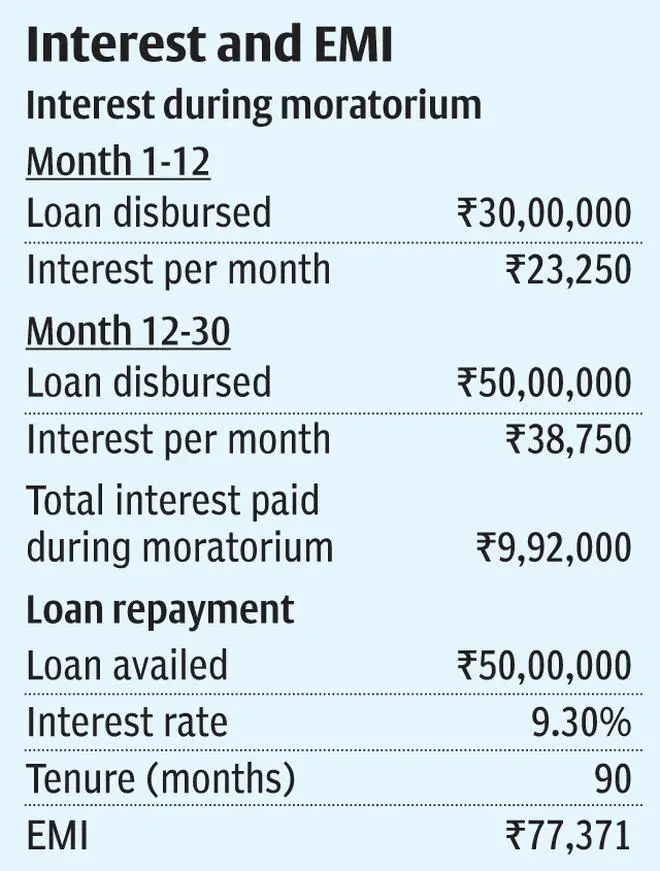

Sanjana was advised to go in for an education loan of ₹50 lakh with her father as guarantor. She availed the loan for a tenure of 10 years with actual EMI starting from the 31st month. For the first 12 months, interest would be charged for ₹30 lakh at 9.3 per cent per annum and for the next 18 months, interest would be charged at ₹50 lakh. Total interest for the entire 30 months was found to be ₹9.92 lakh. This was affordable for Sankaran as he would be redirecting his savings towards the marriage goal to fund this interest costs.

From the 31st month, actual EMI of ₹77,400/- would have to be repaid by Sanjana with the assumption that she will find employment by then to fund this repayment. Sanjana, who was confident of finding financially rewarding job opportunities, would be in a position to close her educational loan earlier.

Initial expenses of ₹7 lakh along with living expenses estimate of ₹75,000 per month for Sanjana for the first 24 months could be funded from the current marriage portfolio.

Though this plan ensures that Sankaran is not using his retirement bucket for this goal, it comes with a sacrifice – to let go of a portion from the marriage expenses portfolio. Sankaran and his wife agreed to reduced expenses for their daughter’s wedding, which was acceptable to Sanjana too. He agreed to allocate a reserve fund to ward off the risk of currency depreciation and unexpected increase in expenses in the US, for Sanjana. This was allocated from his other savings and could be used only if needed.

As Sankaran is a disciplined investor, he wanted to increase his savings to the maximum possible extent to fund the deficit in marriage portfolio in the next 4–5 years. That would be a good approach too.

Sankaran’s challenges illustrate that it is not enough to address high-priority goals. Alongside, one must provide for uncertain requirements. If unexpected expenses don’t come about, then wealth gets created in the process. As the famous adage goes “There is nothing certain but the uncertain”! Preparing for uncertain requirements is indispensable.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.