Kesav and his wife Rekha want to plan their retirement income from their accumulated savings and investments. They live in a tier-2 city and their expenses are reasonable considering their living standards.

Kesav retired recently and received a lump sum of ₹40 lakh from his employer as other retirement benefits. He also encashed his provident fund last month.

His goals are as listed below:

· Ensuring a fixed monthly income of ₹50,000 in a tax-efficient manner

· Kesav seeks certainty in his income stream for all his regular expenses

· Rekha wants to set side sufficient funds for their health needs while ensuring adequate growth to address inflationary concerns pertaining to medical expenses in the long run, along with flexibility to withdraw as the case may be

· Both of them prefer to lead a moderate lifestyle and may occasionally opt for larger expenses. They both are inclined to travel across India, if health permits. This may not be their high priority.

· Rekha would like to know if they can renovate their home to suit their current living standards and lifestyle. It may cost in the range of ₹7-10 lakh.

Kesav understands equity mutual funds and has a fair knowledge about how all their investments work. Rekha is not keen on or aggressive aboutmultiplying wealth as their needs are very limited and they do not have the necessity to pass on their wealth to anyone. However, both desire to have a proper system in place to manage the funds at their old age.

Review and recommendations

After reviewing the couple’s financial resources and goals, an action plan was drawn up for them. It is as follows:

1. They were advised to opt for adequate health cover with super top-up plan and a base plan for an aggregate sum insured of ₹1 crore.

2. Rekha had been maintaining an expenses account for the previous years. This helped in confirming their lifestyle and other needs. They need a fixed income of ₹35,000 per month and their discretionary expenses in a year is around ₹2.5 lakh. It was agreed to work for a monthly retirement income of ₹60,000 to manage the unexpected and unplanned expenses. If there is any surplus at year end, it will be reinvested every year in a separate investment vehicle.

3. It was advised to retain NPS and mapped to health needs. NPS has the flexibility to defer the lumpsum till Kesav’s age of 75. Annuity withdrawal will be opted from next year out of 40 per cent of the corpus, which will be used for health needs if any, else it was suggested to be reinvested in a fixed income investment. It was recommended to hold PPF for the next five years.

4. It was suggested to the couple to invest ₹30 lakh in Senior Citizen Savings Scheme and another ₹30 lakh in RBI Bond. This ensures that they will receive ₹4.8 lakh per year as regular income in the current interest rate scenario. As they plan to get ₹60,000 per month as retirement income, balance ₹20,000 per month needs to be managed from other investments.

5. With SCSS and RBI Bond, their requirement of certainty of income and capital safety are taken care. If interest rates fall to 7 per cent, the interest income will be reduced by ₹20,000 per year. This has to be managed with flexibility by opting for other investment avenues.

6. To get additional ₹20,000 per month and to manage inflation over the next 30 years, they need to invest ₹83 lakh in a portfolio of 40 per cent equity and 60 per cent fixed income. This will ensure that they get 8 per cent post tax income for the next 30 years and sufficient growth to the corpus to manage the inflation of 5 per cent per annum.

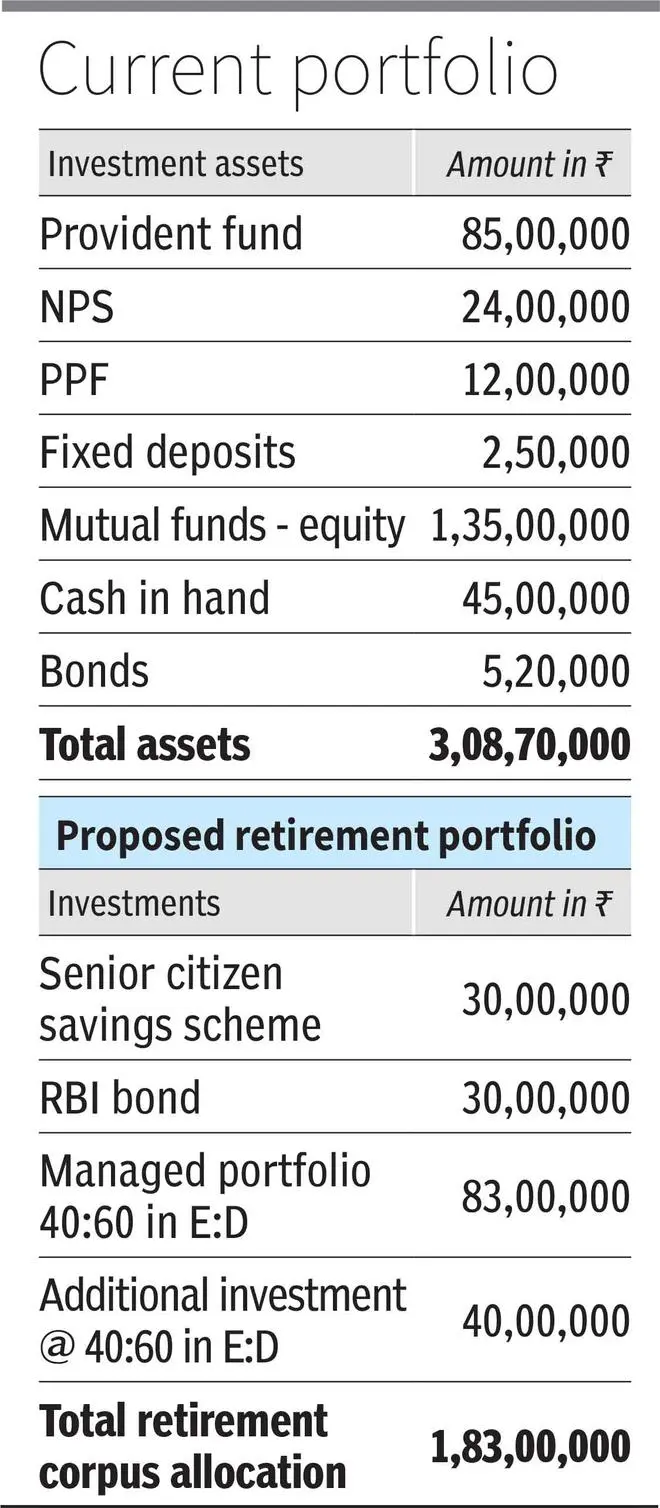

7. It was also recommended to set aside an additional ₹40 lakh towards retirement income distribution to manage changes in economic assumptions over the longer period. This corpus will also be invested with the same asset allocation of 40 per cent in equity and 60 per cent in fixed income. Their retirement portfolio will be as given in the accompanying table.

Retirement portfolio

1. This portfolio will be constructed from the funds available from Provident Fund, Mutual funds – Equity and Cash in hand. This leaves the couple with a surplus of ₹82 lakh from their current investment assets

2. Bonds will be reinvested in fixed deposits upon maturity and the total value, along with current fixed deposit, will be maintained as emergency fund.

3. They were advised to spend ₹7-10 lakh for the house renovation. Balance from the surplus wealth is to be managed in a suitable way to generate sufficient growth for any unplanned and unexpected expenses.

Certainty of income on a monthly basis is a key objective that retirees do not want to neglect. As human beings are used to drawing salary every month on a particular day, retirement phase also has to provide this basic need. Managing multiple sources of income is another area that is seen a bit complex in nature, especially as age catches up with the retirees.

Hence, it is advised to keep the avenues as limited as possible while ensuring that the instruments that one invests in are easy to understand in nature. Retirement living is generally considered to be long and keeping this in mind, the plan should have the flexibility to address the primary objectives of the retirees. Retirement life is not just a mix of numbers but much more than that!

The author is a SEBI Registered Individual Investment Adviser (www.financialplanners.co.in)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.