A new product has been rolled out from the LIC (Life Insurance Corporation) stable. New Jeevan Shanti from LIC, unveiled earlier this month, is a single premium, non-linked deferred annuity policy. Will the product be a reasonably good source of pension income for you? Here’s what you must know about its features, likely yields and potential drawbacks before making your decision.

How the annuity is structured

As mentioned earlier, you pay a single premium upfront. GST (Goods and Services Tax) is levied on the premium amount. The rate is 1.8 per cent currently. So, if you purchase a policy of ₹10 lakh (purchase price), you end up paying ₹10.18 lakh.

Also read: Tax Query: Tax implications on gift towards investment

The minimum age of entry is 30 while the maximum is 79. Then comes the deferment period once you pay the premium. This is the timeframe that you will have to wait out after premium payment to start receiving your pension. The deferment period in the Jeevan Shanti policy is in the range of 1-12 years. The longer the deferment period, the higher is your pension payout.

There are two options for receiving your pension payout. The first gives you, the annuitant, payments till your time and returns the death benefits to your nominee. Another option is to take joint life annuity that gives you pension till your time and pays the same amount to the second annuitant. Upon the death of the second annuitant, the nominee receives the death benefits.

Now the death benefit is the higher of premium paid (excluding GST) plus any accrued additional benefit on death minus the total annuity amount payable till date of death or 105 per cent of the purchase price. The accrued additional benefit is applicable for death during the deferment period only. The minimum vesting age is 31 years, while the maximum is 80.

You can choose to receive the pension amounts on monthly, quarterly, half-yearly and annual basis. But the first three options entail a reduction in yearly annuity rate of 2-4 per cent. It may thus be beneficial to take the annual payout option, if at all.

Also read: Make cashless health insurance settlement smooth with these steps

Yields underwhelm

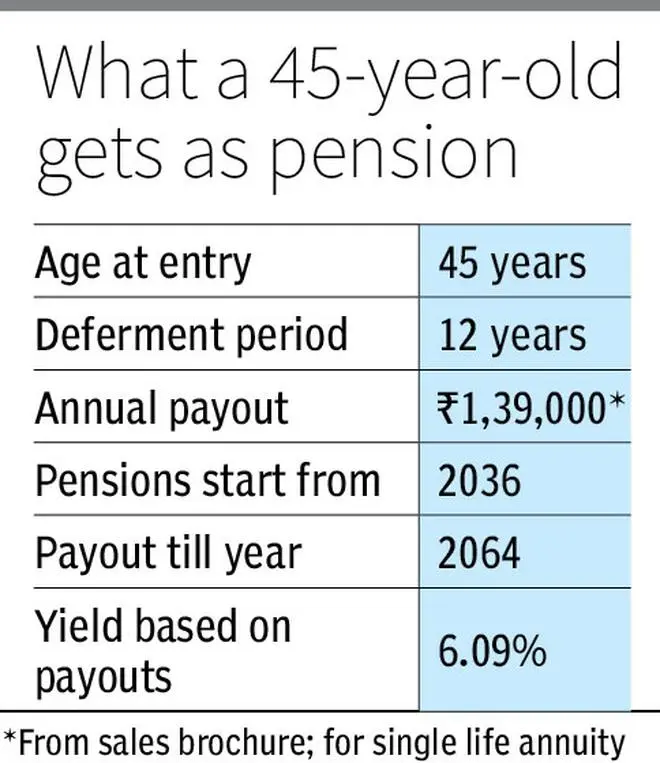

Let us assume a 45-year-old male is looking to take the deferred annuity policy for single life. The premium paid is ₹10 lakh (excluding GST), with a deferment period of 12 years. Assuming annual pension payments, the product document specifies ₹139,900 as the payout.

When we assume a 45-year-old takes a policy in January 2023 with a 12-year deferment period and lives up to the year 2064, the annual payout option, the yield that a policyholder would get from the New Jeevan Shanti is just 6.09 per cent (Internal rate of return (XIRR) based on annual cashflows).

What’s more, these annuity payments are fully taxable at your slab rate, further reducing their attraction.

Immediate annuities from HDFC Life and Tata AIA, though not strictly comparable, offer close to 7 per cent yields.

For perspective, we have a government security maturing in 2062 that offers 7.38 per cent yield (based on January 11 closing price). And there are many g-secs maturing 20-30-40 years down the line that offer semi-annual interest payouts that can be part of your retirement income portfolio.

If you definitely feel the need for an annuity policy for pension, you can consider immediate annuities closer to retirement and skip the deferred annuity part. During the corpus accumulation phase prior to retirement, you would be better off taking the mutual funds route.

And when you do opt for annuities, consider the ones offered by private insurers mentioned earlier.

Also read: How to secure the inheritance of your minor children

Most investors would be better off avoiding the New Jeevan Shanti in light of its low yield and availability of better options for pension purposes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.