I am an Indian employee in an MNC listed in London stock exchange. My company extended employee stock option plan in 2019 to date and I subscribed to it. Kindly let me know how to calculate the tax gains or loss from the sale of such shares listed in foreign exchange. They have deducted exchange transaction taxes while buying shares too. For the bonus shares they allotted, my organisation has deducted TDS as per slab rates applicable in India showing it as income.

Arun

Shares which are not listed in a recognised stock exchange in India are treated as “unlisted shares” for the purpose of computation of capital gains under the Income-tax Act, 1961. Accordingly, if you are holding the shares for a period of 24 months or more, then the resulting capital gain (if any) from sale of such shares would be regarded long-term capital gains. This would be taxable at 12.5 per cent if sold on or after July 23, 2024.

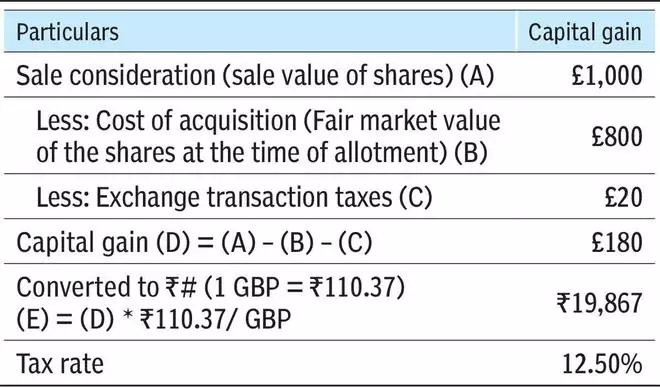

Section 48 of the Income-tax Act, 1961, allows for deduction of expenses which were incurred “wholly and exclusively” for the purpose of transfer while computing the long-term capital gains. Hence, the exchange transaction taxes charged on sale of shares can be deducted while arriving at taxable capital gains.

Since these transactions are in foreign currency, the capital gain/loss would need to be converted to INR as provided in Rule 115 for the purposes of capital gain computations. Capital gain/loss is computed as follows (illustrated using sample values):

#For the purpose of illustration, State Bank of India telegraphic transfer buying rate as on September 30, 2024, has been used in line with Rule 115 of the Income-tax Rules, 1962, on the assumption that the shares are sold in October 2024.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.