The stocks of oil refining and marketing companies—Hindustan Petroleum Corporation and Bharat Petroleum Corporation—were on a falling spree on Monday, shedding 4.6 and 3.1 per cent, respectively. The sharp fall in stock prices followed disappointing performance during the June quarter, reported over the weekend. This has, however, been in line with our expectation, as discussed in our earlier earnings preview story.

Higher GRMs offset by under recoveries

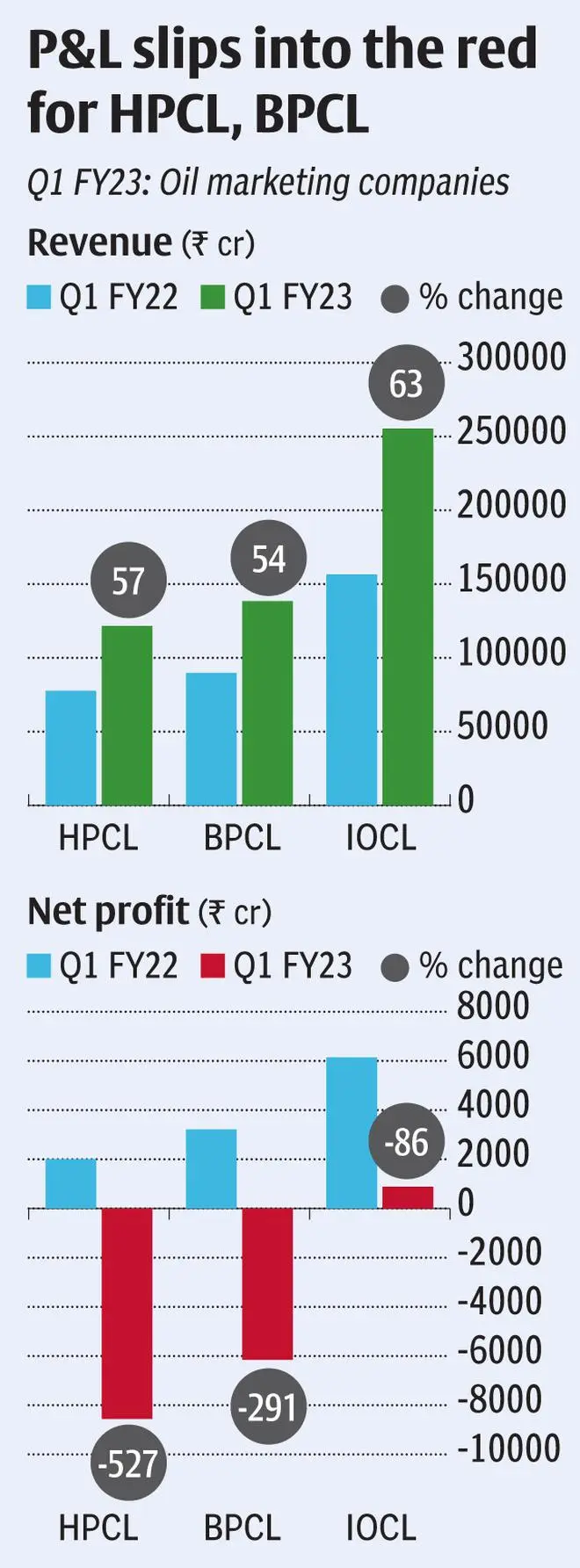

HPCL reported a loss of ₹8,557 crore in Q1 FY23 on a consolidated basis as compared to a profit of ₹2,003 crore for the same period last year.

This is despite a 5x growth in the gross refining margins (GRMs) at $16.69 per barrel as compared to $3.31 per barrel in June 2021 quarter, although it was lower than the estimated GRM of about $22 per barrel.

Even as global crude prices soared to a new high of over $120 a barrel in June, the prices of motor fuels were kept at levels equivalent to $75-80 per barrel, resulting in severe losses for oil marketing companies.

For the government, which has been is fighting hard to contain the inflation, passing on fuel prices to customers would have risked the inflation numbers even further (file picture)

Besides marketing losses, the sharp depreciation of Indian rupee against US dollar added to the losses, with HPCL reporting forex losses of ₹945 crore vis-à-vis a loss of ₹71 crore in April-June 2021 period.

Also, doubling of total raw material cost at ₹1,21, 374 crore vis-à-vis ₹6,5457 crore last year was a drag on the margins. However, higher realisation for downstream products resulted in 56 per cent increase in operational revenue to ₹1,21,497 crore.

ALSO READ: Bharti Airtel Q1: Inline results and stable operating metrics

Besides the impact on profitability, HPCL saw its debt-to-equity ratio swell from 0.92 times last year to 1.52 times as of June end. This was possibly on account of erosion in the shareholders’ fund due to high losses and increase in debt raised to meet working capital obligations.

The company’s net worth declined from ₹39,168 crore in June 2021 quarter to ₹32,483 crore in the June 2022 quarter. HPCL’s total borrowings increased by 37 per cent in the reporting period over Q1 FY22.

BPCL’s performance

For BPCL, though the overall consolidated losses were lower than that of HPCL at ₹6,147 crore in Q1 FY23 against a profit of ₹3,214 crore during the same period last year, the performance was significantly lower than expectations.

Notably, BPCL reported higher than expected GRM of $27.51 per barrel. However, the marketing margin losses eroded the benefits accrued from higher refining margins.

BPCL’s total raw material cost at ₹1,18,128 crore for the quarter was nearly twice that of last year | Photo Credit: PICHUMANI K

The company’s fuel sales volume— 11.76 million metric tonnes for the quarter vis-à-vis 9.6 million metric tonnes last year—and higher GRMs aided the 54 per cent growth in consolidated operational revenue to ₹1,38,424 crore.

The other surprise was that the company consolidated the numbers of Bharat Oman Refinery Limited (BOML) during the quarter, due to which the numbers are not comparable on a year-on-year basis. BPCL also saw its debt-to-equity ratio increase from 0.91 times in June 2021 to 1.21 times in Q1 FY23.

ALSO READ: Why investors should look beyond MTM losses of SBI in Q1 FY23

The consolidated net worth of the company declined from ₹57,412 crore in the June 2022 quarter to ₹45,806 crore in the June 2022 quarter, while total outstanding debt rose from ₹52,482 crore to ₹55, 309 crore over the same period. Likewise, forex losses during the June quarter widened from ₹48 crore to ₹966 crore in June 2022 quarter, accentuating the losses.

IOC fared relatively better

Even as HPCL and BPCL saw their stock prices tumble, the stock of other State refiner and marketing company Indian Oil Corporation (IOCL) closed marginally higher at 0.4 per cent on Monday compared to its closing price on Friday.

Interestingly, the company which reported its June quarter performance in July end, recorded the highest gross refining margin of $31.81 per barrel. However, adjusting for the inventory loss, the GRM was at $25.34 per barrel, higher than $6.5 per barrel in June last year.

IOCL was successful in keeping its debt-to-equity ratio largely flat at 0.86 times | Photo Credit: ARUN KULKARNI

Unlike its peers BPCL and HPCL, which reported steep losses, IOCL managed to post a total comprehensive income of ₹808 crore vis-à-vis ₹8,413 crore profit last year. The sharp fall in profitability was attributed to marketing margin losses.

ALSO READ: Shree Cement Q1 FY23 weighed down by cost pressures

Unlike BPCL and HPCL, IOC managed to grow its net worth from ₹1.2 lakh crore to ₹1.34 lakh crore.

The relatively better performance, compared to its peers, has helped the stock remain steady.

Outlook

The six-month performance of the three stocks have been in line with the quality of the earnings—while IOCL managed to contain downside in the stock price at 10 per cent, BPCL and HPCL lost 14 per cent and 16 per cent, respectively.

While the current moderation in crude prices may help the company pare some of its marketing margin losses, the gross refining margins would also edge lower.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.