The hotel sector sustained its momentum in Q1FY24 despite the high base. Here are 4 charts that give more insights.

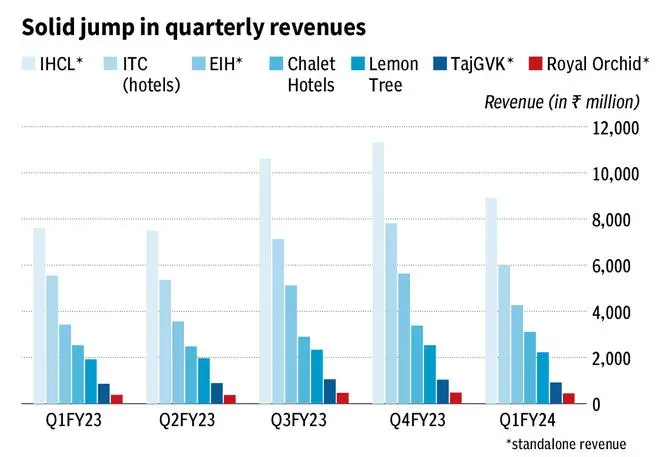

Steady topline growth

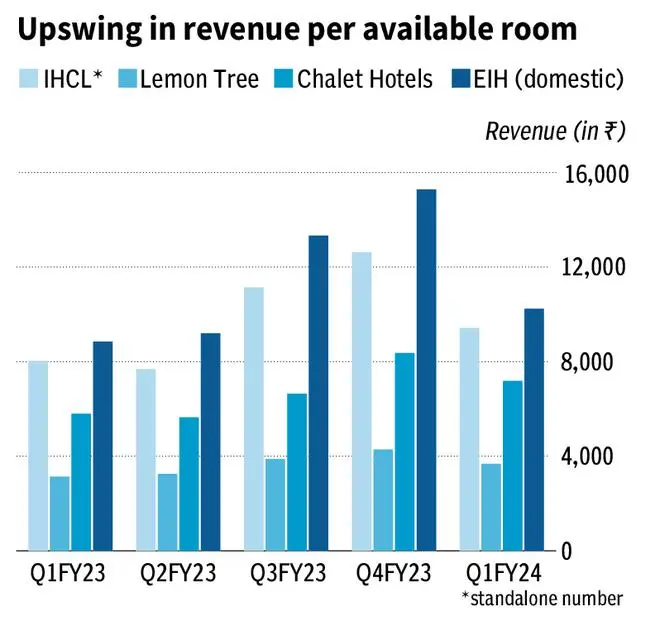

Indian Hotels (IHCL)/EIH/Lemon Tree/Chalet Hotels (Chalet) clocked RevPar growth of 18%/16%/17%/24% respectively.

On a 4Y CAGR basis, IHCL has clocked the highest RevPar growth of 13% backed by its premium brand and its higher share of leisure portfolio. See a similar trend with EIH also.

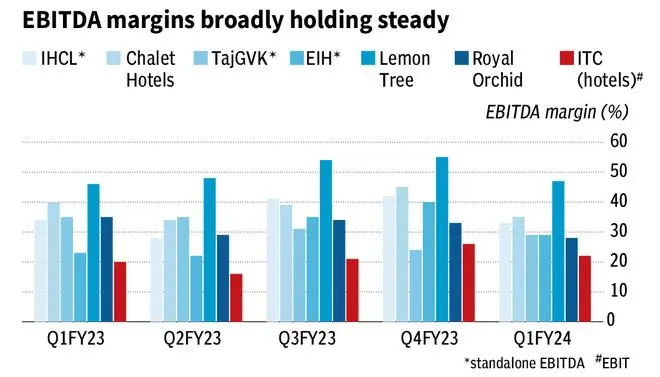

Margin picture

Despite the strong RevPar growth, EBITDA margins for all key players were flat/down YoY (average margin down 127bps YoY) as costs are normalizing, especially towards employee costs and renovation led expenses.

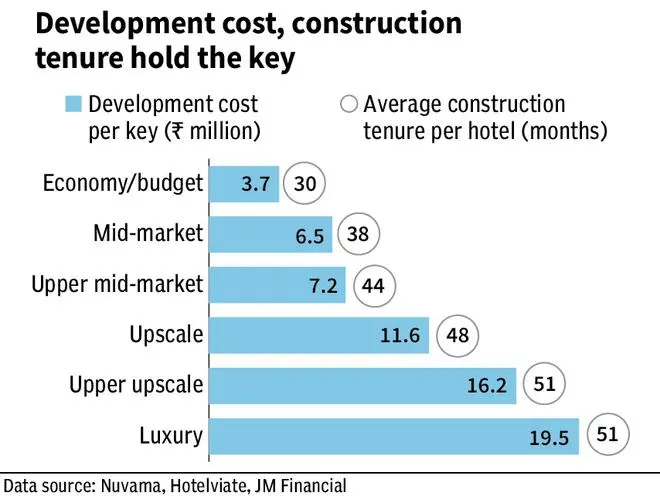

Mumbai market remains the strongest. Similarly, the leisure markets of Goa and Udaipur, while strong are seeing some moderation versus the outperformance in FY23. Hotel building costs and construction tenures have a bearing on industry dynamics.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.