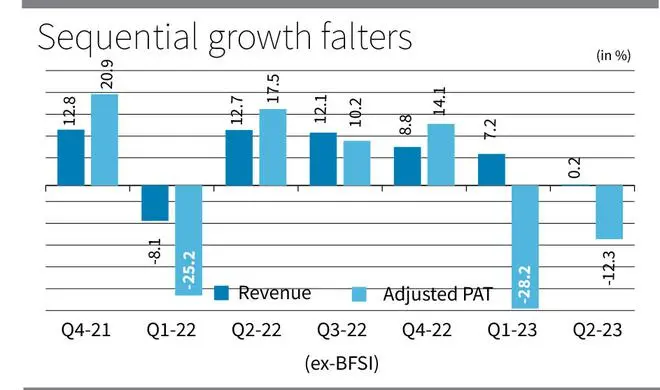

While the year-on-year revenue growth for India Inc at 30 per cent in the second quarter Q2 looks robust, a study of the sequential trend paints a different picture.

Excluding banking and financials (BFSI), sequential (quarter-on-quarter or QoQ) revenue growth came in at just 0.2 per cent, the lowest in a year (see chart). Adjusted profits declined 12 per cent sequentially, impacted by weak revenues as well as cost pressures.

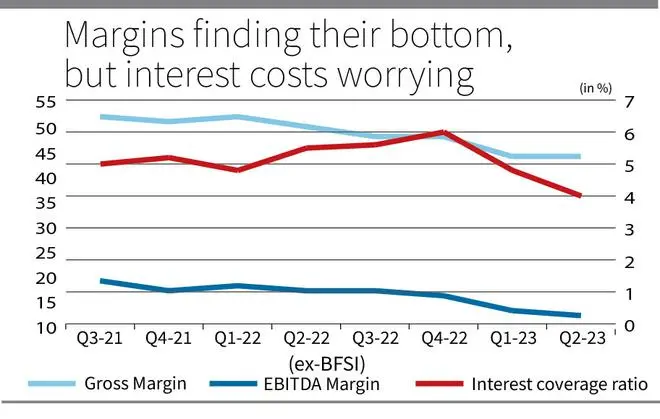

But as a silver lining, the sequential gross margin decline, which averaged 200 basis points in the last four quarters, slowed to 30 bps in Q2. As high-cost raw material inventory runs out, the second half of FY23 is expected to report better operating margins.

With expectation of decelerating the raw material cost inflation (if not reversal), prospects for better earnings don’t seem far fetched, provided demand holds up. This analysis is based on 1,306 listed companies whose Q2 FY23 numbers were out until November 10.

Top line impacted

Ex- BFSI, the 0.2 per cent sequential QoQ revenue growth stands in stark contrast to the 7-13 per cent rise in the previous four quarters. Weak topline performance in Q2 was led by refineries, power distribution and cement companies. Refiners and oil marketing companies (3 per cent QoQ revenue decline) faced lower realisation in the quarter, as crude corrected from $120 per barrel level to a low of $82.

In the cement sector, price pass throughs weren’t robust and revenues declined by 9 per cent QoQ. Steel and power sectors, facing lower realisations, also reported flat QoQ revenue growth.

On the other hand, what provided support for the overall growth, though small, was the price pass through in defensive sectors of pharma, FMCG and telecom. Telecom’s 20 per cent increase in ARPU over the last year aided its topline growth (5 per cent QoQ).

FMCG managed 2 per cent QoQ growth following its first quarter’s 12 per cent QoQ growth. Any further input inflation for this segment may face stiffer resistance on being passed on, as volume growth led by rural regions are already weak.

Pharmaceuticals performance has been aided by domestic growth and the quarter also gained from strong US launches by leading companies which can sustain over the fiscal. IT sector continues its strong growth trend in revenues.

Margin dip eases

Gross and EBITDA margin declined to around 43/12 per cent for the set of companies (ex-BFSI) but the sequential decline has slowed (see graph). Cement companies with excess capacities couldn’t pass on the full extent of price increase and faced EBITDA margin decline of 600 bps QoQ. Gas distribution companies faced higher raw material on one side but have been held back (by inflationary pressures) from passing on the costs, which led to a fall in margins by 500 bps. As lower steel prices crept into earnings, steel sector with a high operating leverage reported 700 points decline in EBITDA margins QoQ.

On the other hand, with easing outsourcing and attrition costs, IT margins recovered in the quarter (QoQ 60 bps EBITDA margin growth). Automobile companies gained from resumption of chip supplies which spurred deliveries and hence margins (270 bps). As higher prices reach shelves, FMCG margins also improved in the quarter by 10 bps.

Going forward, management commentary indicates that cost of commodities, fuel/power, and logistics are softening for companies. With price pass through initiated and softening of input materials expected, companies may have an elbow room to recover volume growth going forward. Hence, margins may have bottomed out in this quarter.

Eye on interest cost

Even as operating margin decline has been arrested for now, costs below the EBITDA level may come into focus from here on. Absolute interest costs have increased 10 per cent QoQ or 23 per cent YoY as higher benchmark rates trickle down to borrowing costs. Interest coverage ratio is also hovering at lower levels of 4 times in Q2FY23 having declined from 5.5 times in last year Q2FY22.

Stock valuations, on the other hand, are buoyed by the expectation of lower input costs as well as a lower rate hikes by central banks, aiding margin growth and volume recovery. At 22 times one year forward earnings, the Nifty is trading at the higher end of its five-year range, which itself is a 10 per cent premium to pre-Covid levels.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.