Last week, bellweather indices S&P BSE Sensex and Nifty delivered modest returns of 0.8 per cent and 0.4 per cent respectively. Sectoral indices such as BSE Capital Goods (6.4 per cent), BSE Realty (5.5 per cent), BSE PSU (4.3 per cent), and BSE Consumer Durables (4.3 per cent) gained the most while BSE FMCG (-0.8 per cent), BSE Teck (-1.0 per cent) and BSE Teck (-1.1 per cent) were tepid during the week.

While many stocks moved up without being backed by any significant news-flows or fundamentals, here are three stocks that were the top gainers driven by fundamental news within the BSE 500 index last week.

Home First Finance Company India Ltd

The stock of Home First Finance surged 26 per cent over the past week, driven by a buy call on the stock by Motilal Oswal with a target price of ₹1,080.

The company is a small cap NBFC operating in the housing finance space. It advances home loans to first time home buyers with a predominant focus on salaried individuals having income of less than ₹50,000 per month.

The NBFC recorded all time high quarterly disbursements in Q4 FY24 with a sequential growth of 9.4 per cent and YoY growth of 26.8 per cent. It also posted record high quarterly PAT of ₹83.5 crores and a record high annual PAT of ₹305.7 crores for FY24. The RoA for the financial year stands at 3.8 per cent.

Currently, the stock trades at a trailing price-to-book value (P/B) ratio of 4.5 times.

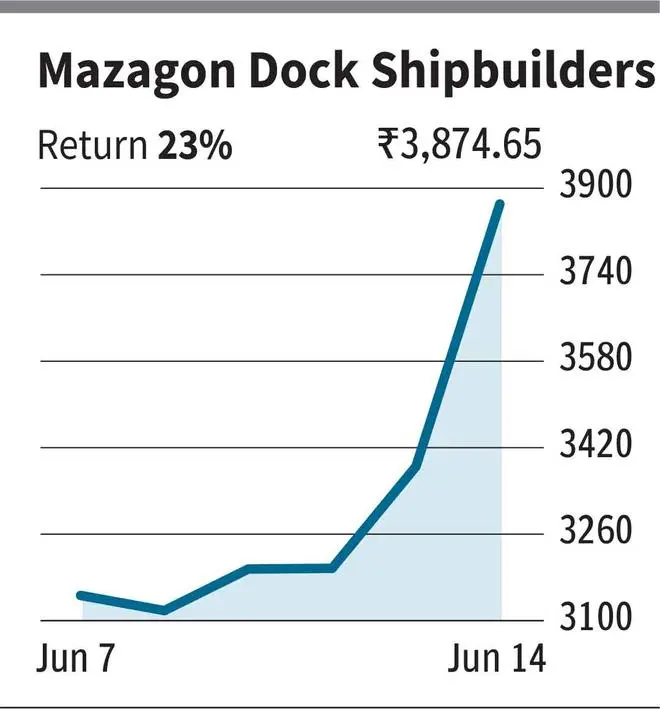

Mazagon Dock Shipbuilders Ltd

Mazagon Dock Shipbuilders’ stock rose by more than 23 per cent last week, in anticipation of order inflows, following Defence Minister’s commitment to boosting defence exports to ₹50,000 crore by 2028-29, alongside ongoing efforts to modernize the armed forces.

Mazagon Dock Shipbuilders is one of the leading shipbuilding yards in India. The Mini Ratna PSU is into building warships and submarines for both domestic and overseas clients. It also builds and delivers tugs, barges, dredgers, ferries and support vessels.

The company earlier on 2nd May, informed the exchanges that it had secured contracts to build three 7,500 DWT Multi-purpose Hybrid Powered Vessels for a European client. The contracts will fetch the company a revenue of $42 million (around ₹350 crores). As per the latest quarterly earnings update, the company’s order book stands at ₹38,561 crores (about 4 times FY24 revenue).

The Mumbai based shipbuilder reported a stellar set of numbers in Q4 FY24 with record high revenue, EBITDA and PAT figures at ₹3,104 crores, ₹873 crores, and ₹663 crores respectively.

The stock is currently trading at a trailing price-to-earnings ratio (P/E) ratio of 40.3 times.

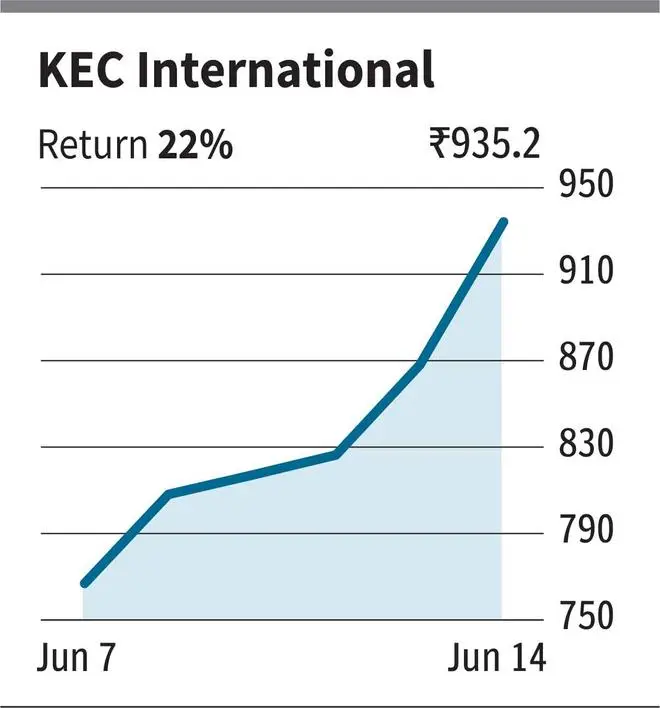

KEC International

The stock of KEC International jumped nearly 22 per cent last week on account of securing new orders and target price revision by brokerage house.

The company (a part of RP Goenka Group) is engaged in the business of executing power transmission and distribution (T&D) and other projects in the engineering, procurement, and construction (EPC) infrastructure space.

In recent filings to the exchange, the company announced that it had bagged orders worth ₹1,061 across its various business verticals including T&D, railways, and cables. Further, Nomura Research has revised its price target from ₹598 to ₹960 owing to anticipation of EBITDA margin expansion on the back of increasing order inflows in T&D and infra space and improved profitability of subsidiaries.

The stock is currently trading at a trailing P/E of around 69 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.