More for Less! This about sums up what Indian Big Tech companies offer in terms of valuation vis-à-vis their fundamentals and growth prospects compared to their US peers.

The nature of business varies — US Big Tech has a mix of product and services companies, while Indian Big Tech is predominantly on the service side.

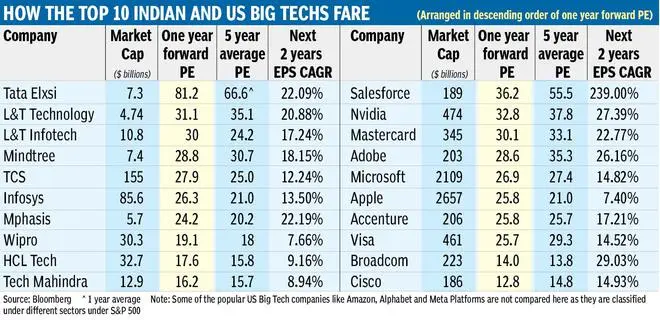

To have a common base for the analysis, the top 10 companies by marketcap in the Nifty 500 and the US S&P 500 (as per companies classified under ‘Information Technology’ in respective indices), have been considered. The companies have then been ranked based on their one-year forward PE multiple (highest to lowest), per Bloomberg consensus.

Lower growth

Measured in terms of growth prospects, eight out of the top ten Indian Big Tech companies have lower EPS growth prospects over the next two years than their equally ranked peers from the S&P 500. But, at the same time, seven Indian companies have higher valuation multiples. Salesforce, which tops the pecking order of US companies, trades at a one-year forward PE of 36 times. On the other hand, the most expensive from the Indian list, Tata Elxsi, trades at 81 times. This is when Salesforce, the most dominant player in the global SaaS industry, is expected to report far superior earnings growth than Tata Elxsi (see table).

Similarly, take the case of industry heavyweights Microsoft and TCS, both of which are ranked fifth. Microsoft trades slightly cheaper although both its historical and expected earnings growth is much better. Even when compared with its most similar global peer in terms of business, Accenture, TCS trades at a higher multiple, despite its lower growth on a trailing as well as forward basis .

The average one-year forward PE ratio of top ten Indian Big Tech companies is around 30 times, while that of top 10 US Big Tech firms is much cheaper at around 25.8 times. Global tech appears much cheaper in this context given 9 out of the 10 are expected to report next two years earnings CAGR of 15 per cent or higher, versus just fivein India. Measured in other ways, also, the global players appear cheaper. Seven out of ten US Big Tech are trading at a discount to their (historical) five-year average valuation, while just one amongst the top ten in India is trading at a discount.

Is the premium justified?

On a fundamental basis, the premium valuation of Indian players may not be justified. While there is a case for premium valuation in quite a few sectors in the Indian context, given far superior growth prospects in India compared to any other major economy, this logic does not apply to Big Tech. Indian Big Tech is still largely a global story dependent on global growth and levered to more or less the same economies as the Big Tech within S&P 500.

A global slowdown or a recession in the US or Europe will surely impact Indian Big Tech. Earnings downgrades for Indian Big Tech in such a scenario may be the same as that that for global Big Tech. What may be of support in such a context will be valuation relative to fundamentals. In this aspect the foreign counterparts appear to be safer bets.

Premia may last for Indian tech as long as they enjoy liquidity (flows into equities) and sentiment. In the long term however, fundamentals are likely to triumph. Thus, while today’s ‘More for less’ may be okay for investors who got in much earlier at cheaper valuations, for new investors buying into these stocks today, it will be ‘Less for More’.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.