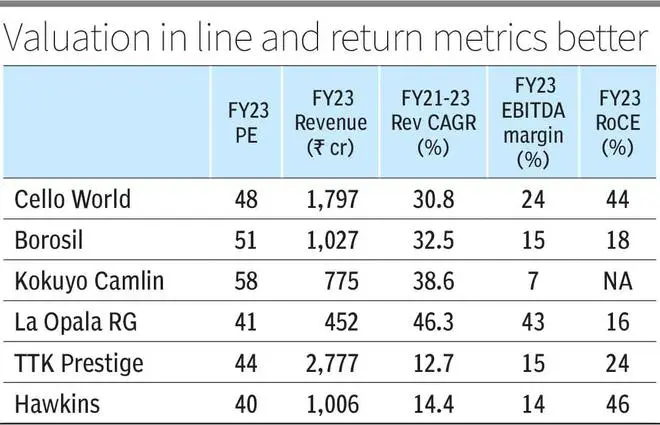

Cello World is a consumerware maker in India which is also manufacturing writing instruments and moulded furniture. Its IPO is completely an offer for sale of up to ₹1,900 crore and open till November 1, 2023. The offering values the company at 48 times FY23 earnings. Though not cheap, the valuation is in line with the peer group. We recommend that investors can subscribe to the offer. Riding on the consumer growth story in India and on the established, pan-India presence of the company, earnings growth can stay elevated in the near term.

Business segments

Cello World has six decades of operations behind it. The current operations are divided into three segments: consumerware business which accounts for 66 per cent of FY23 revenues, writing instruments and stationary business (16 per cent) and moulded furniture (18 per cent). Among the segments, consumerware and writing instruments reported 23 per cent EBIT margins in FY23 and moulded furniture reported 17 per cent.

The company reported revenues of 1,796 crore in FY23, which grew at a CAGR of 31 per cent in the last two years. PAT grew at a similar rate for the same period. Covid base year and an elongated ‘back to school’ sales may have supported the strong growth for the company and the wider industry.

The company has a wide presence across the segments with more than 15,000 SKUs. The company offers products in drinkware, insulated ware, dinnerware, cookware, small kitchen appliances, stationery, and moulded furniture. This across price points (economy, mid and premium) and in different materials (plastic, glass, steel and ceramic).

Plastic and allied manufacturing is through its 13 facilities. Steel and glassware is supplied by third party manufacturers which accounts for 21 per cent of revenues in FY23.

Demographic push

Cello World’s product profile leverages the demographic changes driving consumer growth in India. Working women population, nuclear families, urbanisation, growing preference for premium products align with the kitchen, storage, and hydration demand in the country.

The broader demand drivers based on discretionary spending and household income are also underliers. This should support volume growth higher than basic products and incremental price growth can be from premium product preference.

The brand — in existence for six decades— is also a strong differentiator. Storage, hydration or other materials face redundancy of materials every 4-5 years driven by health, environmental or safety concerns. With a brand, scale of operations and a dedicated team in R&D, Cello World and other large operates can respond to such changes with ease compared to unorganised players. The company is expanding in Rajasthan with a new opal (a type of glass) facilty to accommodate the growing demand in this segment.

Cello World maintained 50 per cent gross margins in the last three fiscals which again points to the pricing power the company enjoys. It has has been able to pass on the highly volatile RM cost in the last three years to end user comfortably. The EBITDA Margin though was volatile as logistics, power and energy costs were also highly volatile in the last three years.

Peer valuation

Cello World does not have like-to-like peers in the listed space.. But on comparison with other branded manufacturers in consumerware, stationary, kitchenware and glassware, we infer an in-line valuation range for the IPO at 48 times FY23 earnings. Also, the company operates on a high return metric of 44 per cent ROCE ( return on capital employed) in FY23 and on a smaller net fixed asset base of ₹254 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.