The IPO of EMS opened on September 8, and closes on September 12. The issue size is around ₹321 crore with ₹146 crore as fresh issue and remaining offer for sale (OFS). The proceeds from the fresh issue will be utilised to fund the company’s working capital requirements. The promoter and promoter group holding will come down to 72.6 per cent post issue, from 96.7 per cent pre-issue.

The core competency of the company is handling water supply, wastewater treatment and sewerage solution projects. The company bids for tenders issued by CPWD, State governments and urban local bodies (ULBs) on EPC or HAM basis.

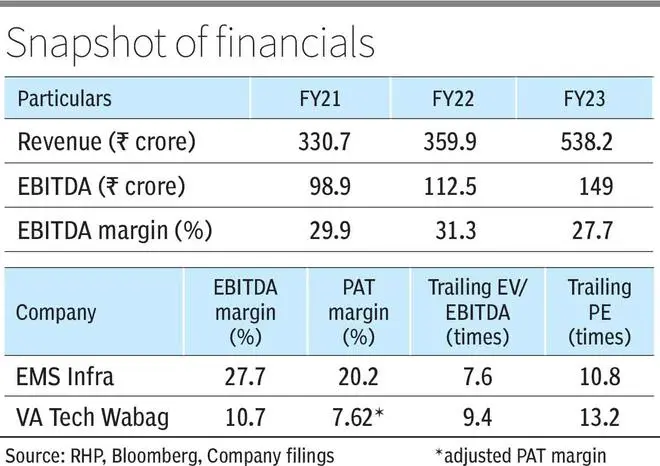

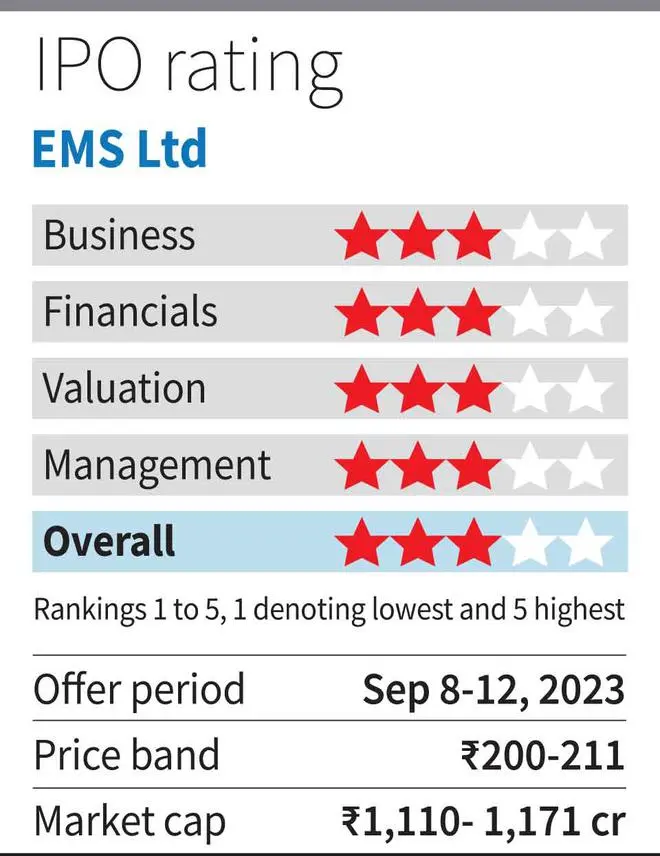

The price band of the issue is ₹200-₹211, which implies market capitalisation of ₹1,171.46 crore (at the upper price band). The FY23 trailing EV/EBITDA comes to 7.6 times and the post issue trailing PE works out to 10.8 times. The listed peer of the company is VA Tech WABAG, which has a trailing EV/EBITDA of 9.37 times and trailing PE of 13.2 times (adjusted EPS for FY23). Considering the reasonable valuation, decent financials, and the government’s allocation for infra projects, investors can subscribe to the issue. At the same time, it would be ideal to take a limited exposure in the stock, given its small-cap nature.

Business

The company is in the business of sewerage solutions, water supply system, water and waste treatment plants, electrical transmission and distribution, road and allied works, wastewater scheme projects (WWSPs) and water supply scheme projects (WSSPs) for government authorities/bodies. WWSPs include sewerage treatment plants (STPs) along with sewerage network schemes and common effluent treatment plants (CETPs); WSSPs include water treatment plants (WTPs) along with pumping stations and laying of pipelines for supply of water. The sewage treatment plants of the company are compliant with the norms of the Ministry of Environment, Forest and Climate Change and the treated water can be used for horticulture, washing, refrigeration and other process industries.

The company bids for tenders issued by CPWD, State governments and ULBs to develop WWSPs and WSSPs. It has an in-house team of designing, engineering, and construction, as also a team of 61 engineers supported by third-party consultants and industry experts.

The business being civil, and construction-based, it is vulnerable to commodity cycles i.e., price changes in metal, cement, petrol/diesel, etc. However, the company has a price escalation clause in its contracts where the increased price may be passed through with lag.

EMS Infra prefers to bid for projects aided by agencies like World Bank, JICA or Central government in view of smooth payments. Also, it bids for the projects with at least 25 per cent of EBITDA margin, which has been in the range of 27 per cent to 31.5 per cent for FY21-23.

Prospects/Order book

In the past two Budgets, the government’s focus on infrastructure has been increasing. The allocation to department of water resources in Budget 2023-24 was ₹20,054 crore which is 43 per cent higher than in previous year and the allocation for Ministry of Jal Shakti was ₹77,223 crore, 29 per cent higher YoY. This bodes well for the company.

The order book as on July 31, was around ₹1,745 crore, of which 67 per cent is sewerage work, 4.7 per cent sewerage and water works, 4.8 per cent projects of common effluent treatment plant and remaining 23 per cent building works. The book to bill ratio comes to 3.24 times (based on FY23 revenue).

Financials

The revenue from operations in FY23 was ₹538.16 crore which is nearly 50 per cent higher YoY, while EBITDA was ₹149 crore, 32.4 per cent higher YoY, and the PAT was ₹108.61 per cent, which is 37 per cent higher YoY. EBITDA margin for FY23 was 27.69 per cent as against 31.27 per cent in FY22. This fall in EBITDA margin seems mainly due to the increase in cost of operations which was 76 per cent of revenue in FY23 against 68 per cent of revenue in FY22. The company is a net cash company ₹36.27 crore in FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.