Glenmark Life Sciences (GLS) debuted in capital markets at the peak of its quarterly revenue run rate in July-2021. From then, the company faced declining revenues from Covid portfolio and weak demand from its parent Glenmark Pharma (owns 83 per cent in GLS). In this period, the company valuation has tracked the stock price decline of 43 per cent and is now priced at 11 times trailing earnings.

We had recommended subscribing to the IPO (July 2021) at a valuation of 22 times FY21 earnings based on long-term growth potential of the high-value API manufacturer. GLS facing revenue slowdown, post pandemic, resulted in its earnings multiple shrinking to 11 times FY22 earnings (incidentally similar to Glenmark Pharma). The current multiple should provide a valuation base over which earnings growth can be reaped by the investor, from capacity addition, domestic demand and new product introduction.

On the macro front, along with global demand finding alternate sources away from China and even Europe, US price erosion slowing down from high double digits can be (if it materialises) a positive surprise.

Revenue headwinds to subside

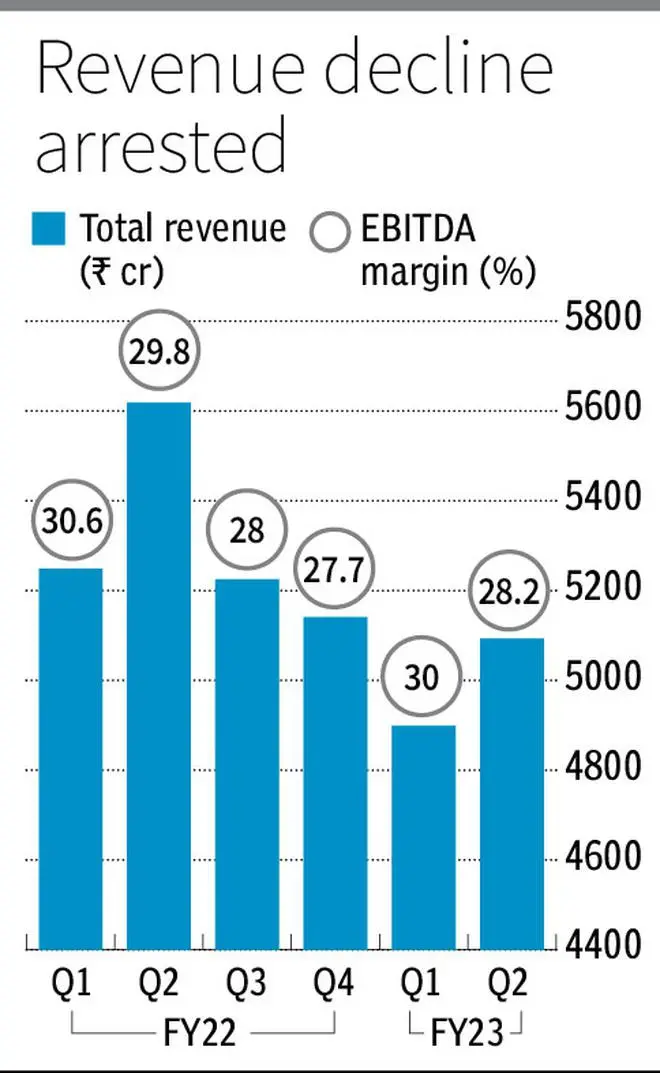

Glenmark Pharma had a robust portfolio of Covid drugs, led by Favipiravir, in the last two years. GLS’s FY21 and FY22 revenue contribution from API supplies for Covid portfolio stood at 7 and 5 per cent. It has since dropped to near zero in FY23. Beyond Covid drugs, sluggishness from parent company demand owing to high erosion in US and competition from other price-efficient vendors have led to revenue from parent company dropping by 41 per cent YoY in Q2FY23. Consequently the share of revenue from Glenmark Pharma reduced to 26 per cent in Q2FY23 from 40 per cent at the time of IPO. GLS expects this to revert to 35 per cent share, aided by cost-competitive API supplies (third-generation processes) by 2HFY23.

GLS’s traction in external business has been strong at 13-15 per cent YoY growth in Q1 and Q2FY23 across India, Japan and LatAM. With the parent/largest-client order book returning to growth and strong growth in other business, GLS should resume top-line growth from FY24 at least (FY23 will have tough comparable of Covid base).

GLS’s CDMO (Contract Development and Manufacturing Outsourcing) business, with 8 per cent revenue contribution in FY22, has been volatile in the early stages with one of three clients experiencing sales volatility on account of Covid. On a lower base (37 per cent YoY decline in H1FY23) for CDMO and expecting addition of a fourth client, GLS’s CDMO operations also should stabilise from here.

Contribution from new facilities

GLS will be adding to its existing 740 KL of operational capacity with a 240-KL facility at Dahej, which is a brownfield expansion and hence can scale to 50 per cent capacity utilisation in the next one year. Apart from this, GLS will also operationalise this year a backward integration facility at Ankleshwar of 400-KL capacity.

GLS product portfolio consists of chronic compounds (CVS, CNS, Diabetes and Pain), with leading market shares (more than 30 per cent in five of the 120-product portfolio) which are in the second or third generation of API development process. Backward integration aimed at five leading projects, and eventually expanding to 20 or more, strengthens GLS’s market presence in such a long-established portfolio. Apart from these, GLS has the groundwork laid for a 1,000-KL facility at Solapur, which it intends to develop in a phased manner according to demand. GLS, operating at peak capacity, will find relief from Dahej and Ankleshwar facilities.

GLS also started an Oncology block at Dahej and has added iron complex products which should drive new product growth in a high-value segment. Exclusivity loss for original innovators, across regions, in diabetes, should add another lever for GLS in the next one year.

Financials and valuation

GLS operates in high-value, low-volume products, with significant scale-enabling, to generate 30 per cent EBITDA margins, compared to 15-20 per cent across competitors. The company has been able to sustain the margins in the face of cost pressures, volatile top line, and logistics costs. Easing costs of a few raw materials (solvents from China), energy and logistics costs, better forex rates and added backward integration facility are minor tailwinds to margins. But operationalising new facilities with low utilisation and continued China lockdowns will pressure the margins in the short term. GLS has also gained from PLI incentives that have flowed to the company from FY23 and are expected to add 50-100 bps to EBITDA margins. GLS has cleared the debt from IPO proceeds and has sufficient capacity for short-term demand growth, with Solapur facility as an option.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.