India is witnessing a structural increase in the consumption of natural gas on the back of the Union government’s (GoI) planned and sustained push to increase the share of gas in India’s energy mix to 15 per cent by 2030, from the current 6.7 per cent. Efforts are on to stimulate both supply and demand in this space. In this background, the Gujarat State Petroleum Corporation group — predominantly the listed duo of Gujarat Gas (GGL) and Gujarat State Petronet (GSPL) and the unlisted Gujarat State Petroleum Corporation (GSPC) — has chalked out an elaborate scheme of arrangement involving a merger and a demerger.

The shares of GGL have rallied around 41 per cent in the last one year and also reacted positively to the merger announcement. The company is richly valued at PE of 38.1 times TTM earnings and is now trading a 38 per cent premium to its five-year historical average of 27.7.It is also expensivewhen compared with its peers – Mahanagar Gas (PE of 14.8 times) and Indraprastha Gas (21.6). Most positives — structural push from the GoI, synergies on merger and the falling crude prices, seem to be priced in post this rally. Dividend yield, which is an added factor to invest in PSU stocks is also not attractive any more at 0.9 per cent. With volatility and cyclicality being an inherent part of the business and the same being enhanced with the prospective merger of exploration and production (E&P) segment of GSPC into GGL, investors can consider booking profits and locking in on the gains. This is a valuation call. Another factor to note is that, given the merger swap ratio favours GSPL at current prices, GGL may be a relative underperformer.

Scheme of arrangement

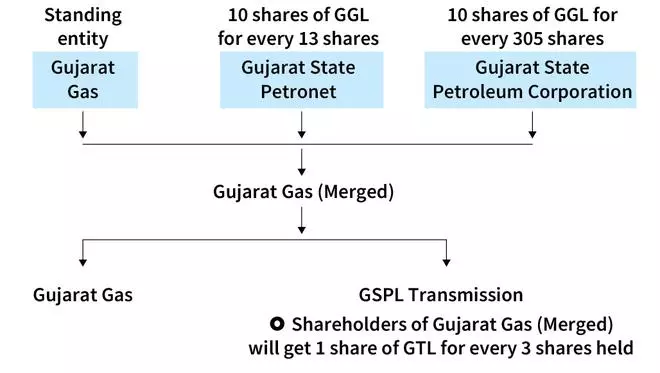

The scheme proposes to merge GSPL, Gujarat State Petroleum (along with its wholly-owned subsidiary GSPC Energy) — with GGL. Share-swap ratio is as explained in the illustration. Post-merger, gas transmission and related investments will be carved out into a separate entity - GSPL Transmission Ltd (GTL). While investments pertaining to transmission business alone will be carved out, all other investments will remain with the integrated GGL. This scheme of arrangement is proposed to be wrapped up by August 2025, subject to approval of shareholders and all relevant authorities and regulatory bodies.

This arrangement, amongst other things, disentangles the ownership structure. As painted by the management, the merger is aimed at enhancing the operating efficiencies boosted by merger synergies. Currently, gas is traded from Gujarat State Petroleum to GGL, and gets distributed to the end-customer (B2B2C). Post merger, by becoming an integrated entity, this will be simplified by directly selling to the end-user (B2C).

There are more tangible benefits from this merger: One, the point of taxation for indirect tax will be one entity (integrated). Two, accumulated losses in the books of Gujarat State Petroleum to the tune of ₹7,200 crore could be utilised to set off future profits of the resultant entity, approximately over the next two years.

Business

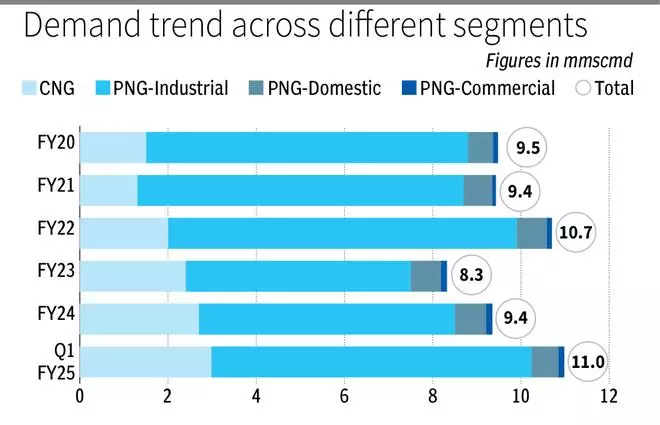

GGL is a city gas distribution (CGD) player with prominent presence in Gujarat alongside some presence in five other States. The company is the largest CGD player in India in terms of volume and also operates around 810-plus CNG (compressed natural gas) stations across the above regions. Business involves maintaining and operating the gas distribution network and adding new connections (customers), while monetising the gas distribution — adding a mark-up on the cost of gas distributed. Based on the end-use, the company has four segments – CNG (27.1 per cent of revenue), PNG (Piped Natural Gas) - Industrial (66 per cent), PNG-Domestic (5.7 per cent) and PNG-Commercial (1.2 per cent).

Volumes surged for GGL in Q1 FY25, mainly on the back of Morbi-led demand recovery from the industrial segment, improving from 9.4 mmscmd (million metric standard cubic metre per day) in FY24 to around 11 mmscmd in Q1 FY25. However, the management has guided for softer volumes in Q2 owing to container shortages, which is expected to negatively hit businesses in Morbi and subsequently, gas consumption.

Morbi, a city in Gujarat, popularly known as the Ceramic Capital of India, accounts for around two-thirds of GGL’s supply of PNG for industrial use cases. Morbi is predominantly supplied with imported natural gas, which is relatively expensive, as domestic natural gas under the cheaper administered price mechanism (APM) route is earmarked to meet the demand from PNG-Domestic and CNG segments. Anyhike in LNG prices negatively impacts the industrial demand, with LPG being a cheaper alternate source, as has been observed in the past (refer illustration). Switching from PNG to propane is generally observed when Gas - Propane price premium is greater than ₹1-2/scm. Thus, the impact of the recent rate hike exercise by GGL in the Morbi region, is a key monitorable for Q2.

Demand for CNG, although a fraction of industrial PNG volumes, has improved steadily since FY20. However, long-term risk exists, as EVs gain share in the mobility space. On the other hand, PNG for commercial and domestic use has relatively stayed flat since FY20.

Operating metrics

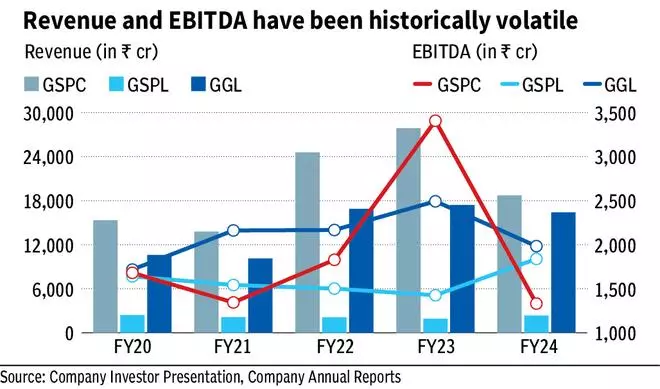

Revenue and EBITDA grew at 11.5 per cent and 3.7 per cent CAGR respectively for GGL since FY20, while the numbers were volatile for Gujarat State Pertroleum and GSPL, as observed in the table above. The numbers pertaining to Gujarat Energy are not material in relation to overall size of the merged entity.

Currently, the contracts on the supply side, predominantly managed by Gujarat State Petroleum (which then sells to GGL), are in the ratio of 60:40, long-term and short-term respectively. Long-term contracts are linked to crude prices, while short-term contracts are mostly based on spot-LNG prices. GGL also has around 25 per cent spot-dependence. Thus, even post the scheme of arrangement, the volatility on account of spot-dependence will continue.

Outlook

Though the current scenario of descending and deflated prices of crude is the best the sector could ask for, the business is fundamentally cyclical in nature, and hence the current valuation appears expensive.

Another important factor to note is that per the scheme of arrangement, investors will get 10 shares of GGL for 13 shares of GSPL. Assuming the merger will go through, GGL is trading at 15 per cent premium to value of GSPL based on share-swap ratio. This can also result in some relative underperformance in GGL, as new investors may choose to buy GSPL over GGL.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.