From being one of the earliest global corporations to invest big in the ‘India growth story’ much before the theme became the trend, and capturing the imaginations of millions of Indians with one of the most jazzy launches with the captivating Mr Kim-Shah Rukh commercials, to becoming India’s second-largest car manufacturer, Hyundai Motors India (HMIL) has made quite a strong imprint in India. It has continued its trend-setting tradition into the IPO markets as well, by launching the country’s largest IPO now. The IPO of HMIL will be open during October 15-17. The ₹27,870-crore offer for sale (no fresh issue) values the company at ₹1.59 lakh crore at a PE of 26.7 times Q1FY25 earnings, annualised. This is close to peer Maruti Suzuki’s valuation at 26 times FY25 earnings estimate.

The company is coming out with the IPO just when domestic passenger vehicle (PV) sales have moved past a cyclical peak and are expected to go through a downturn in the near to medium term. Structural shift to bigger vehicles (premiumisation) in the domestic PV industry, thrust on using India as an export hub by HMIL’s parent, capacity additions planned and upcoming expansion in its electric vehicle (EV) portfolio can help cushion the downturn as well as provide levers for growth in the long term. Considering that the industry is off its cyclical peak and that the offer seems fully priced now, only long-term investors need to subscribe to the issue.

Premiumisation to offset volume slowdown

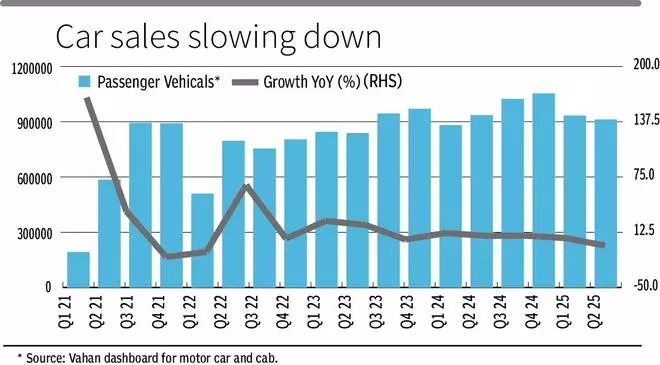

The PV industry should expect volume consolidation after three years (FY21-24) of 16 per cent CAGR growth. Vahan data, capturing retail sales, show that the growth turned negative for the first time in the last three years — at -2.6 per cent year on year for Q2FY25. However, while volume growth may moderate in the near to medium-term, the industry will retain the premiumisation shift it has acquired. In the last five years, the industry reported a 5 per cent CAGR volume growth including the 10 per cent CAGR decline in FY19-21 and the 16 per cent CAGR growth of FY21-24. More importantly, the average selling price (ASP) steadily increased from 4.9 lakh in FY19 to 7.3 lakh in FY24 (8 per cent CAGR), which delivered an overall growth of 13 per cent CAGR. The price growth was primarily driven by demand for SUVs, along with demand for better features, cost involving compliance with emission norms, as well as rise in input costs. In FY19, hatchbacks (47 per cent of sales) led the demand, which now shrunk to 25 per cent in Q1FY25; SUVs have increased their share from 23 per cent to 54 per cent. This structural shift will support higher ASPs (average selling price) in the future despite volume headwinds.

High competition and lower RM costs are things to watch out for when it comes to ASP growth prospects. While Maruti Suzuki is the market leader, the middle three of the PV market — HMIL, Tata Motors and M&M — with Q1FY25 market shares (market share including EVs, as per RHP) of 14.6 per cent/13.5 per cent/12.2 per cent are in intense competition compared with FY19 (16.3 per cent/6.3 per cent/7.1 per cent share), which may lead to price competition. Steel prices are close to 30 per cent below their peaks of FY22-23 and the semi-conductor shortage has eased recently.

Growth drivers

Demand side:Going forward, EV shift and continued premiumisation are the key demand drivers for the company in the domestic market.

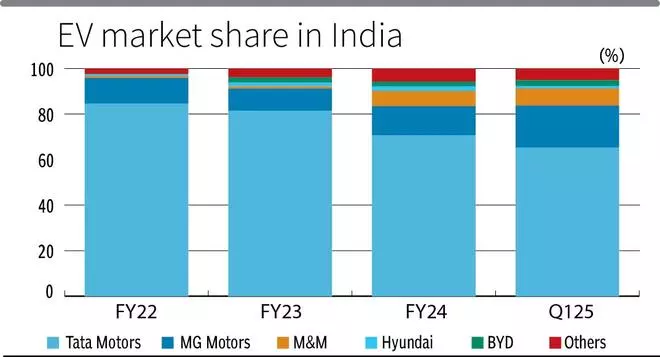

EV penetration in PVs is still nascent in India at 2 per cent of total ICE (internal combustion engine) vehicles sold in FY24. Yet, the demand-based incentive programme for electric PVs look a bit bleak, as the successor to FAME — the recently-announced PM E-Drive scheme — has no incentives for PVs, with the only positive being the 22,000 PV charging stations envisaged.

Currently, CAFE, or Corporate Average Fuel Efficiency/Economy, norms (130 g/km of CO2 emissions by FY22 and 113 g/km thereafter) are being met with ICE-led portfolios. With the standards slated to become stricter in future, the portfolio of any OEM should have EV/CNG/hybrid presence to meet the standards and hence, e-PVs will continue to hold relevance for companies. From a user perspective, EVs bring down the total cost of ownership. Besides, lowering range anxiety due to expansion in charging network can support EV sales.

HMIL has approached EV portfolio cautiously, considering the early phase of adoption in India. But as discussed above, EV has partially driven Tata Motors and M&M share gains substantially in the last five years. HMIL’s EV share can better in future with four launches scheduled in FY25, including an EV extension for HMIL’s hugely-successful Creta (38 per cent market share in the prized mid-size SUV segment). HMIL plans for a sustainably-significant EV presence along with a localised supply chain; it has leased space to Mobis (group concern for parts manufacturing) for EV batteries and is collaborating with Exide Energy for battery products. HMIL is developing a dedicated EV manufacturing platform, E-GMP, based out of its Chennai plant for sub-categories of EV (hybrid, plug-in hybrid, mild hybrid and fuel cell).

Premium models have aided HMIL and will continue to do so. The company portfolio consists of SUVs accounting for a good 67 per cent of sales and the demand for features can sustain ASP growth. The strong parent backing with a consolidated R&D that invested $26 billion in the last 10 years, combined with HMIL’s 26 years of experience of catering to India, which is on the cusp of value-added demand, can ensure optimal scope for feature-driven increase in ASPs.

Supply side:HMIL operated at 97 per cent capacity utilisation (824,000 vehicles capacity for domestic and export) in FY24. HMIL expects to operationalise additional 20 per cent capacity by H2CY25, taking installed capacity to 994,000 in the first phase. The second phase, expected by CY28, will lead to an installed capacity of 10,74,000 units per year, which is a total addition of 30 per cent. Assuming a gradual ramp-up to 90 per cent utilisation over three years, this should deliver a conservative 5 per cent volume CAGR to HMIL till FY30. This will encompass the export capacity as well, which is the focus for the parent Hyundai Motor Company (HMC). Owing to developing market characteristics of Latin America, Africa and West Asian markets, HMC expects HMIL to be the export hub for these nations. As the export market delivers a 10 per cent average premium on ASP compared with the domestic market, the increased capacity can sustain the margin-accretive export markets. Exports currently constitute around 20 per cent of sales.

Financials

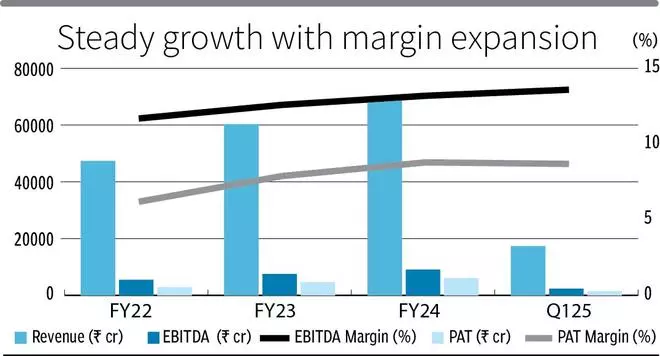

HMILs balance sheet is strong with net debt to EBITDA at -0.9 times in Q1FY25 or in other words, net cash. But the company has paid a large dividend (₹15,435 crore in FY24 or 10x FY23 dividend) “to compensate for Covid years” as per the management. Investors will have to watch the space as the management says it will return to “industry best practice” for dividends. The management also mentions that royalty will stand at 3.5 per cent of sales beginning June 10, 2024, following tweaks to the royalty agreement. For a perspective, royalty for FY24 comes to 2.2 per cent of sales for HMIL. Maruti’s Q1FY25 royalty number stand 3.5 per cent.

The company reported EBITDA margins of 13 per cent in FY24 comparable to Maruti or M&M while delivering a revenue/profit growth of 15.8 per cent/28.7 per cent year on year. The first quarter of FY25 witnessed flat domestic revenues but aided by 20 per cent year-on-year export revenue growth, the overall revenue growth stood at 4 per cent. Capacity expansion, strengthening of EV portfolio, export momentum and strong ASP in domestic markets should sustain HMIL’s earnings growth in 10-12 per cent range for the next five years supporting the valuation at a PE of 26.7 times Q1FY25 earnings, annualised. Though the parent trades at five times earnings, the growth prospects of domestic markets lend support to the higher multiple. The gap between Maruti Suzuki (26 times FY25 EPS) and its parent Suzuki (7 times) also illustrate the difference.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.