In the current times of market volatility, Infrastructure Investment Trusts (InvITs) can prove to be an attractive long-term investment for investors. They can provide investors with a steady flow of income through regular distributions and scope forcapital appreciation. Thus, they have characteristics of both debt and equity asset classes.

Investors with a long-term perspective can look towards accumulating the shares of power transmission company, India Grid Trust (IndiGrid).

IndiGrid, through its nature of projects, can ensure more stable cashflows than InvITs present in other projects. This, along with other characteristics such as investments in already cash-generating projects and attractive pre-tax yield (annual distribution to investors/unit price) of 10 per cent at current market price, makes IndiGrid InvIT an attractive investment.

In the last one year, IndiGrid’s unit price has seen a decline of about 12 per cent. Adjust for dividends and other distributions to investors, the decline is milder at about 3 per cent. The decline in unit price has been on account of sharp rise in interest rates in the last one year. In general, InvIT share prices and interest rate have inverse correlation. When interest rates increase, investors expect higher yield from InvITs and thus unit prices may decline till investors find it attractive.

However, this now presents an opportunity for long-term investors to accumulate its units as capital appreciation can materialise when the interest rate cycle reverses. Further, capital appreciation can also come from business growth when InvITs add more assets to their business.

Business

IndiGrid, India’s first listed InvIT, owns and operates inter-State and intra-State power transmission assets. It is sponsored by global investment firm KKR. The sponsor is responsible for setting up the trust and holding at least 15 per cent stake in the same as per the SEBI mandate. While it started with two power transmission assets in 2017, today IndiGrid has a portfolio of 16 projects, including 14 operational transmission projects, one greenfield transmission and one solar generation project.

Following the SEBI mandate, at least 80 per cent of IndiGrid’s investments comprise operational projects that are already generating income and a maximum of 10 per cent in under-construction projects, which poses less risk for investors.

The InvIT earns its revenue based on the fixed tariffs on its long-term transmission service agreements of around 35 years provided normative availability of 98 per cent. Hence, its revenue is immune to the fluctuations in volumes transmitted and volatility in power demand. Margins can be affected only if there are variations in operations and maintenance expenses, but it is not a significant percentage of revenue. Such a model ensures revenue visibility and steady cash flows as compared to other InvITs, like in the roads space, whose revenues are based on collection from toll and have to depend upon traffic growth.

Further, POC (Point of Connection) mechanism on majority of transmission SPVs (special purpose vehicles) reduces payment risk for the InvIT. Here, central transmission utility Power Grid is assigned to collect transmission charges from multiple distribution companies and then it is disbursed to the transmission licensees from the pool due to which counter party risk is reduced.

Financials

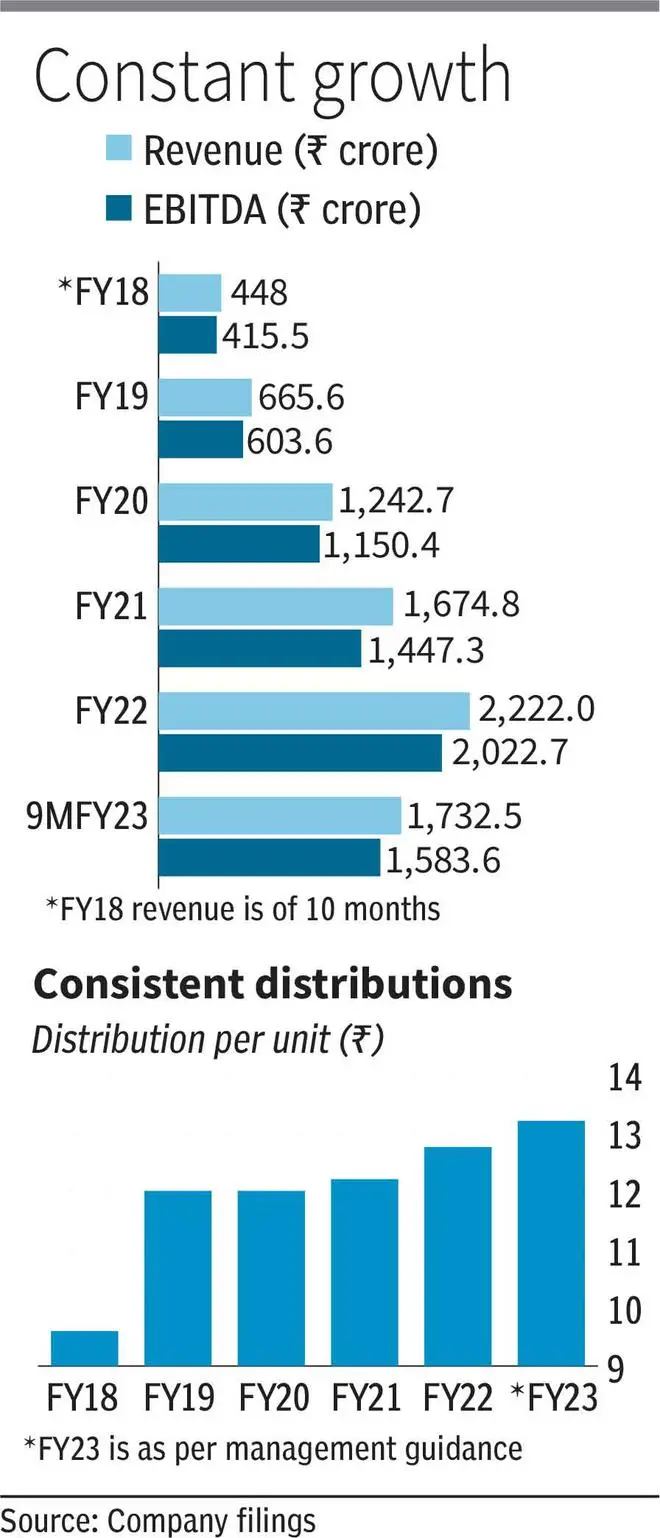

During FY2018-22, IndiGrid increased its revenue at a CAGR of about 49 per cent to ₹2,222 crore on account of regular acquisitions of operational transmission projects. Further, on account of steady cash flow model and operating above normative availability, IndiGrid maintained EBITDA margins in the range of 85-90 per cent while its CAGR was also in line with that of revenue.

For nine months ended FY23, IndiGrid generated revenue of about ₹1,733 crore with a growth of around 3.6 per cent Y-o-Y. As on December 31, 2022, it reported net debt to AUM (assets under management) of about 58 per cent, which is below the 70 per cent cap as mandated by SEBI. This puts IndiGrid in a comfortable position and provides enough room for further acquisitions. AUM refers to the value of the InvIT’s operational transmission-based assets.

Distribution and returns

IndiGrid’s net distributable cash flow (NDCF) from which it can make distributions to investors rose at a CAGR of around 36 per cent during FY2018-22. In general, NDCF can be calculated as PAT plus, depreciation/amortisation, less repayment of external obligations, plus/(minus) gain/(loss) on selling infrastructure assets. InvITs are supposed to make distributions to the tune of at least 90 per cent of NDCF to the investors. IndiGrid makes such distributions on a quarterly basis. For FY23, management has guided for a distribution per unit (DPU) of about ₹13.2 per unit, which results in pre-tax yield of a little over 10 per cent.

Here the distributions are made in the form of either interest, dividends orcapital repayment. Dividends distributed are taxed in the hands of investors based on their tax slabs if the InvIT’S SPVs apply for concessional tax regime for their projects, else they aren’t taxable for investors. Further, capital repayment received was not taxable for investors which may be taxable April 2023 onwards considering the proposal in Budget 2023, while interest is taxable in any case at investor’s tax slab. Budget proposal will not affect IndiGrid’s investors much as majority of its distribution to investors has been in the form of interest payment, which is likely in the future too.

Comparatively, similar InvITof PowerGrid too gives about 10 per cent dividend yield to investors. Its distribution has portion dividends which are not taxable. It might thus enable investors to earn slightly higher yield compared to IndiGrid, but direct comparison is not possible due to PowerGrid InvIT’s limited track record as it got listed in May 2021 .

Growth prospects

From about ₹5,200 crore in FY18, IndiGrid has grown its AUM nearly fourfold to ₹21,173 crore owing to acquisitions at a steady pace. Consequently, distributions have grown from about ₹270 crore in FY18 to an expected ₹924.26 crore in FY23. During Q3FY23, the InvIT completed acquisition of Raichur Sholapur transmission line worth ₹250 crore. IndiGrid has signed agreement to acquire Khargone Transmission Ltd from Sterlite Power for about ₹1,500 crore, closure of which is expected by the end of Q4FY23.

Further, IndiGrid has signed an MOU with GR Infra to jointly bid for identified tariff-based competitive bidding (TBCB) projects worth ₹5,000 crore wherein GR Infra will develop and execute the projects post which IndiGrid will acquire them.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.