Jupiter Lifelines Hospital (Jupiter) is a west India-based healthcare service provider with three multi-speciality hospitals. The group, as of March 31, 2023, has 950 operational beds in Thane, Mumbai (commercialised in 2007), Pune (2017) and Indore (2020). The premium hospital, with above-industry ARPOBs (Average revenue per operating bed) and premium service offering, is expected to add close to 50 per cent more capacity in the next three years with a new facility in Dombivli, Mumbai.

The fresh issue of ₹542 crore (OFS of ₹327 crore) will clear existing debt. Conservatively assuming a flat growth in revenue and flat EBITDA margins, the IPO is priced at 40 times FY24 expected earnings, which is in line with established and larger peers. With expansion in Indore and also in Pune to an extent, the group can generate higher revenue growth in the short term and, driven by Dombivli, in the longer term. Given the lower competition from organised hospitals in local market (west India), the earnings jump from debt clearance with IPO proceeds, and capacity expansion on cards, we recommend that investors subscribe to the issue.

Premium offering

The three multi-speciality facilities offer up to tertiary and quaternary care, including advanced transplants and oncological services. Each unit already has a capacity (or will be scaled up) of 250 to 300 + beds to provide economies that support a multi-speciality offering in each unit — without going for a hub-spoke model opted for in organised hospital chains. This provides customer stickiness and higher utilisation of assets with the trade-off being limited footprint.

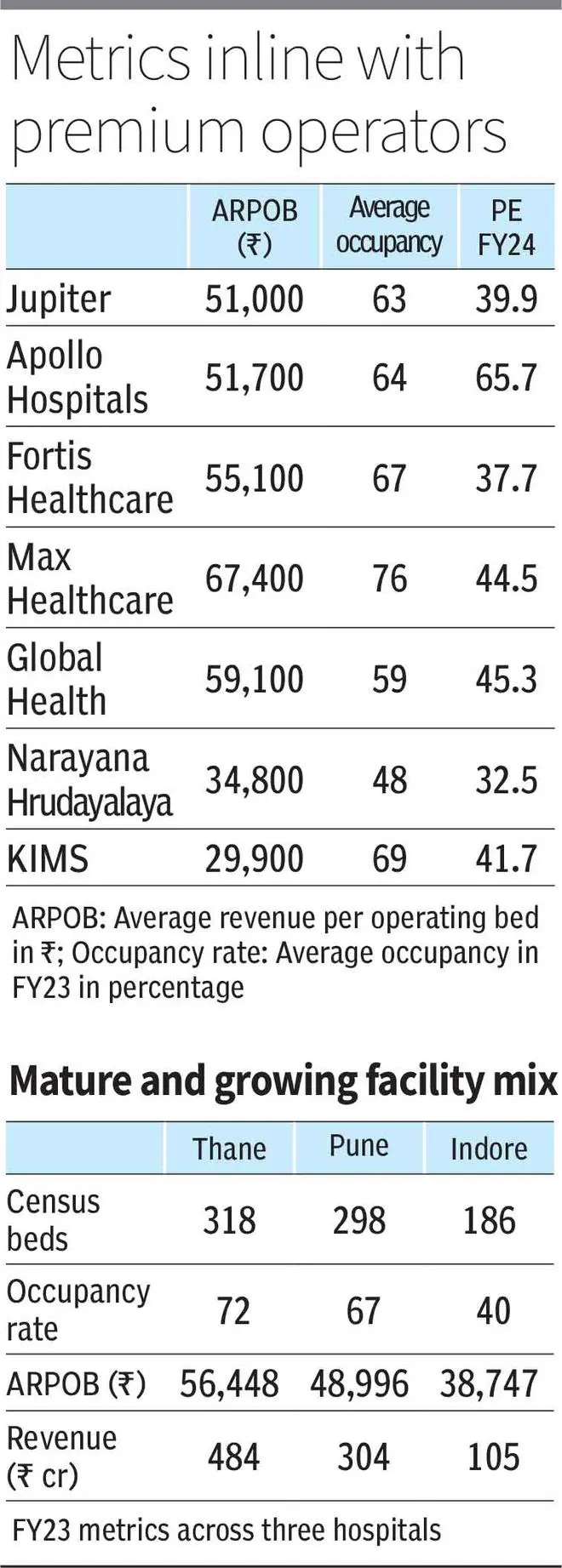

Against a hospital benchmark of ₹57,000 ARPOB for a premium offering and 65 per cent occupancy rate for a hospital group, Jupiter seems to be moving towards industry benchmarks. ARPOB-occupancy rates reached ₹56,500/72 per cent for its Thane facility in FY23, ₹49,000/67 per cent for Pune established in 2017 and ₹38,800/40 per cent for Indore, which has been acquired in 2020 and is being expanded. Jupiter is focussed on service quality as well, maintaining 1,000 square feet to bed ratio, ventilation and open spaces in its facilities, along with high-end care.

Expansion

Jupiter has 950 operational beds of which census beds (used for inpatient) account for 802 beds as of FY23. Hospitals in Thane, Pune and Indore account for 318, 298 and 186 census beds respectively. Pune operationalised 50 more beds in March 2023, Thane 11 beds, and Indore has scope to expand to 100-150 more beds in next two years. The Indore facility, acquired in FY21, has a capacity of 430 beds and currently operates only 186 beds.

The company started Dombivli project in FY23, which will have a capacity of 500 beds, with all regulatory permissions for the land parcel in place, and has commenced construction. The project will be financed by internal accruals and existing cash after the IPO proceeds clear the debt. The expected commercialisation is three years from now. This provides a sufficient runway for volume growth for the next three years. The company plans to focus on western India market. The region has lower penetration of group or large hospitals, which are mostly in North and South India. Jupiter brand, with 15 years of operations in Thane, can provide brand recognition for the company.

Financials and valuation

The company reported revenue of ₹892 crore in FY23 (22 per cent YoY growth), driven by ARPOB growth of 5 per cent and improvement in occupancy rate by 860 bps as the group returns to post-Covid normalisation in surgical procedures. The group also gained from 45-bed addition, primarily in Indore and Pune facilities. With increasing utilisation and ARPOB, the EBITDA margins also improved to 23 per cent in FY23, which is a 200 bps improvement.

The company has a total debt of ₹430 crore as on March 31, 2023, primarily from Indore acquisition and Pune commercialisation in the last two years. The fresh issue proceeds from IPO will be utilised to clear debt, which will eliminate the finance cost. The current net debt to EBITDA stands at 1.5 times. Debt will be eliminated post-IPO. Assuming flat growth and flat EBITDA margins conservatively the IPO pricing appears to be at 40 times FY24 earnings. This is comparable to ‘premium’ grouping of the industry.

The industry growth factors of rising middle class with increasing health cover penetration and significantly insufficient public healthcare facilities should support volume and price growth for the industry.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.