The week gone by saw Nifty and Sensex touch all-time highs of 24,854 and 81,587 points respectively while a panic Friday erased almost all the gains with both Nifty and Sensex gaining a miserly 0.1% for the week as at close of markets on Jul 19, 2024.

Most of the BSE Sectoral Indices were in the red, while TECk, IT and FMCG ended up being the outliers with around 2 per cent gains. Dalal street celebrated the better-than-anticipated results of the Tech Big 4.

Here are 3 stocks from the BSE 500 universe which outperformed the benchmark indices during the last week, with the fundamental developments decoded behind such outperformance,

Just Dial Limited

Just Dial Limited zoomed past market cap of ₹10,000 crores in the week gone by, touching its 52-week high of Rs. 1,305 per share before settling down at ₹1,252 on Jul 19, 2024. This climb during the week came on the back of encouraging results for the period Q1 of FY 2025.

Operating revenue grew by 13.6 per cent Y-o-Y to ₹2,806 million while EBITDA grew by 119.8 per cent to ₹806 million. The Q-o-Q growth was at 3.8 per cent and 14.2 per cent respectively. The showstopper was the jump in EBITDA margin to 28.7 per cent in the Q1 FY 2025 from 14.9 per cent in Q1 FY 2024. The sequential jump was 261 bps. The business has been showing gradual yet consistent growth in user traffic and active listings.

Just Dial Limited provides local search-related services to users across India in a platform-agnostic manner.

The stock is trading at a trailing 12 month PE of around 25 times.

Alembic Pharmaceuticals Limited

Alembic Pharmaceuticals Limited also soared to its 52-week high touching ₹1,119 per share before settling down at ₹1,080 as at market close on Jul 19, 2024. The upmove was on account of tentative approval obtained by the Company from USFDA for Selexipag for Injection, which the Company announced after market hours on Jul 12, 2024.

It is noted that Alembic is the first applicant to have filed its ANDA for Selexipag for Injection and upon the receipt of final approval, the Company might be eligible for 180 days of generic marketing exclusivity in US.

This injection is indicated for the treatment of pulmonary arterial hypertension (PAH) which is a condition of blood vessels in the lungs getting narrowed, blocked or destroyed.

Alembic Pharmaceuticals is in the business of development, manufacturing, and marketing of Pharmaceuticals products i.e. Formulations and Active Pharmaceutical Ingredients.

The stock is trading at a trailing 12 month PE of 34.6 times.

Hatsun Agro Product Limited

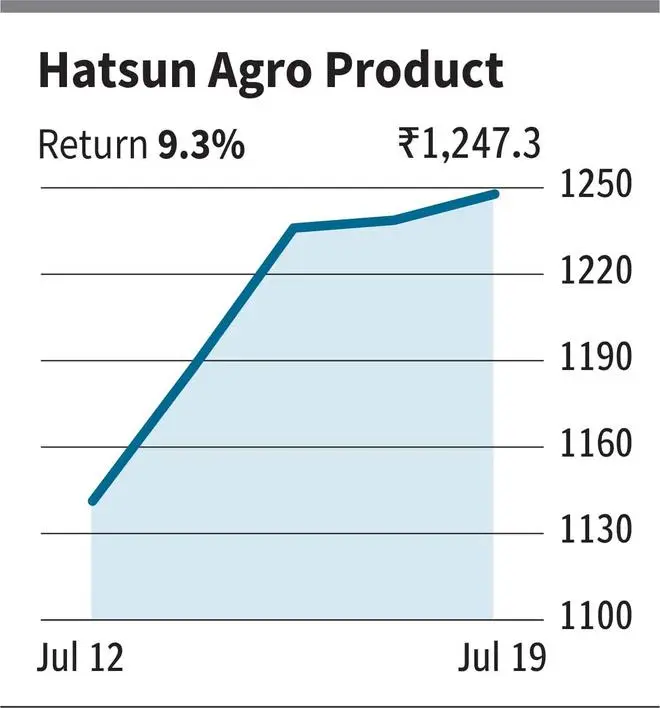

The share price of Hatsun Agro Product Limited touched its 52-week high of ₹1,400 during the week and settled down at ₹1,246 logging in a healthy weekly gain of 9.3 per cent. The rise could be attributed to the Q1 results of FY 2025 declared during the week, where the topline comfortably grew by 16.0per cent Q-o-Q and 10.4 per cent Y-o-Y to ₹23,750 million.

EBITDA margin expanded by around 300 bps both Q-o-Q and Y-o-Y to 14.0 per cent. This enabled the EPS to grow impressively by 62.8 per cent Y-o-Y to ₹5.86 per share for the quarter. The Company also declared interim dividend of ₹6 per share with Jul 24, 2024 as the record date. The Company also approved the opening of Foreign Branch Office in the State of Delaware, US.

Hatsun Agro Product Limited is in the business of dairy sector manufacturing and marketing milk and milk products, ice-cream amidst other dairy products.

The stock is trading at a trailing 12 month PE of 87.4 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.