The stock price of Laurus Labs has been on a roller-coaster ride since its IPO. The stock, which was listed in late-2016, came into limelight with Covid-related orders in 2020-21; it returned 600 per cent from IPO to Covid peak in 2021. Later on, it corrected as Covid supplies neared their end and the company started on its transformation journey. The stock corrected 60 per cent from the peak to its lowest point in March 2023. With financial implication of the strategic turnaround becoming firmer, the stock has rallied 60 per cent since then.

The company’s investments are nearing fruition in the next two years. But with the stock trading at 37 times FY26 expected earnings, investors can hold the stock at the current levels and not add new positions in the stock. The new revenue-drivers must be initiated, then scaled up and must deliver margin improvement before the stock can regain its momentum.

Difficult patch

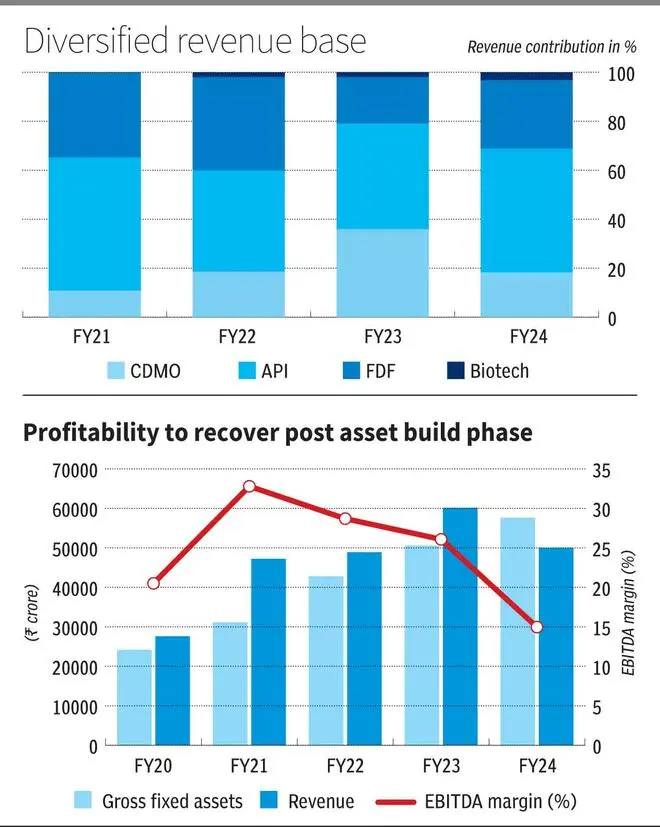

Laurus Labs was a leading producer of APIs for ARVs (anti-retrovirals) at the time of its IPO. The company later added finished dosage facilities (FDF), again focussed on ARVs. To move away from the price volatility, competition and concentration risks of operating in ARVs, the company has initiated several new ventures which have taken shape in the last three years. It has added a CDMO division to partner clients in the drug development process. The FDF unit has matured into a strong revenue segment. The company has also initiated a nascent Biotechnology division. This build-up, which is still ongoing, has impacted the financials in the recent years, as the assets were underutilised and the expected revenue ramp is elongated in these segments.

The company invested ₹2,600 crore in the last three years, primarily in CDMO and Biotech divisions, yet to be fully utilised. The operational costs, including the R&D personnel required to develop and commercialise the portfolio in CDMO, FDF and Biotech divisions, have impacted margins apart from the finance and depreciation costs. The corresponding revenue from the divisions is back-ended and yet to significantly impact the toplines owing to five-six year development timelines for the complex projects.

The company also received a large purchase order in FY23 for Covid products, which promptly dissipated in FY24 adding to the revenue deceleration and asset underutilisation. The API prices in ARVs and other segments such as cardio and diabetes were volatile, adding to the impact.

Growth drivers

The recent capex focus has been on the CDMO division followed by biotech, which will be the growth drivers in the medium term. In the CDMO division, there are 10 products at the commercial scale out of 70 projects being handled. The company expects to add more in the commercial side by H2FY25, currently under post-Phase 3 stage or late-stage evaluation in developed markets. This improves revenue visibility at a higher scale of operations for those products.

Besides, a bulk of the capex has been directed at establishing an animal health facility and a crop science facility. These multi-product, multi-year contracts are with specific clients in each division. The animal health facility is expected to increase revenues in FY25-26 with three of the 20 product portfolio currently under validation. Similarly, crop science CDMO operations will crystallise in FY26-27.

The company, in collaboration with IIT Kanpur, is setting up a cell and gene therapy laboratory, expected to start Phase-1 operations by FY25-end. The same collaboration had introduced NexCAR19 in December 2023, a CAR-T therapy for blood cancers in India. An additional facility to expand production of NexCAR19 is also in the works in Kanpur. Notably, the company had presented data in American Society of Haematology conference in November 2023, which increases the optional value of the programme.

The biotechnology division is currently focussed on microbial-based fermentation for biocatalysis, used for intermediates in nutraceuticals, dietary supplements and alternate food proteins. Organic or enzyme-based catalysis is preferred for some applications in green chemistry and has scope in small molecule intermediates and APIs as well. In addition to the initial facilities, the company is developing two more facilities in Visakhapatnam (pharma intermediaries) and Mysuru (food proteins), which should add around two million litres of fermentation capacity. The Visakhapatnam facility is expected to start by mid-2026.

In the FDF segment, the company is in partnership with Krka Pharma, a Poland-based group with 49 per cent share. This entity is expanding the dosage capacity from 10 billion tablets per year to 13 billion with an initial investment of $50 million. The API facility is also expanding operations in the Oncological APIs capacity, which has grown rapidly in the last two years albeit on a small base.

The company has several growth avenues in CDMO (late-stage addition, animal and crop science facilities, and cell and gene therapy initiatives), biotechnology’s fermentation assets and expansion in FDF and API segments. The scope of the projects, the revenue traction and margin improvement scope will be realised once the projects get commercialised in the next two years. The company’s Net debt (₹2,733 crore) to EBITDA at 3.5 times is on the higher side, compounded by the contraction in margins in the last one year. It targets 2.5 times by FY25-end and should be possible, as the under-utilised asset base is put into work. The scope of revenue expansion from the new growth initiatives should be the primary monitorable.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.