After falling 28 per cent from the IPO price (upper end), the tide may be turning in favour of LIC. In June FY23 quarter (Q1), the insurance behemoth posted ₹603 crore of net profit, up by nearly 24x higher than ₹24.3 crore net profit posted a year-ago. While the growth may be coming off on a relatively subdued base — as Q1 FY22 was impacted by the Delta-wave of the Covid-19 pandemic, broader numbers also support LIC’s comeback. For instance, recent data on premium growth indicates that LIC has done better than the top private life insurers.

Bettering peers on premium growth

Data published in July with respect to annualized premium equivalent (APE) indicates a decline in premium (individual and group) growth for top four private players namely SBI Life (the current market leader), followed by HDFC life, ICICI Prudential Life (I-Pru Life) and Max Life. While I-Pru Life’s APE growth in July has been flat year-on-year, other have posted a decline in growth of 1 – 8 per cent (see table).

LIC on the other hand has posted 57 per cent increase in APE growth for the month. This betters the private sector’s growth at eight per cent and the industry’s growth at 29 per cent. The word of caution here is that LIC’s growth has come on an extremely subdued base. While the April – August 2021 period was stressful for all life insurers because of the second wave of the pandemic, LIC, which derives 96 per cent of its business from agency channel (highest in the industry domestically and globally), took a larger knock in the business. Now with its agents back on feet, LIC’s bounce back in July 2022 is robust compared to private peers.

But even if you take the July numbers with a pinch of salt, data for the first four months of this fiscal (April -July 2022) too, is skewed in LIC’s favour.

At 42 per cent APE growth during this period, it has outdone the private sector and the total industry’s growth. Interestingly, among the top 4 players, only SBI Life has outperformed LIC. What’s also noteworthy is that even with the private sector, growth is largely coming from the smaller players such as Bajaj Allianz Life and Tata AIG Life, which have posted 71 per cent and 66 per cent growth in the 4m-FY22 period.

Retail market share needs a watch

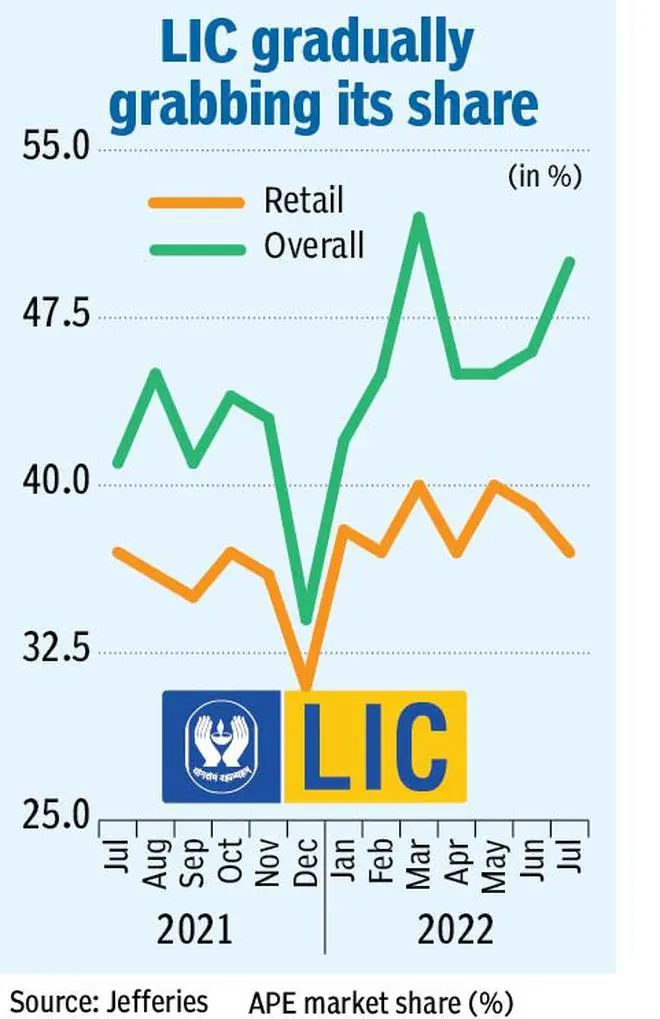

LIC’s bettering numbers is reflected in its improved overall industry market share, which has moved up from 41 per cent in July 2021 to 50 per cent in July 2022. However, on the retail front, the market share now remains flat vs. July 2021. After touching 40 per cent market share in March’22, LIC’s retail share number has dipped by 300 bps in July. With private players growing aggressively thanks to their savings products, LIC, has a lot of catching up to do.

Meanwhile, yield across savings products have come off by 80 – 90 bps for all players due to interest rate reversals since May 2022. Therefore, LIC’s performance in the retail segment needs monitoring, given that it can have implications on its growth and profitability.

Besides, LIC’s value of new business margin (VNB margin) has fallen by 140 bps from the March quarter to 13.6 per cent now due to change in product mix. The company has indicated that it will compete with private players on VNB margin (at over 25 per cent in FY22) in the next few years. For now, it’s at the half-way mark and with private peers seeming to stagnate in the recent times, it would be interesting to see how much gap can be bridged by LIC in FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.