In the five-year period since 2018-19 (pre-pandemic), the shares of Maruti Suzuki have at best put up a flat performance. Being a small car maker in a market shifting to utility vehicles (UVs) and being a laggard in electric vehicles (EVs) were not received well by the markets.

However, even as the upcycle in the industry is peaking out now, the case for Maruti Suzuki is gathering steam. Launches in the UV segment, strong order book and capacity expansion plans, as well as progress on green mobility, stand in favour.

Expectations of higher realisations from richer product mix is improving earnings visibility for the stock, which now trades at a one-year forward PE multiple of 23.7 times. This is at a 15 per cent discount to its 5-year average of 28 times. Considering the promising prospects and reasonable valuation, investors can accumulate the stock.

Sweet spot

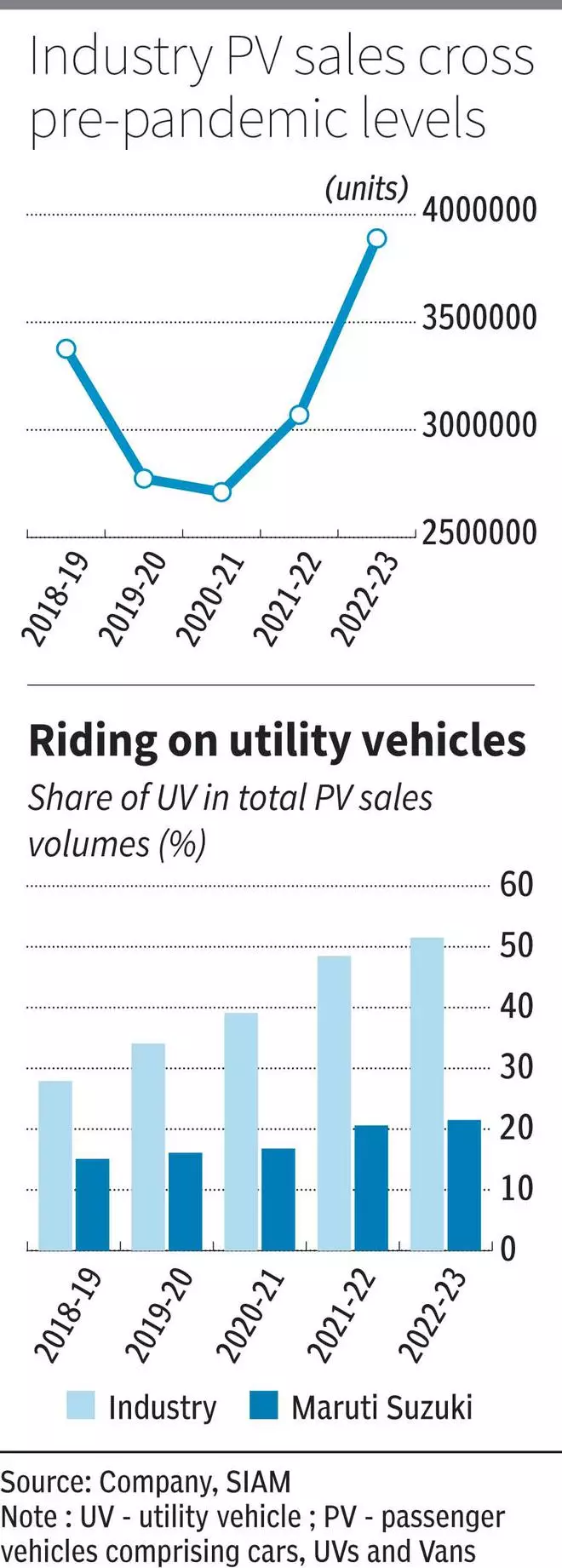

Despite the upturn in the auto cycle after the pandemic, two/three-wheeler as well as commercial vehicle sales volumes are yet to touch pre-pandemic levels at the end of 2022-23.

However, the passenger vehicle (PV) segment (comprising cars, UVs and vans) is a different story, having crossed pre-pandemic volumes, thanks to a shift in consumer preference for UVs.

UV sales volumes in the last two years have grown by 35-40 per cent (year-on-year) in each year and thus, the share of UVs in total PV shares has gradually moved up from 27.9 per cent five years ago to 51.5 per cent now. In other words, one in every two PVs sold is a UV today.

To be fair, Maruti’s portfolio was not bereft of UVs and the company’s share of UVs in total sales too moved up in this period. But these vehicles — Vitara Brezza and the S-Cross — were launched much earlier and there were no big launches in the last few years. Thus, stiff competition ensured that Maruti lost market share in UVs in this phase.

However, the company is making amends. The successful launch of the Grand Vitara is an example. The recently launched Fronx, the upcoming Jimny and the refreshed Brezza too are expected to address the drought and promise footfall conversions.

With several paths to reduce emissions and some policy uncertainties surrounding this, the company is following a technology-agnostic approach to maximise volumes. The launch of strong hybrids (aided by its partnership with Toyota) or its CNG portfolio is an example.

The hybrid Grand Vitara has been well received. Ditto with CNG vehicles, an array of which were launched in the last year, across all segments ranging from small car to hatchbacks to UVs. In FY23, CNG and hybrid vehicles constituted about 37 per cent of total sales volumes for the company.

Its absence in the EV segment, long its Achilles’ heel, is being addressed, not to mention the company’s preparedness for a flex fuel regime. Its first EV, designed and developed by Suzuki Motor, is expected to be launched next fiscal. A flex-fuel Wagon R is also showcased.

Sanguine prospects

After two years of double-digit growth, SIAM, the industry body, expects growth in PV sales volumes to moderate to 5-7 per cent year-on-year in 2023-24.

Maruti is expected to outshine industry growth this fiscal, thanks to the launches as well as its strong order book of 4.12 lakh units. Of the order book, one-third is CNG vehicles. The newly launched UVs also constitute a good number, according to the management. Channel inventory is only at 2-3 weeks currently.

While there is still no visibility on better availability of semiconductors, the company could not produce 1.7 lakh units in FY23 due to this shortage. All these factors point to the fact that though the auto cycle is peaking out, Maruti Suzuki still has tailwinds.

The company is setting up a new plant at Kharkhoda in Haryana with initial capacity of 2.5 lakh units, which is expected to be commissioned within 2025.

A capex of ₹8,000 crore (funded by internal accruals) is envisaged for FY24. Another 1 lakh capacity will also be added at Manesar.

Financials

In the quarter ended March 2023, while volumes moved up by 5.3 per cent year on year, net sales grew by a higher 20.8 per cent to ₹30,821 crore, aided by higher realisations.

Net profits grew by 42 per cent to ₹2,623 crore. Operating margin improved to 10.45 per cent Vs 9 per cent in the same period last year, aided by reductions in material, employee costs and other expenses.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.