In the week ending September 29, the Benchmark indices, Sensex and Nifty 50 declined 0.3 and 0.2 per cent respectively. BSE Healthcare gained the most by 2.6 per cent followed by BSE Realty 2.5 per cent. BSE Capital Goods and BSE Metal gained 2.2 per cent each. BSE IT and BSE Teck declined 2.8 per cent and 2.3 per cent.

However, during the week many stocks moved up without being backed by any significant news-flows or fundamentals Amongst those in BSE 500 that outperformed driven by fundamental news flows, MCX, Dixon Technologies and Sobha Ltd were the top gainers.

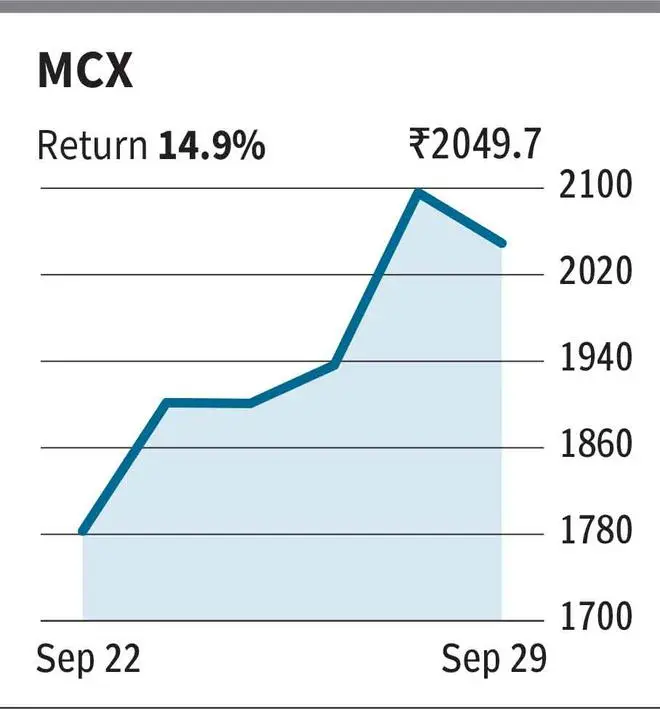

MCX

The stock of MCX gained 14.87 per cent in the week ending September 29,2023. On September 27, MCX announced its much awaited plan for implementation of its new web-based Commodity Derivatives Platform. The delay in launching the platform has been impacting operating profit of MCX signifcantly due to higher payments being made to 63 Moons Technologies to use its software for running the current trading platform. This seems to have triggered rally in the stock. However, it must be noted while originally the launch of the platform developed by TCS was expected by October 3, it has been suspended temporarily by SEBI till further notice.

The trailing PE of the company is 70 times whereas the trailing price to book ratio is 7.07 times.

Dixon Technologies

The stock of Dixon Technologies rose 9.96 per cent in the week ending September 29, with the highest single day gain of 4 per cent on September 26,2023. The company touched its 52-week high on September 28,2023 on the news of signing a contract with Padget Electronics, a subsidiary of Xiaomi Technology India Pvt Ltd for the production of smart phones.

The trailing PE of the company is 123 times whereas the price to book ratio is 24.5 times.

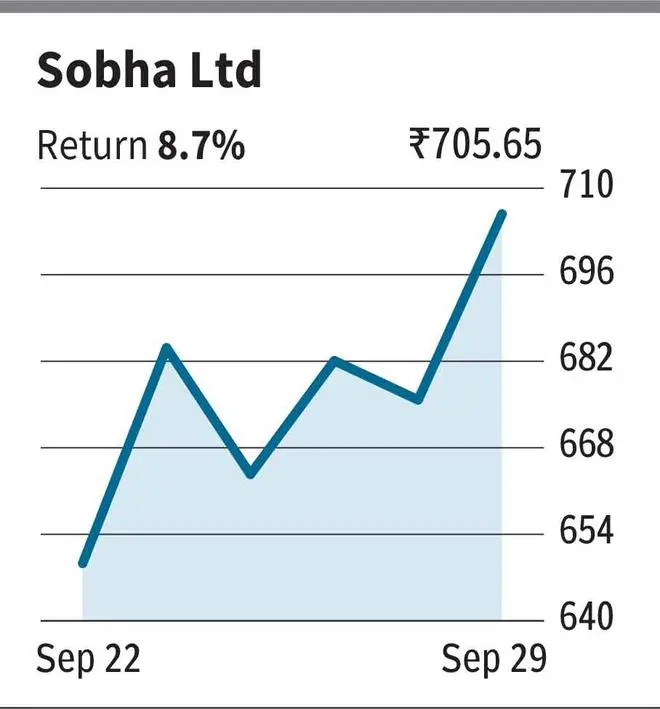

Sobha Ltd

The stock of real estate developer Shobha Ltd rose 8.74 per cent in the week ending September 29 with the highest single day gain of 5.3 per cent on September 25. The main reason for the trigger of the rally was a report by Reuters which stated that the government intends to spend ₹60,000 crore to provide subsidised loans for small urban housing over the next five years. As per the report the scheme will offer an annual interest subsidy of between 3-6.5% on up to ₹9 lakh of the loan amount. Housing loans below ₹50 lakh availed for a tenure of 20 years will be eligible for the proposed scheme.

The trailing PE of the company is 64.2 times and the price to book ratio of the company is 2.7 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.