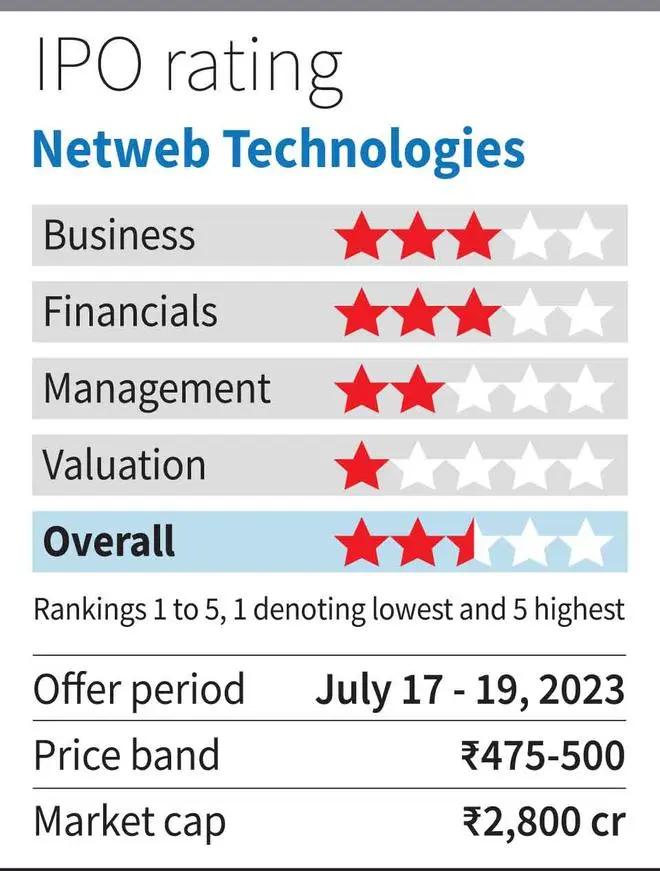

Investors can give the IPO of Netweb Technologies (Netweb) which opens on July 17, a pass. The IPO size is ₹631 crore, consisting of a fresh issue of ₹206 crore and offer for sale of ₹425 crore. Netweb market cap at the upper end of the price band of ₹475-500 will be ₹2,800 crore.

While the company is involved in the business of high-end computing solutions and manufacturing of supercomputers, the exact value add and strength of its proprietary technology in the business require more details which cannot be ascertained satisfactorily from information in the prospectus and other publicly available information.

Further, its steep valuation also does not appear justifiable, given low gross/EBITDA margins and competitive threats from large players. On pre-issue basis, the company is priced at a trailing EV/EBITDA 37 times, PE of 55 times, and price/book of 27 times. On post-issue basis, while EV/EBITDA remains unchanged, the PE increases to nearly 60 times (before adjusting for any interest savings/income from fresh inflow) while P/B will reduce to around 10 times (still expensive). Besides, the company also faces high customer concentration risks with a significant 47.1 per cent of revenues from top five customers in FY23. On the whole, while there may be listing gains given current market mood, for long-term investors a wait and watch approach by tracking its performance as a listed company and gathering more details is ideal in this case.

Business

The core business of the company is in the area of high-end computing solutions (HCS) provider. This encompasses high performance computing (Supercomputing) systems (39 per cent of FY23 revenue), private cloud and hyperconverged infrastructure (33 per cent of FY23 revenue), AI systems and enterprise work stations, high performance storage, data centre servers, and software and services for HCL offerings. In simple terms, HPC systems outperform commodity desktop, laptop and server computers with speeds more than a million times faster.

The company had acquired the erstwhile sole proprietorship business of one of its promoters – M/s Netweb Technologies in 2016. Including the past tack record of this acquired business, Netweb has undertaken installations of over 300 supercomputing systems, 50 private cloud and HCI installations. Business from government accounted for 53 per cent of FY23 revenue. Netweb was the vendor to the Centre for Development of Advanced Computing for ‘AIRAWAT’ which has been ranked 75th in the world as per recently released Top 500 Global Supercomputing list at the International Supercomputing Conference.

In FY23, the company reported revenue of ₹445 crore and PAT of ₹47 crore (Y-o-Y growth of 80 and 109 per cent respectively). Gross margin was at 27 per cent, EBITDA margin at 15.9 per cent and PAT margin at 10.6 per cent.

While, given the prevalent digital and emerging AI trend and recent performance of the company, the business looks interesting, we highlight a few concerns and risks that make the IPO a wait and watch.

Factors to watch

Level of technological moat: As mentioned in the IPO prospectus, the company designs, manufactures and deploys its HCS offerings comprising proprietary middleware solutions, end-user utilities and precompiled application stack. Further, explanations in the prospectus push a case of high technological prowess in the HPC space for Netweb. However, one factor that caught our attention was the lack of technological patents owned that support the core technological strength of the company.

According to management, they were earlier focussed on building the technology and hence had not paid attention to patents, but are in the process of getting it done. However this must be of concern for an IPO investor. In the absence of patents, one can’t determine the level of technological moat that the company has. There are also risks that if key employees move, without patents, the company might lose the technology.

Further, the company’s financials also do not indicate the extent of investments in R&D, which is crucial to a company engaged in a high-tech business.

Low margins: High-tech companies typically have very high gross margins, and usually high EBITDA/PAT margins as well (although this may vary based on business model and phase of growth). However, the low gross margin of Netweb at just 27 per cent in FY23 is another factor that requires investors to wait and further ascertain the extent of value add and technological prowess it has in the HPC space.

Assessing prospects not easy: As per the IPO prospectus, Netweb has no listed peers in domestic or international markets. Most of the big tech companies globally are either in the software space or hardware space and thus there is no clear integrated competitor in the HPC space. Thus there is not much of public data to assess the prospects for an integrated player and value add they bring in the ecosystem.

Governance watch: Currently, promoters own 97.8 per cent of the company which will reduce to a little over 75 per cent. Thus there has hardly been any external investor oversight and the strength of corporate governance and management practices can be ascertained only post listing. While not necessarily red flags, consistent churn in statutory auditors (current statutory auditor is third appointed in last 3 years) needs to be noted..

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.