The artificial intelligence (AI) wave has undoubtedly arrived and is in early stages, and probably similar to where the dotcom wave was in late 90s or early 2000. The structural changes it will entail in a digital global economy will disproportionately benefit a few sectors more than others. One such sector that has potential to benefit at a disproportionate scale is the semiconductor sector, with chips of varied kinds at the core of enabling AI level computing.

For now, the listed space in India does not offer much when it comes to tapping opportunities in the semiconductor space. So, investors who are interested in partaking in this opportunity will have to look at opportunities in US markets. The listed cluster of semiconductor stocks in the US is a universe within a universe — with nearly 100 listed stocks encompassing chip designers, fabless chip companies, semiconductor equipment makers, equipment and chip testing companies, packaging companies and foundries. Thus, while amongst semiconductor companies Nvidia has taken the centre stage over the last month on booming demand for AI computing chips, the AI theme will flow through to the entire semiconductor ecosystem. At different times, different stocks in the ecosystem will offer good entry opportunities based on valuation and growth prospects.

One company that we believe presents such an opportunity now and will be a beneficiary of the AI theme is Nasdaq listed GlobalFoundries (Ticker: GFS). We recommend investors to gradually accumulate the stock and are adding it to the list of semiconductor stocks in which we have a positive view for the long term based on risk-reward analysis. Earlier last year we had given an accumulate on dips rating on Intel and recently this year we had given a buy recommendation on Qualcomm.

GlobalFoundries as its name suggests, is a foundry. Many of the global semiconductor giants like Nvidia, Advanced Micro Devices (AMD), Qualcomm, Broadcom and Micron follow what is known as the fabless business model, wherein they design and sell the hardware/semiconductor chips, but outsource the manufacturing of the chips. Foundries are the factories where semiconductor chips are manufactured. Manufacturing of semiconductor chips is a complicated and high tech-driven processes with just a handful of companies having been able to establish themselves in that space, GlobalFoundries being one of them.

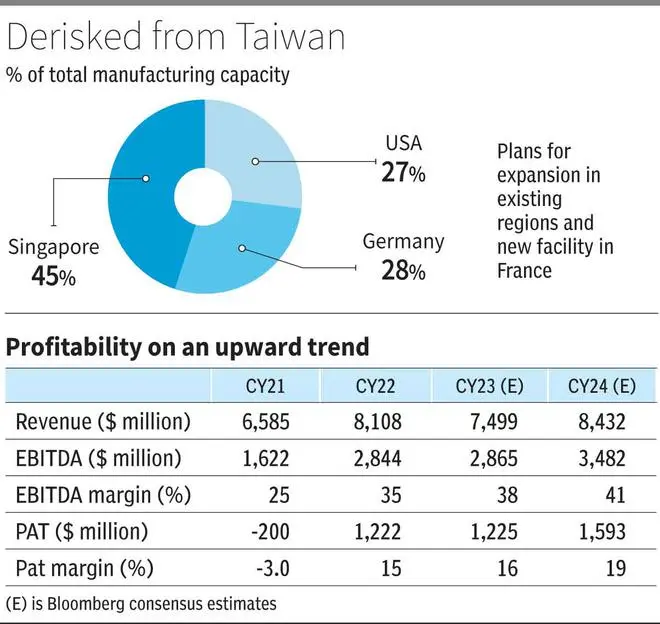

The AI theme apart, another structural theme that works in favour of GlobalFoundries is the de-risking of supply chains, with companies and governments working with a clear intent to increase sourcing of chips outside of China/Taiwan. This, combined with overhang of China-Taiwan relations, is a factor that works in favour of GlobalFoundries which has no exposure to this region. This is one reason why GlobalFoundries is a better investment option as compared to Taiwan Semiconductor Manufacturing Company – the global giant in the foundry space. As of 2022, nearly 50 per cent of foundry capacity was in Taiwan.

Thus, while GlobalFoundries presents a good thematic opportunity, there will also be speed bumps along the way. Number one being the fact that semiconductors is a notoriously cyclical industry. Two, the valuations of GlobalFoundries at one-year forward PE of 25 times and EV/EBITDA at 10.8 times, while definitely not expensive, is not cheap either. Three, global slowdown can impact near-term performance. Hence we recommend accumulate instead of buy, although the thematic opportunity is strong.

Business and prospects

GlobalFoundries was established in 2009 when a subsidiary of sovereign wealth fund Mubadala acquired AMD’s manufacturing operations. Since then it has grown significantly in scale via acquisitions and billions of dollars invested in scaling up capacities. It was listed in the stock markets via IPO in October 2021. Currently Mubadala owns around 85 per cent of the company.

Today, GlobalFoundries is one of the world’s leading semiconductor companies with foundry market share of around 7 per cent (ranked third). It manufactures the complex feature-rich integrated circuits (chips) that enable the functioning of billions of electronic devices around the world. It serves a broad range of customers, including the global leaders in chip design, and provides them with optimised solutions for the function, performance and power requirements of critical semiconductor applications.

As mentioned above, chip manufacturing is a highly complicated process involving intense application of advanced technologies. Foundries add significant value to their customers’ business by bringing in efficiency in the manufacturing process by innovating on reducing the size of transistors chips. In industry terms, one way in which efficiency is measured is based on nanometers (NM) or size of the chips. Lower nm chips are more efficient (lower power consumption) and faster (computing performance). The advanced technology required for such innovation and multiple other features in chips offer a significant moat to existing foundry players. This factor also makes existing customer relationships very strong and sticky. This makes for better longer term revenue visibility.

Within the foundry segment, GlobalFoundries is focussed more on manufacturing what is known as pervasive semiconductors. This represents integrated circuits with multiple functionalities that serve a broad range of applications meeting requirements of a wide range of end markets, as compared to traditional integrated circuits focused on compute-centric verticals.

Currently, globally there are only five foundries with significant scale — GlobalFoundries, TSMC, Samsung Semiconductor, Semiconductor Manufacturing International Corporation and United Microelectronics Corporation. Out of these, GlobalFoundries is the only player with a global footprint not based in China or Taiwan, enabling customers to mitigate geopolitical risks in their supply chain. Last year, the US government passed the Chips+ Act that provides significant funding for manufacturing of semiconductors in the US. Globafoundries is well-positioned to capitalise on that.

Financials

After reporting solid growth of 23 per cent in CY22 to $8.1 billion, GlobalFoundries is expected to report a decline in revenue of 7.5 per cent in CY23. This decline follows two solid years in CY21 and CY22. During the two-year period, revenue was up by nearly 70 per cent, reflecting the strong demand for chips. The decline in CY23 reflects inventory reduction efforts by customers and industry cyclicality, which is par. Despite the revenue trend, profitability trend is on an upward trajectory. A bounce-back in revenue trend too is expected in CY24. However, while the exact path business trends may vary due to multiple moving factors in global economy, the long-term structural trends bode very favourably for GlobalFoundries. This should get reflected in its financials over the next 3-5 years. The company also has a strong balance sheet with a modest net cash position.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.