Investors with a medium-term horizon can consider buying the stock of PSU crude oil producer Oil India. With the acquisition of Numaligarh Refinery Ltd (NRL) from BPCL, wherein the company currently holds 69.6 per cent, Oil India has achieved forward-integration, and is strengthening its position as an end-to-end energy player.

Steady crude oil prices, increasing gas throughput and higher gas realisation, coupled with expansion at its subsidiary NRL, are expected to drive Oil India’s growth over the next 3-5 years. With the company being a consistent dividend payer, the stock looks attractive at the current levels, trading at 3.05 times trailing twelve-month earnings and 0.68 times its book value. The stock’s trailing dividend yield also is impressive at 7.5 per cent.

Incorporated in 1959 as a joint venture between Burmah Oil company and Government of India, Oil India, which started off as an entity enabling installation, commissioning and maintenance of crude oil pipeline, has transformed itself into an energy major, over the years. Its business consists of three key segments — crude exploration and production (31.6 per cent of 9MFY23 revenue), gas production (9.3 per cent) and refinery through NRL (57.6 per cent). Other segments — pipeline transportation, LPG, renewable energy (green hydrogen) — account for the balance.

We believe Oil India is an interesting investment opportunity for five reasons.

First, in the oil exploration business, the company is augmenting more blocks to compensate for lower output from existing old blocks. It has 64 operated acreages in India, which includes 60 onshore blocks across the North-East, Andhra Pradesh, Odisha, and Rajasthan and four offshore blocks, including Krishna Godavari, Andaman, and Kerala Konkan. Outside India, the company operates blocks across seven countries including Russia, with 10 ongoing projects covering 44,300 square kilometres.

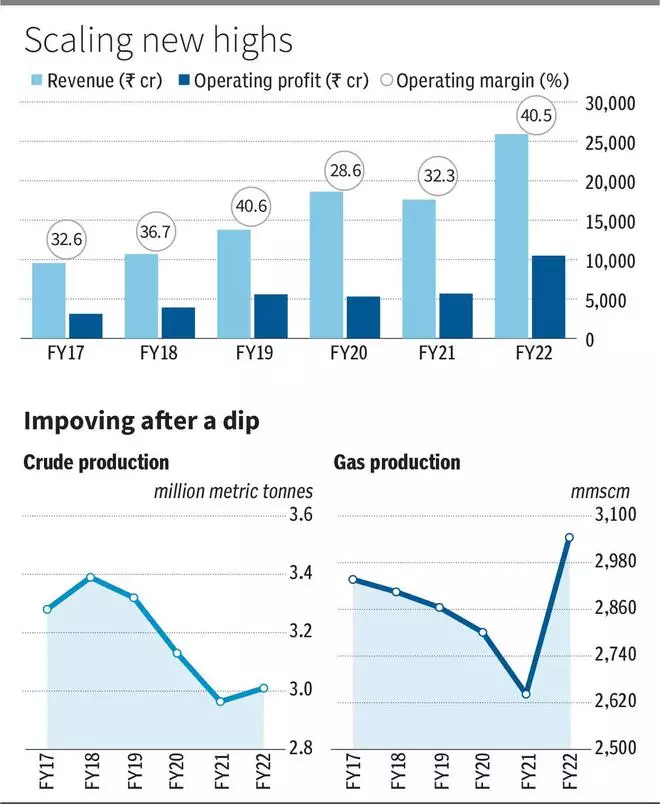

The company has identified five fields in the North-East and Rajasthan and infrastructure development has commenced. It has also implemented state-of-the art technologies such as electrical submersible pumps, hydro fracturing, steam gun perforation, amongst others, to increase output from mature fields. With this, the company expects crude output to increase from 3.01 mmt to 3.2 in FY23, 3.4 mmt in FY24 and thereafter to 4 mmt by FY25. On the gas front also, the output is expected to increase from 3,045 million standard cubic metre (mmscm) in FY22 to 3,300 mmscm by FY24 and to 4,000 mmscm by FY25.

The second reason for being optimistic is that higher realisation for crude, with the ongoing energy crisis, is positive for the company. Though the Government’s imposition of windfall tax has led to moderation of profits, the division’s revenue and profits are likely to grow at a healthy pace, should crude remain steady in the $65-80 a barrel range. Even in FY20, when the average crude net realisation dropped to $40.7 a barrel for Oil India, the exploration business’ margin remained healthy at 29 per cent; net profit grew 55 per cent to ₹5,005 crore. In FY21, despite Covid impact, the net profit decline was contained at 15 per cent.

Three, the refining business — NRL is expected to sustain healthy revenue and profit growth, with steady crude and downstream product realisation. In 3QFY23, at net crude realisation of about $74 a barrel, NRL’s gross refining margin was at an impressive $13.5 a barrel. Further, over the next three years, the refining capacity at NRL will treble from the current 3 million tonnes per annum to 9 mn tpa by 2025 and the project is under way. NRL will spend a total of ₹32,000 crore over the next four years, on expansion in refining capacity and other initiatives such as pipeline expansion. Currently, about 90 per cent of the refinery’s crude needs are met from domestic crude including Oil India and about 10 per cent is imported.

Four, in March 2022, the Government announced increase in the price of gas from domestic sources ,from $2.9 per mmbtu to $6.1 mmbtu, as global crude and gas prices hit the roof. This has helped the gas segment’s operating margin swell to an impressive 52 per cent in the 9MFY23 period (₹2,030 crore), compared to a loss of ₹540 crore same period last year. With the planned increase in gas volumes over the next two years, and higher realisation, this segment should help the company’s overall profitability.

Five, attractive valuations for the core business on a consolidated basis, at the current 0.68 times book and 3.05 times trailing earnings, are positive. With dividend per share of ₹14.5 in FY23 so far, trailing dividend yield of 7.5 per cent looks impressive. Further, the company holds about 3.4 per cent stake in Indian Oil Corporation which, at the current price of IOCL stock of ₹77 apiece, translates into a per share value of about ₹35 for Oil India.

Strong financials

In the 9MFY23, the company reported consolidated revenue growth of 50 per cent to ₹32,821 crore, compared to the same period last year. Net profit grew at a robust 88 per cent to ₹7,874 crore on a year-on-year basis, helped largely by the gas segment, followed by crude exploration and production. Total debt to equity as of September 2022 remained comfortable at 0.5 times.

Risks

Volatility in crude prices and realisation for downstream products will have a bearing on both the company’s oil production and NRL’s refining business, and this remains the key risk. On the oil production front, even as the company has been undertaking initiatives to identify new blocks and increase production from old blocks, the depleting reserves from mature blocks is a risk.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.