Investors with a two-three-year investment horizon can consider accumulating the stock of crop protection maker PI Industries on dips. Incorporated in 1946, PI Industries has a presence across the entire agrochemical value chain — right from R&D to distribution.

Besides strong technological competencies both in terms of chemistry and engineering, the company has a strong brand portfolio and a large pan-India network connecting it to over 70,000 retail touch points. PI’s decision to foray into contract development and manufacture of pharmaceutical chemicals, through the recent acquisitions in India (TRM India and Solis Pharmachem) and Italy (Archimica S.p.A) which are profitable already, will help it gain foothold quickly in the Pharma CDMO space, in addition to giving it access to a US FDA-approved facility near Milan.

At the current price of ₹3,483, the stock trades about 42 times its trailing twelve-month earnings. With the management’s guidance of 20 per cent growth in revenue and improvement in operating margins, one can expect 18-20 per cent annualised earnings growth for the company over the next two years, implying a 35 times FY24 earnings and 30 times its FY25 estimated earnings. Investors with a moderate risk appetite can consider accumulating the stock on declines, for three reasons.

Differentiated portfolio

First, PI Industries, which is among the leading producers of crop protection chemicals, has a differentiated portfolio of products. The product basket includes 19 insecticides, 7 fungicides and 9 herbicides. In addition to its branded generic business in India, the company has forged partnerships with innovators to develop and manufacture several patented products. One such is with Japanese innovator Kumiai to make products such as byspiribac sodium and pyroxasulphone, to name a few.

In the custom synthesis business, PI does custom research, development, and manufacturing of novel molecules for innovators. The company’s strength lies in its ability to cater to the innovator’s requirement end-to-end — right from synthesising complex chemical compounds to scaling the product to meeting the requirement post commercial launch. The strong product portfolio, about 4-5 new launches every year, has insulated the company from the pricing pressure in the home market due to channel stocking, etc.

In addition to crop protection products, the company also has 4 specialty products such as Biovita, a natural fertiliser, which helps increase microbial activity and nutrient availability to plants.

Pharma foray to add value

Second, the company’s move to foray into pharma CDMO will not only re-risk the business but also help it tap into the large global CDMO market which was pegged at $131 billion in 2019 and growing at high single digit. The company, through its subsidiaries, has acquired the Indian subsidiaries of Therachem Research Medilab (TRM), US and a few of their assets for a consideration of $75 million ($50 million upfront and balance as milestone payment).

TRM with a few molecules in Phase 2 and 3 of drug development will serve as a good launchpad for PI Industries’ CDMO foray, TRM had a revenue of $33 million with a normalised operating profit of $14 million as of March 2022, translating into an operating margin of 42 per cent. The acquisition price of $75 million is at an attractive 5.2 times operating profit versus 38 times for Divi’s Laboratories, although the latter is much larger in terms of scale of operations.

PI has acquired the assets of Archimica including its plant in Milan, which will provide the company access to 24 DMFs (drug master files for API) and a US FDA approved API (active pharma ingredient) manufacturing facility. With a utilisation of just about 50 per cent and about 12 APIs yet to be commercialised, there is significant scope for growth in the business, from the current revenue and operating profit of $45 million and $7 million respectively.. Also, Archimica’s GMP and US FDA compliant facility will help the company in manufacturing the late-stage innovative molecules that are currently under TRM’s fold, when these molecules are commercialised.

Impressive balance sheet

Third, the company with negligible debt of ₹46 crore and ₹2,243 crore cash equivalents, which includes the ₹2,000 crore QIP proceeds, done in July 2020, is well-positioned to pursue inorganic growth opportunities, which can strengthen the business over the medium term. T

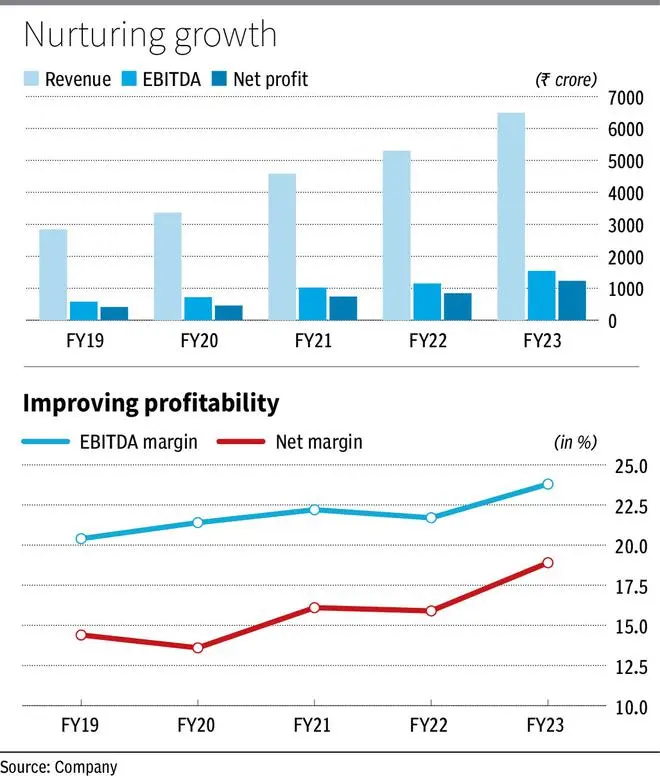

In FY23, the company’s revenue grew 22.5 per cent to ₹6,492 crore, while operating profit rose 34 per cent to ₹1,542 crore. Over the last three years, the company has managed to grow revenue by 24 per cent and profit by 39 per cent annually. Operating profit margins have improved from 21 per cent in FY20 to 24 per cent in FY23.

Concerns

The impact of a possible El Nino phenomenon remains to be seen, given that some purchase of agrochem products particularly the ones that are used prior to the pest emergence, happens ahead of the monsoon. However, one cannot rule out impact on its domestic sales should the market remain docile, and monsoon play havoc.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.