In the last week, three major road infrastructure players - Ashoka Buildcon, PNC Infratech and KNR constructions came up with the results. Though the performance show a decent revenue growth, there seems to be some hiccups while translating into EBITDA and PAT growth. The industry saw a slowdown in the awarding activity by NHAI in H1FY23 with awarding 4,092 k.m. as compared to 4,609 k.m. in the first half of FY22. The main reason for this seems to be the land acquisition for the projects.

Ashoka Buildcon

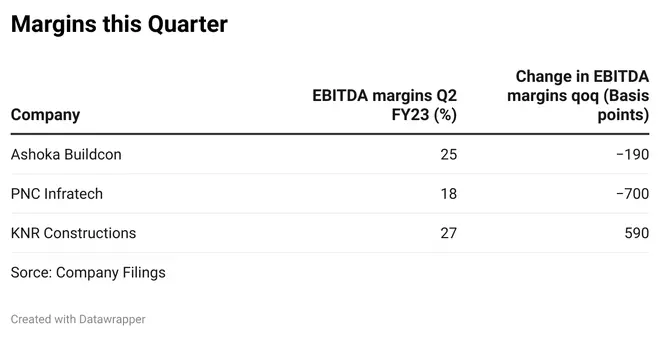

The company reported a consolidated revenue of ₹1,807.7 crore in Q2FY23, a 4 per cent growth over the same period previous year. The EBITDA grew around 4.3 per cent YoY on absolute terms to ₹466.7 crore from ₹447.6 crore, but the EBITDA margin declined 900 basis points to 25.3 per cent from 34.3 per cent. This decline in EBITDA, despite revenue growth, can be attributed to the cost pressures. The operating expenditure in Q2FY23 was ₹1,378.2 crore, around 61 per cent higher than Q2FY22 which was at ₹857.1 crore.

The management stated that the current projects arecompetitively bid with lower margins than the earlier periods. The company is in the advanced stages of concluding a deal for the sale of its 5 BOT (Build operate and Transfer) SPVs. The consolidated debt of the company stands at ₹7,079.7 crore and stated that the sale of 5 BOTs will bring down the debt by ₹2,930 crore and reduce the debt-to-equity ratio to 2.62 from 4.5.

The order backlog growth has been good with ₹14,900-crore worth orders as on September 2022 against ₹11,883 crore in the same period last year. The company has revised its guidance for revenue growth to 25-30 per cent from 15-20 per cent with margin guidance of 9-9.5 per cent for FY23 (on standalone basis).

PNC Infratech

The company reported consolidated revenue of ₹1,795.07 crore in Q2FY23 against ₹1,797.69 crore in Q2FY22. The EBITDA has declined to around 11 per cent in Q2FY23 to ₹326.41 crore from ₹366.17 crore in Q2FY22. The EBITDA margin also declined 220 basis points to 18.2 per cent in Q2FY23 from 20.4 per cent in Q2FY22. With the revenue staying flat over the quarters, the decline in EBITDA and its margin is primarily due to rise in the cost of materials which grew 8.5 per cent in Q2FY23 over September 2021 quarter.

The management gave revenue guidance of 10 per cent plus for FY23 and stated that extended rains may hamper execution. The company seems to be having a comfortable leverage position, with the net debt to equity of the company at 1.09x.

The order book growth has been robust with ₹19,261 crore as at September 30, 2022 over ₹13,178 crore in Q2FY22, a straight 46 per cent growth. The company needs to infuse equity of ₹1,280 crore in the next 2 to 3 years for its HAM projects, which the management expects to be met from internal accruals.

KNR Constructions

KNR Constructions reported a Q2FY23 consolidated revenue of ₹961.65 crore, which is 14 per cent higher than Q2FY22 when it was ₹842.01 crore. The EBITDA grew 48 per cent to ₹263.29 crore in September 2022 over ₹177.52 crore in September 2021. The EBITDA margins bucked the trend seen in peers and grew 630 basis points to 27.4 per cent in Q2 FY23 to 21.1 per cent in Q2FY22. However the margin jump is due to benefit of extraordinary items as well. The company has given 18 to 19 per cent guidance margins for FY23 and FY24. On execution front, the company faces delays due to extended monsoon/rains in southern India.

The company targets nearly ₹3,000-4,000 crore worth order inflow for the next one year and has also placed bids for the same. The company seems to be having a decent leverage position with debt to equity of the company at 0.74x. However, it must be noted that the company could not bag any new project in the last couple of quarters.

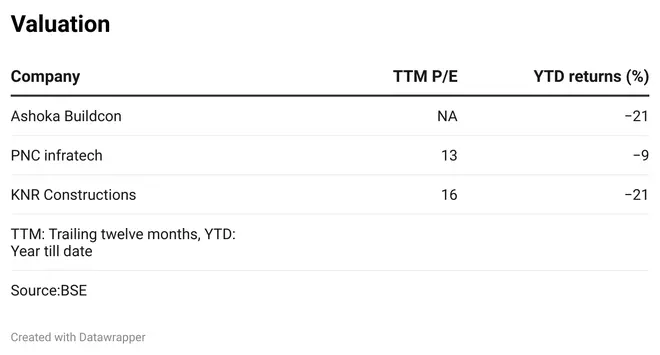

The stock price reaction has been positive for PNC Infratech and KNR Constructions. Post the results, PNC Infratech gained around 3 per cent while that of KNR constructions 6.1 per cent, whereas Ashoka Buildcon lost 3 per cent.

At present, PNC Infratech is trading at a trailing twelve months (TTM) PE of 13.11x while KNR constructions is trading at 16.38x, and for Ashoka Buildcon the TTM EPS is negative.

Key Takeaways

The results of these three major EPC and HAM developers reveals that this sector has not been immune to cost inflation. The material cost of PNC Infratech rose 8.5 per cent YoY in Q2FY23 whereas the rise was 14.8 per cent for KNR constructions and 75 per cent for Ashoka Buildcon.

The management of PNC Infratech mentioned that the competition for EPC projects is higher than HAM, huge for bigger projects, and at a lower-level for Jal Jeevan mission. This is a positive point as both PNC Infratech and KNR constructions are into irrigation projects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.