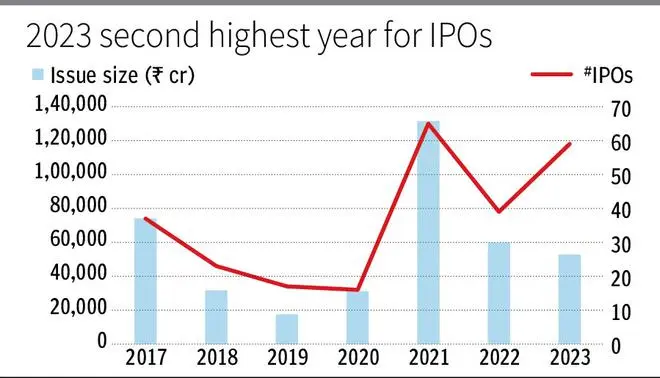

With 59 IPOs in the 2023, primary markets are back in action. Close to 44 of the 59 IPOs in 2023 were in the last two quarters which indicates early 2024 may continue with the momentum. The last two years returns have also been better than average. We analyse the IPOs in last seven years to get a readthrough on what could be in store for 2024.

Based on the number of IPOs - 2023 made a comeback in second half of the year. The largest in 2023 has been Mankind Pharma, Tata Technologies and Nexus ReIT.

2021 with largest corpus raised through IPOs in a year had One 97, Zomato, IRFC and many more large issues while 2017 was powered by Invit’s, public and private insurers which tend to of larger size.

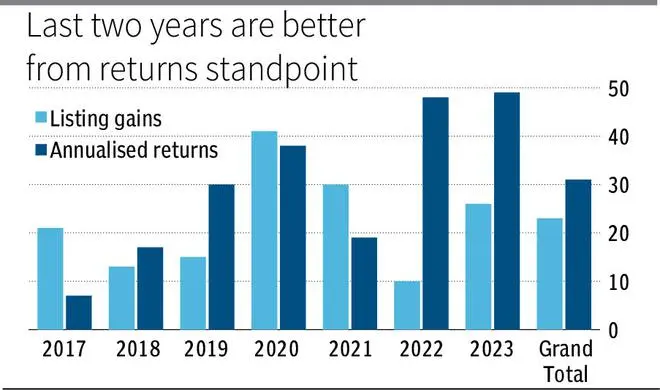

On the overall return metric 2023 and 2021 have been strong even as it could be due to recency effect in part. IREDA, Tata Tech, and Cyient DLM have powered 2023 IPO performance. Listing premiums also fared better in 2023 after a weak year in 2022.

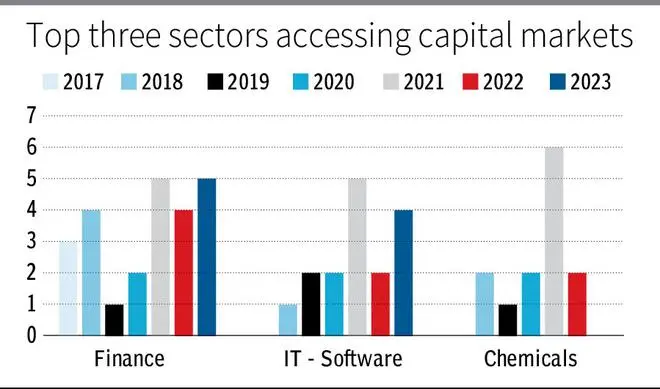

Following the established pecking order in secondary markets, Financials and IT had the highest IPOs overall with 24 and 16 IPOs. Chemicals which had a stellar 2021 with 6 IPOs had none in 2023. Jewellary IPO’s with 4 in 2023 may continue the trend going forward.

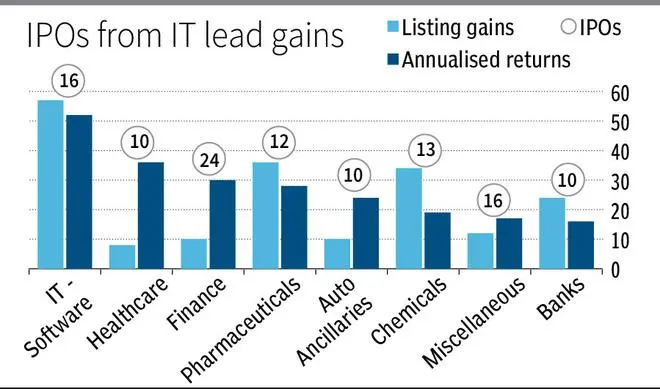

IPOs from IT have delivered gains on listing day and overall returns as well. Healthcare and Finance have not made strong debuts but have delierved overall results. Chemicals and Banks on the other hand have delivered strong listing gains, but below par overal returns.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.