Allied Blenders and Distillers (ABD) — India’s leading producer of IMFL spirits — has its IPO open to subscription till June 27. The company manufactures under 17 brand names, largely in mass, to prestige segments including Officers Choice, the leading mass premium whiskey.

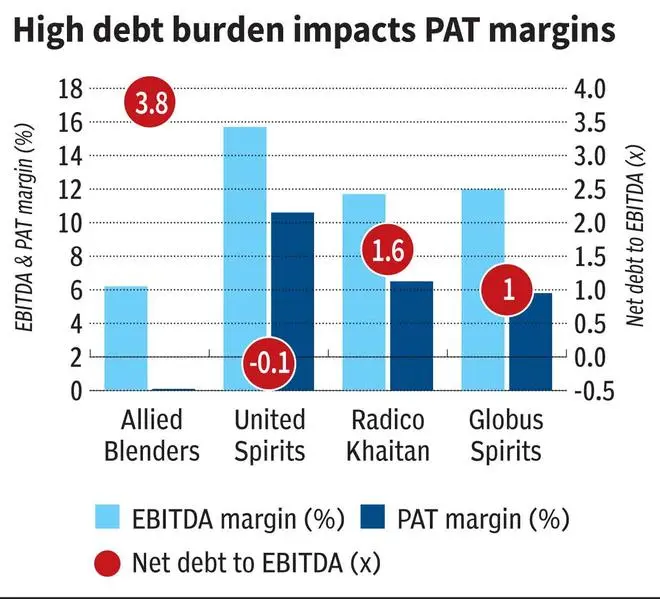

Established in 1998, the company has a wide reach across India with established sales network in each of the states and their procurement models. But owing to operations in non-premium segments and a high debt burden, the company operates on razor-thin margins. At the upper end of IPO price (₹281), the issue is priced at around 1,400 times post-IPO EPS or 2.3 times the price to net sales. With its anticipated foray into premium segments and debt reduction with the fresh issues (₹1,000 crore fresh and ₹500 crore OFS), ABD can improve its margins and valuation. We recommend investors wait and watch for now to ascertain the debt levels and their ability to deliver premiumisation before investing in the stock.

Anticipated positives

The lowest hanging fruit for ABD will be the debt clearance (net debt to EBITDA of 3 times in 9MFY24). The high blended rate of interest at 15-17 per cent in the last three years and the high debt can be addressed with fresh issue proceeds, of which ₹720 crore will be utilised to clear the debt (₹834 crore as on March, 2024).

Of the four segments — popular, prestige, premium and luxury — classified based on the selling price, from ₹450 to ₹2,000, 65 per cent of ABD’s sales are from popular segment, which has the lowest realisations.

ABD successfully launched three millionaire brands (more than 1 million cases sold in a year) from 2018. The company plans to launch only in the premium and above segments from here on to improve the product mix. This should improve the gross and EBITDA margins as well. Compared to the 20-30 per cent gross margins for popular segment, premium and luxury segments can fetch gross margins of 65-70 per cent.

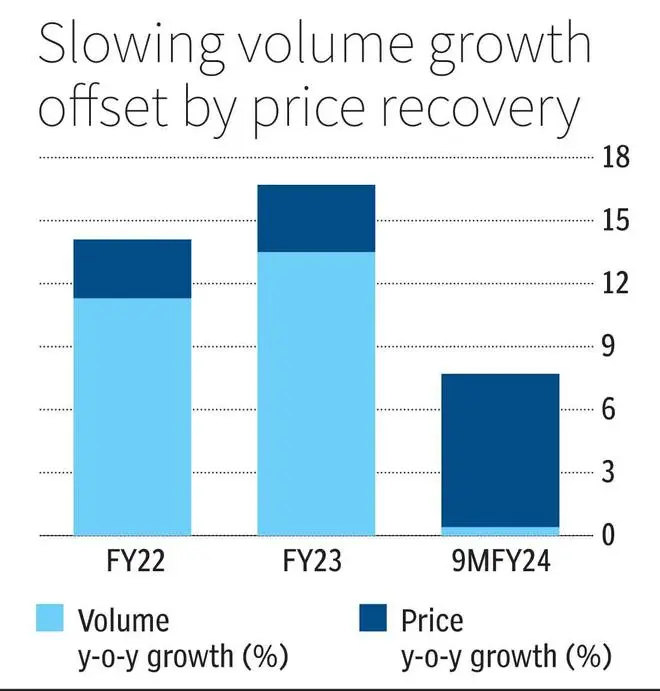

Industry tailwinds will also gradually benefit ABD. Owing to premiumisation at all levels and growing awareness of health hazards, IMIL (Indian-made Indian liquor) is losing share to IMFL (Indian-made foreign liquor). With a heavy presence in the entry segment of IMFL, ABD can gain from this gradual shift.

Apart from these, ABD also has several cost measures to shore up margins. ENA (extra neutral alcohol) is the primary raw material for making alcoholic beverages, of which 70 per cent is procured and only 30 per cent is internally manufactured. ABD may look to commercially produce ENA to lower the costs and improve supply chain. The company has moved from glass and other expensive packaging to lower cost materials including tetra and PET bottles, which has improved EBITDA margins in 9MFY24 by 140 bps to 7.1 per cent. ABD is also expected to lower the managerial remuneration to related parties which can add another 150-200 bps to EBITDA margins going ahead.

Headwinds to change

Domestic major United Spirits and international major Pernod Ricard operating in India have a product mix which is largely from prestige and above — the space where ABD intends to increase its share. Given the media ban on promoting liquor brands including surrogate promotion, building a brand in competition to established players will be a tall task. ABD has delivered successful premium brands but to do so consistently so as to improve financials will have to be assessed in the long run.

ABD can improve its debt metrics with fresh inflows, but the industry is working capital intensive. Along with a large capital outlay which may be planned, increasing working capital needs may again burden the balance sheet for the company.

Apart from these, industry headwinds are a considerable threat especially on low margins which ABD currently operates on. Pricing is highly regulated with taxation, distribution and marketing varying from state to state. With states accounting for 50 per cent of ABD sales, receivables and associated delays will further impact operational margins. The company has an existing contingent liability of ₹193 crore primarily from tax disputes which can disrupt financial flows if the final ruling is unfavourable to company.

We recommend investors wait and watch for now and asses how company performs for few quarters post listing before investing in the stock. Deleveraging the balance sheet in the short term and ability to improve margins from premiumisation and cost control in the long-term need to be assessed from the quarterly results.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.