IKIO Lighting is an ODM (Original Design Manufacturer) specialising in lighting solutions for decorative, customised, and industrial uses.

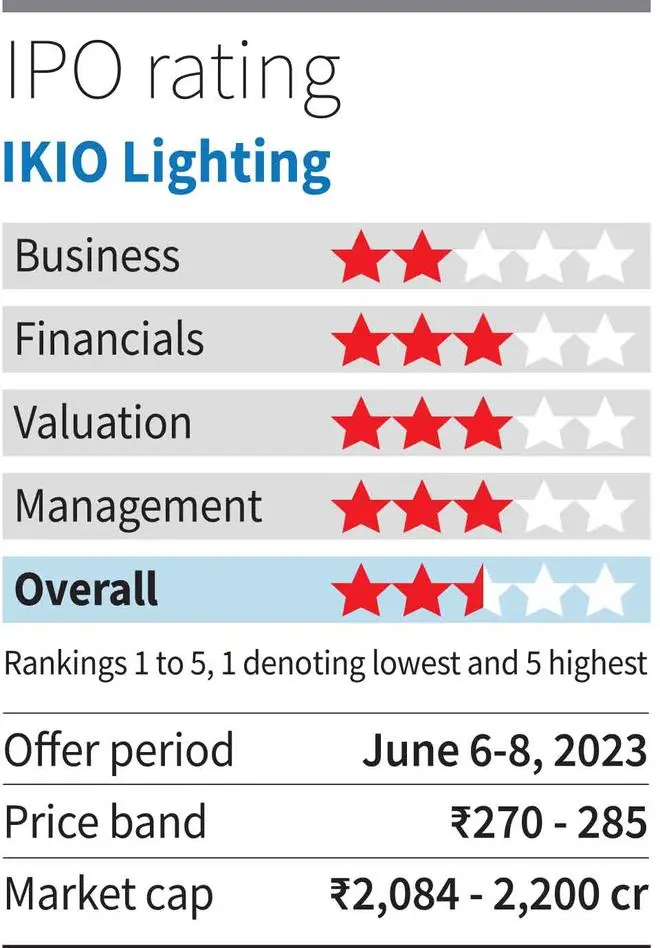

While the IPO has been fully subscribed on Day One, investors waiting on the sidelines need not rush to subscribe in the remaining two days, and can adopt a wait-and-watch approach. Though its valuation is cheaper than its peers, customer concentration risk, foray into product segments whose potential remains to be seen, as well as stiff competition in the branded retail/ home lighting space are dampeners. At the upper end of the price band, the IPO is valued at a P/E of 32x FY23 earnings (annualised). Its peers in the segment are Dixon, which trades at a trailing P/E of 92.3x, Amber at 46.6x and SGS Syrma at 52.3x. At least half the company’s revenue comes from contract manufacture for Philips.

Also read: Market watch. IPO screener: IKIO Lighting issue opens for subscription

The ₹607-crore IPO consists of a fresh issue worth ₹350 crore, and the rest is an offer-for-sale. The company intends to repay/ prepay debt to the extent of ₹50 crore, and invest ₹236 crore in IKIO Solutions, a wholly-owned subsidiary, to set up a new facility at Noida. Post-dilution from the IPO, close to 73 per cent will still be owned by the promoter group.

Business

IKIO started as a manufacturer of fan regulator switches and rotary potentiometers for the audio and TV Industry in 1999 and ventured into the LED manufacturing space in 2008. The company designs, develops, manufactures and supplies products for customers, who then further distribute these products under their own brands.

The company’s products are categorised as (i) LED lighting; (ii) refrigeration lights; (iii) ABS (acrylonitrile butadiene styrene) piping; and (iv) other products. The company’s LED lighting offerings focus on the premium segment and include lighting, fittings, fixtures, accessories, and components. It provides lighting solutions (lights, drivers, and controls) to commercial refrigeration equipment suppliers under the refrigeration light segment. The company also manufactures an alternative to PVC piping called ABS piping, which is primarily used by US customers for plumbing applications in recreational vehicles.

Signify Innovations India Ltd (Philips India), which has a 50 per cent market share in India’s functional decorative lighting category (including LED spotlights, LED downlights and cove lights), according to a Frost & Sullivan report, is the company’s biggest client. IKIO fulfils around 45 per cent of Philips’ demand.

In FY22 Philips’ business accounted for 62 per cent of IKIO’s revenue, which has come down to 50-51 per cent during April-December 2022.

LED lighting accounted for 87 per cent of revenue from operations in FY22. The LED lighting market in India is expected to grow at a CAGR of 12 per cent (FY22-FY26E) to ₹33,800 crore, and the Indian home & decorative lighting market is expected to grow at a CAGR of 14 per cent to ₹6,000 crore in the same period. The main drivers of LED lighting growth are the smart city projects and overall infrastructure development, higher budgets for renovating home spaces and increasing demand for energy-efficient lighting. Lighting solutions for the commercial refrigeration industry is expected to grow at a CAGR of 8 per cent from FY22-26 to ₹384.4 crore.

The company also supplies products under its own brand to branded retail stores, to which it provides customised lighting solutions. The lighting solutions for branded retail stores is a high margin business for the company. Outside of the Philips business, this segment, along with industrial lighting, is the next biggest contributor of revenues.

Besides, IKIO exports lighting equipment for recreational vehicles in the US market. The company got its first order in this segment in 2021.

In the past 12-18 months the company has designed, developed, and commenced commercial production and sale of-ABS pipes, solar energy solutions, accessories, and other products. A portion of the proceeds from the issue will be utilised towards setting up facilities for the expansion and growth of these products, apart from expanding capacities for LED home lighting

The company has been focussing on backward integration for some time now. It produces all the mechanical parts, except diodes and resistors used in LED lighting products.

Financials and Valuations

IKIO lighting has reported a decent set of numbers over the past year. Revenues grew at a CAGR of 22.75 per cent in FY20-22 and the revenue for FY22 was ₹332 crore, the EBITDA grew for the period of FY20-22 at 44 per cent (CAGR) to ₹77.3 crore (FY22) and the profit after tax grew at 53.6 per cent (CAGR) to ₹50.5 crore in FY22. The EBITDA margin of the company was 17 per cent in FY20, whereas it has been in the range of 22-23 per cent from FY21, aided by business growth in other segments outside of contract manufacturing for Philips. The company’s PAT margin has been in the range of 10-15 per cent from FY20-22.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.