The initial public offering from Tamilnad Mercantile Bank (TMB) is an important one. TMB is not only among the last well-known scheduled commercial banks to hit the market but the IPO is also coming amid several legal battles, including the one that unfolded on Friday last week. Questions have been raised regarding some of the shareholders and this is under scrutiny by the RBI and ED

With nearly 30 per cent of the existing shareholders locked in due to these legal proceedings, investors considering TMB IPO should be mindful that the outcome of all this litigation could dampen the sentiments around the stock, post listing. However, what could give some comfort is that the bank, being a listed regulated entity, could pretty much put an end to several hostile takeover attempts that it has witnessed in the past.

Interestingly, it’s also the only bank to roll out an IPO for fresh issue of capital and not an offer for sale. The intent of the IPO is to comply with capital raise norms prescribed by the RBI. With branch expansions put on hold since 2019 as the bank didn’t meet regulatory requirements, the IPO is aimed at remedying the situation.

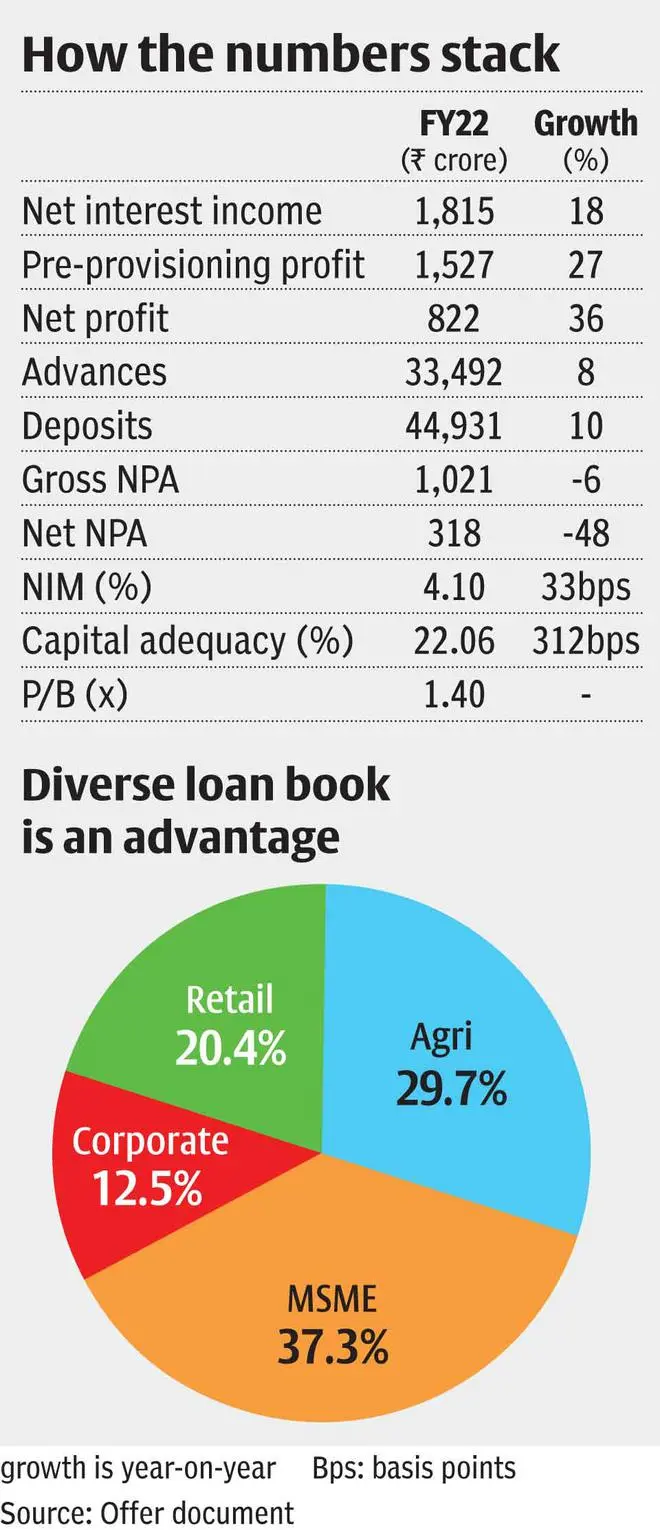

As TMB is not a case of a stressed bank going public, valued at 1.4x FY22 price to book, its asking rate appears reasonable. Also, it scores over peers, whether mid-sized banks or regional players, in terms of asset quality and return ratios and hence we recommend investors to subscribe to the IPO.

Business overview

Initially set up as Nadar Bank in 1921, a community that represents traders and businessmen in Tamil Nadu, the State continues to account for a chunk of its business (75 per cent). A deeper reading of the numbers suggests the concentration impact has worked positively for the bank rather than being a risk factor. In TN, the bank’s 5-year customer retention ratio was nearly 82 per cent. Likewise in Andhra Pradesh, the number stood at 77 per cent. Interestingly, even in States such as Maharashtra, Karnataka, and Gujarat, the proportion of longstanding customers is 58–68 per cent.

Further, catering to the financially literate population, the bank has managed to build a very high proportion of secured loan assets. At nearly 99 per cent in FY22, TMB’s share of secured loans was undoubtedly the best in the industry. This factor played an important role in ensuring a sharp decline in the gross NPA ratio, from 3.44 per cent in FY21 to 1.69 per cent in FY22.

Likewise, retail, agri and MSME loans accounted for 88 per cent of the bank’s total loan book, and this was the highest among mid-cap banks such as RBL, IDFC First, Federal Bank and City Union Bank. What also provides comfort is that over 60 per cent of TMB’s retail book comprises home loans, which adds stability to the book.

Another interesting factor about its loan book composition is its granularity. The average ticket sizes of retail and agri-loans stood at ₹4.7 lakh and ₹1.3 lakh respectively in FY22. Only 3.6 per cent of the bank’s total book had a ticket size exceeding ₹25 lakh and loans in the ₹1 lakh to ₹5 lakh range accounted for 44 per cent of the total book. This extent of granularity can be handy in times of distress.

TMB’s net interest margin (NIM) in FY22 stood at 4.1 per cent. However, investors should consider this a one-off as the bank booked some interest reversals last fiscal. Therefore, going by its historic performance, NIM of 3.85–3.95 per cent seems more achievable.

Asset quality

This aspect could surprise investors. At 1.69 per cent gross NPA (0.95 per cent net NPA) in FY22, slippages ratio at 1.6 per cent and credit cost at 0.4 per cent, TMB’s asset quality numbers were superior to peers such as Karur Vysya Bank, City Union Bank, DCB Bank and RBL Bank. This a key factor that justifies TMB’s valuations based on FY22 financials. That said, most of TMB’s peers witnessed a sharp improvement in asset quality parameters in the June quarter of FY23. How much improvement TMB has seen for the current fiscal will only be known post listing.

Risks to consider

Apart from the litigation surrounding the bank, investors should be mindful that one of the main objectives of the IPO is that the bank can restart opening of branches. With 100–150 branches likely to be opened in the next 18-24 months, as per news reports, and most of them expected to be set up outside Tamil Nadu, it could hike up TMB’s cost to income ratio which, at 42.1 per cent in FY22, was best among peers. A new branch usually takes about three years to break even and therefore the cost pressures could be prolonged for the bank, and not a one-off.

Also, the infusion of ₹832 crore through the IPO would take TMB’s capital adequacy up from 22.1 per cent in FY22 to 25 per cent, post issue. A likely increase in operating costs and the pressure from carrying cost of capital may strain the bank’s return profile, which currently is the best in class and next to CSB. In FY22, the bank’s ROE stood at 16.6 per cent and ROA at 1.7 per cent.

The current MD & CEO’s tenure ended on September 3 (Saturday) and he has been replaced by S Krishnan, former MD & CEO of Punjab and Sind Bank. Usually, a change of guard at a bank sees some amount of kitchen-sinking. This factor may play out in FY23, and investors should be mindful of this risk.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.