Stanley Lifestyles Ltd (SLL), headquartered in Bengaluru, is a manufacturer and retailer of premium, luxury and ultra-luxury furniture. It is the fourth largest by revenue in India in the home furniture segment and operates 62 stores pan-India, across 25 cities, with a predominance in the South, which contributes to around 80 per cent of revenue.

The IPO size is ₹537 crore, out of which the fresh issue part of the pie is ₹200 crore. Of that, the company has earmarked ₹130 crore for capex, including for setting up 24 new COCO (Company Owned Company Operated) stores over the next two years. This is apart from an equal number of FOFO (Franchisee Owned Franchisee Operated) stores expected to come up, as per the management. (Note: The company does not incur capex on any of its FOFO stores and it is left to the franchisee). The promoters will hold around 56.8 per cent stake post issue (67.4 per cent pre-issue)

SLL has a good track record in its business and operates in a niche space. However, the IPO valuation at a trailing PE of 84 times (9M FY24 earnings annualised) appears too high and unattractive. This is especially when considering the fact that revenue growth has slowed quite significantly in FY24 and there are execution risks in launching new stores and growing the business. Hence, we recommend that investors need not subscribe to the issue and wait to see how the business performs over the next few quarters.

SLL doesn’t have a listed peer and a substantial amount of the competition is from the dealers of imported luxury furniture, predominantly from Europe.

Strengths

SLL operates under two segments — B2C and B2B. In the B2C segment, which accounts for around 80 per cent of revenue, the company manufactures bespoke furniture, such as sofas, recliners, dining tables, coffee tables, wardrobes, kitchen units, beds and mattresses, under three different price points — namely, super premium, luxury and ultra-luxury. The price point starts from ₹1.5 lakh to ₹5 lakh and beyond.

In the B2B segment, the company is engaged in contract manufacturing for home furnishing MNCs and a large automobile company. The B2B segment accounts for around 20 per cent of revenue.

Currently, SLL sells the manufactured furniture in 62 stores, 38 being COCO and 24 being FOFO. For 9M FY24, COCO stores contributed 62 per cent to the total revenue, while the FOFO stores contributed a much lower 13 per cent to the company’s overall revenue. The total store count at 62 as of December 31, 2023, has increased from 25 at the end of FY21. A new store takes four to five years to mature (to reach peak output), as estimated by the management.

SLL’s key competitive advantage lies in a vertically integrated business model, right from handling procurement to delivering to retail. Specialising in bespoke furniture, SLL contrasts with competitors who import from distant continents, offering agile lead times and adaptability to trends. This agility enables SLL to deliver superior value to customers compared to its peers.

What works

The Indian housing market, particularly the luxury segment with units valued at ₹1.5 crore and above, has been in an upcycle. According to Anarock, new launches in luxury and ultra-luxury space, as a percentage of total, have grown from around 10 per cent pre-pandemic to a peak of 27 per cent as of Q3 CY2023. The rich who flock to book such units are SLL’s target customers and when the booked units are delivered in the next few years, the furniture budget for these new units becomes the TAM (Total Addressable Market) of SLL. The management notes that 80 per cent of the company’s B2C business comes from new construction and only the rest is from refurbishing.

Further, as per a RedSeer Report in the RHP, the number of Indian affluent households has grown twice between 2017 and 2022 and the luxury PFCE (Private Final Consumption Expenditure) has grown at a CAGR of 26 per cent in the same period. The size of the Indian luxury furniture market is expected to outpace the growth of the non-luxury market by 7 percentage points to reach ₹22,300 crore by FY27, from ₹6,700 crore (FY23). Further, the organised sector market share, which was at 26 per cent in FY23, is projected to be 35 per cent by FY27.

SLL appears poised to piggyback on this growing luxury spending by India’s rich.

These apart, the Government is in discussions with the industry to implement PLI scheme for the furniture sector. In December 2023, the DPIIT was reported to be working closely with 24 sub-sectors, including furniture, to promote import substitution. If successful, this initiative could disadvantage competitors, while bolstering the company’s competitive advantages.

What does not work

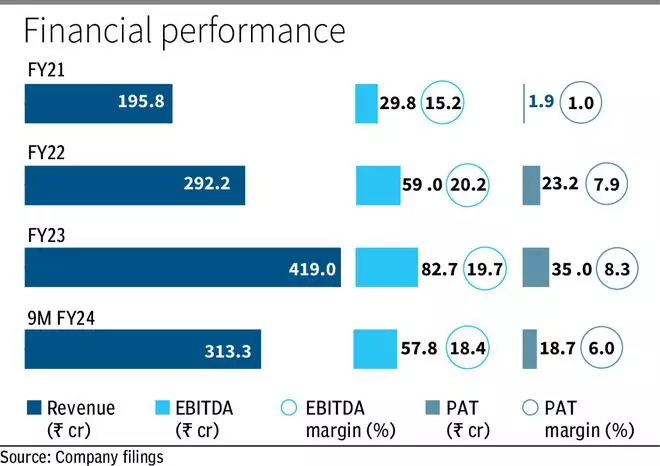

While the macro story is interesting, there are risks and other factors to consider here. First is the slowdown in revenue growth in FY24. Revenue grew at a CAGR of 46 per cent, between FY21 and FY23, to ₹419 crore, rebounding from a low base in FY21 due to the pandemic. Estimated FY24 revenue (9M FY24 annualised/adjusted for seasonality) at ₹420-430 crore, represents a significant slowdown with year on year growth at around 0-2.6 per cent.

Management notes that FY24 numbers are not representative of potential performance, because of delayed apartment handovers and disruptions due to store relocations and a fire at one of the stores. However, even when these are factored, which can explain for 5-7 per cent loss of revenue, the growth is still low.

Further, the slowdown in growth that can be attributed to the delays and disruptions noted above, also points to inherent business risks.

Amid the growth slowdown, the asking valuation at a post issue PE of 84 times (pre-issue PE of 76 times) is quite pricey. Other risks include the company being highly dependent on the luxury housing market upcycle. Any risks to the long-term sustainability of this upcycle would adversely affect the company’s prospects.

While the issue has priced in all the growth opportunities, there are execution risks as far as the scaling up is concerned. Hence, we recommend that investors gain conviction first, probably over the next couple of quarters, and give the issue a pass for the moment.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.