In the April 2021 to January 2022 period, only 6,684 kilometers of national highways were constructed against 9,132 kilometers in the same period a year ago. The sluggish trend in road construction was due to disruption caused by Covid-19 and elongated monsoons. A similar trend has also been observed in the contract awarding activities - only 6,000 km for the year up to January 2022 compared to 6,696 km in the corresponding period last year. The pace is expected to accelerate now, with Budget 2022 giving infrastructure a thrust. The allocation to MORTH (Ministry of Road Transport and Highways) in this Budget has gone up by ₹80,000 crores to around ₹ 1.9 lakh crore - a growth of around 70 per cent year-on-year.

Allocation to NHAI has moved up two-fold and is at 134 per cent of the previous year’s Budget. This huge increase in allocation is backed by the government’s plan to expand the national highways network by 25,000 km in this fiscal year. There is already a pick-up seen in projects awarding by NHAI and Ministry of Road Transport and Highways in March 2022, with projects for 5,113 km awarded. This is nearly a two-fold rise year-on-year (yoy).

Apart from investments in roads and highways, this year’s Budget also provided thrust on river linking which will give a further boost to water availability across the various regions, and irrigation projects. The government has allocated ₹60,000 crore for fiscal 2022-23 for Jal Jeevan Mission, a programme to provide potable drinking water to all the rural households in the country.,

These developments signal good traction for road infrastructure companies as well as those engaged in providing rural irrigation infrastructure such as KNR Construction. The company has a quarter of its order book from irrigation projects and remaining from road projects.

The company is trading at a trailing PE of 16.16x while its peer PNC Infratech is trading at 11.92x. Although the stock is at a premium to its peer, the macro-economic tailwinds, a decent order book, as well as its execution capabilities hold promise.

Investors can continue to hold the stock.

Order book

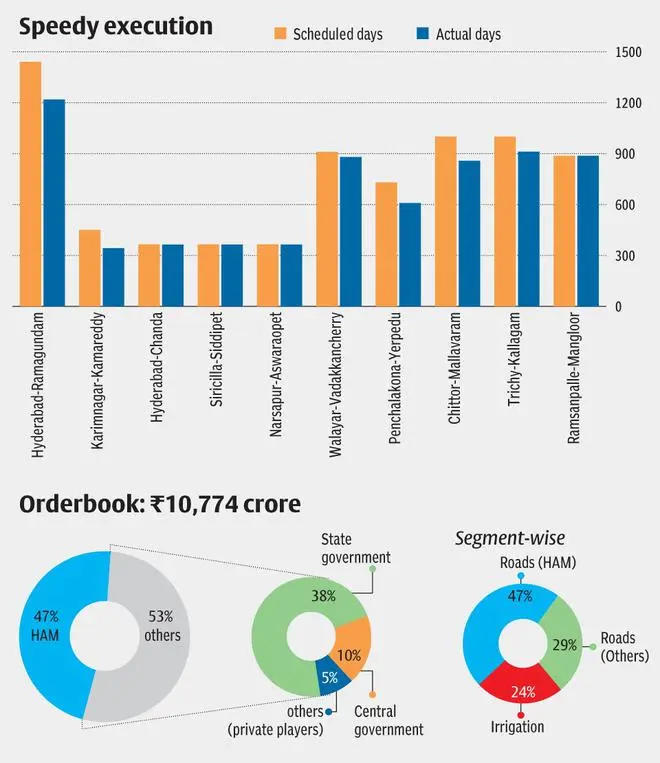

KNR’s order book as of December 31, 2022, was ₹10,009 crore and the new projects won after that date are worth ₹765 crore (estimated EPC cost subject to financial closure), taking the total order book to ₹10,774 crore, which is around 3.71 times FY 21 revenue. The company’s order book is 74 per cent road (EPC and HAM projects) while 26 per cent is irrigation projects; Client-wise, 47 per cent of the order book comes from HAM projects and 53 per cent from third party clients (predominantly State governments, with a small portion from Central government and private players).

EPC contracts i.e., Engineering, Procurement and Construction are the type of contracts where the entire money or cost to build the project is provided by the government, including that for land acquisition and rehabilitation of people affected by the project. The private contractor will design and build the allocated project and then hand over the project to the government whereas in HAM (Hybrid Annuity model), which is a mix of EPC and BOT (Build Operate Transfer) annuity model, the government and the private contractor share the cost in the ratio of 40:60. The private player needs to arrange 60 per cent of the funding and once the project is complete, the government collects toll and pays a fixed annuity to the private contractor over a period.

BOT Toll i.e., Build Operate and Transfer Toll is a system where the developer is allowed to recover the investment by collecting the toll from the users. In BOT- Annuity the developer constructs the road, undertakes the operational risks and receives fixed payments from the National Highway Authority of India or State government authorities during the concession period. In general, the time frame for the concession period is 25-30 years, after which the project is transferred to the State government. EPC contracts are generally favoured by the private contractors as there is no obligation to bring in heavy money and all the cost will be borne by the government.

Business prospects

The order book of the company is concentrated in the southern region of the country with 14 projects in Andhra Pradesh and Telangana with balance value of ₹3194.4 crores, 8 projects in Tamil Nadu with balance value of ₹1,863 crore, 3 projects in Kerala with balance value of ₹3,362.9 crore and 6 projects in Karnataka with balance value of ₹1,588.5 crore.

The trend in order book to revenue ratio seems reasonably healthy for the company with the metric being at 1.08 times for FY21. (1.79 in FY20 and 1.09 in FY19) An order book to revenue ratio greater than 1 is generally considered good and provides revenue visibility for upcoming periods.

The company has enough experience and expertise in this space as it has executed 75 projects worth ₹10,451.3 crore in last 20 years. The track record of the company is promising with efficient execution and timely completion of projects earlier than due date in most cases. In recent years, the Trichy-Kallagam project was completed 89 days earlier while the Chitoor-Mallavaram project was completed 142 days earlier.

The company transferred its 49 per cent stake in KNR Tirumala Infra Pvt Ltd and KNR Shankarampet Projects Pvt Ltd. in December 2021 for a value of ₹136.8 crore and ₹ 108.5 crore respectively to Cube Highways. This divestment is expected to enhance the liquidity position of the company and the gain on the stake sale stands at 19.3 per cent and 15.2 per cent respectively. In FY21 the company had also sold its 100 per cent stake in KNR Walayar Tollways Private Limited (SPV) to Cube Highways.

The company faced troubles due to the delayed payment from the Telangana government in FY21 as the infrastructure funds were diverted towards welfare schemes during the pandemic. However, the phase seems to have passed and with the monetisation of SPVs, the company is expected to be in a comfortable position now.

Financials

The revenue for 9M FY22 stood at ₹2,503.7 crore, a 31 per cent growth YoY. The EBITDA for 9MFY22 rose 9 per cent YoY to ₹519.78 crore. However, the EBITDA margin declined by 420 basis points to 20.8 per cent. There was a 34 per cent rise in operating expenditure in the period. The profit after tax saw a decline of 22 per cent for 9MFY22 to ₹225.69 crore. The company had to recognise a loss of ₹140.52 crore (9 month FY22) for the sale of stake in KNR Tirumala Infra and KNR Shankarampet on account of the descoping of the projects and PCOD (Provisonal Commercial Operation Date) is also received. If this loss was not recognised, then the EBITDA growth YoY would have been 38 per cent. This has led to a de-growth in EBITDA, PAT and margins. However, this is an adjustment entry with no effect on cash of the company.

There were exception items in the 9-month period from the stake sale in SPVs. For 9MFY 22, the profit on account of sale of 49 per cent stake of KNR Tirumala Infra and KNR Shankarampet Projects to Cube Highways was ₹21.4 crore. In 9MFY21, the profit on account of sale of 100 per cent stake in KNR Walayar Tollways to Cube Highways was ₹85.2 crore.

The consolidated net debt of the company came down to ₹ 901.1 crore in December 2021 from ₹1,290.6 crore in September 2021 and the Consolidated net Debt to Equity ratio has also come down to 0.41 in December 2021 from 0.60 in September 2021. The net working capital days (standalone) of the company was 40 days in December 2021, down from 82 days in the three months ended March 2021 and 45 days in the September 2021 quarter

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.