It was a very sober week for Indian equities, with bellwether indices Sensex and Nifty losing 2.5 per cent and 2.7 per cent in the last five trading sessions. Weakness in the global equity markets had a rub off on the Indian markets too.

Metal, Realty underperform

Metal stocks were the worst performers with Nifty Metal Index shedding 6.3 per cent followed by real estate stocks with the Nifty Realty index losing 5.75 per cent in the past week. Media stocks were also under pressure last week with Nifty Media index losing over 5 per cent. Investors were on a selling spree in banks and financial stocks too, with Nifty Bank index falling by almost 3 per cent and Nifty PSU bank tanking over 5 per cent and Nifty Financial services losing over 3 per cent.

The only index that closed the week in green was that of Central Public sector enterprise – Nifty CPSE Index gaining 0.3 per cent. Sectors that managed to contain downside were of defensive themes such as FMCG (Nifty FMCG), Healthcare (Nifty Pharma) and IT (Nifty IT), losing 0.5 per cent, 1.3 per cent and 1.74 per cent respectively.

However amidst the weakness, several stocks bucked the trend in the market and recorded neat gains on a weekly basis. Topping the gainers’ list last week was the stock of online insurance portal company PB Fintech which owns online insurance marketplace Policybazaar and online credit marketplace Paisabazaar.

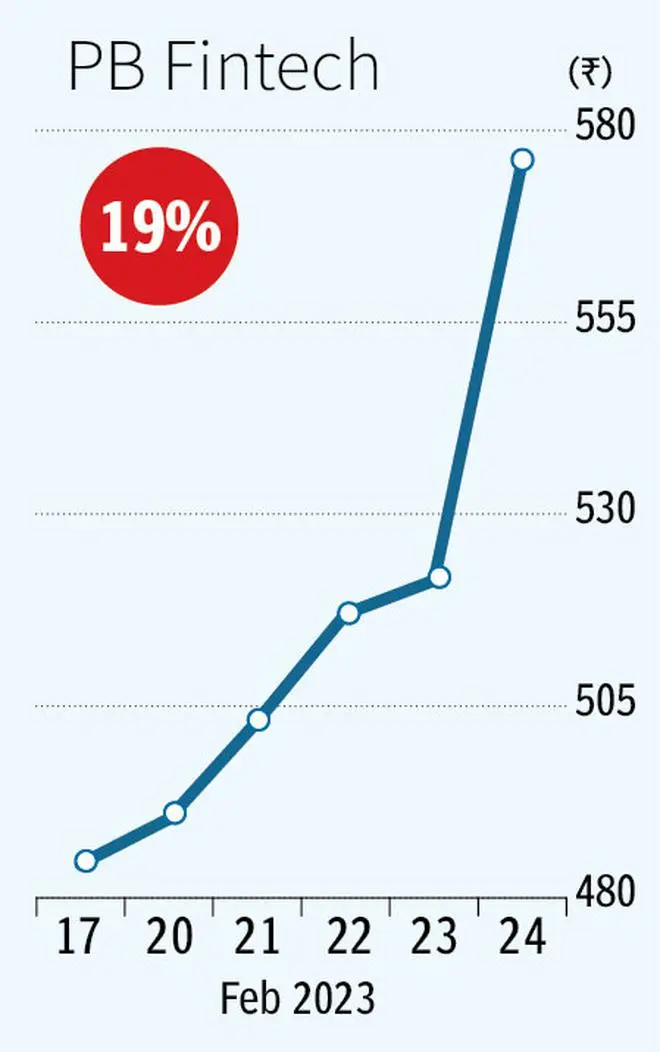

PB Fintech

PB Fintech’s stock gained an impressive 19 per cent last week. In Q3FY23 the company reported lower losses of ₹87 crore, compared with ₹298 crore during the same period last year. This along with positive commentary by the management in a media interview reiterating their profit target of ₹1,000 crore by 2026-27 and confidence about achieving the same has also helped the stock upmove. The stock currently trades about 4.8 times its book.

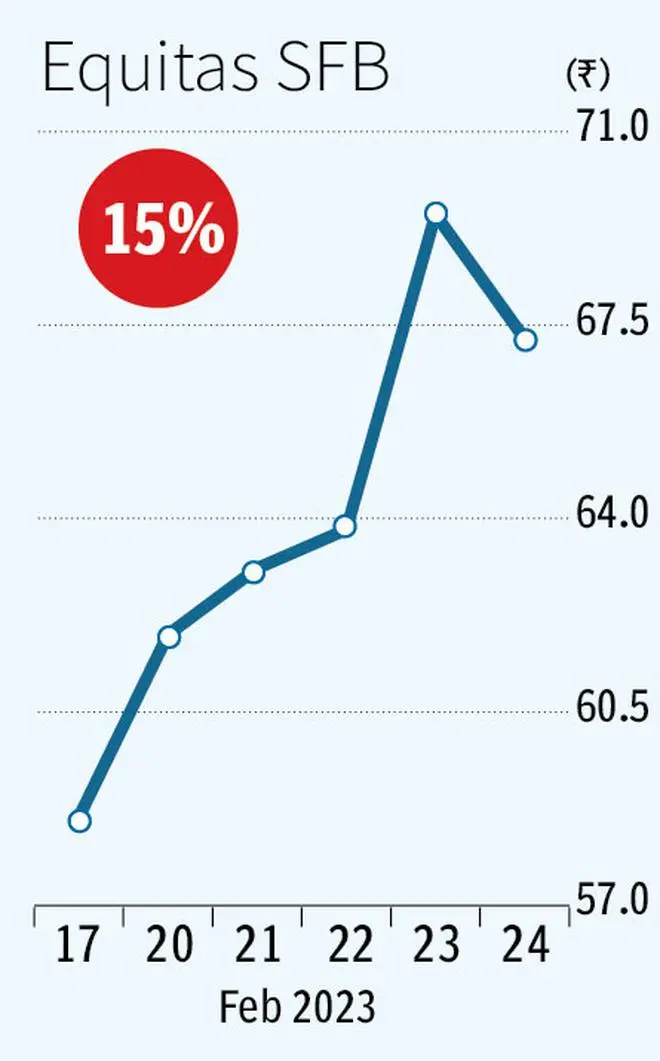

Equitas Small Finance Bank

Equitas Small Finance Bank ranked second among the NSE 500 Index with a 15 per cent gain. The management of the bank, in a media interview mentioned that the financial institution mentioned that it is in discussion with the RBI regarding a universal bank license and was expecting to hear from the RBI in this regard.

Positive commentary about improvement in asset quality over the next few quarters have also possibly helped the interest in the stock. At the current price, Equitas trades about two its book value, the current valuation is at a marginal premium to its median price to book multiple of 1.8 times.

Mahindra CIE Automotive

Third in the gainers’ list last week was the stock of auto component maker Mahindra CIE Automotive, rising 15 per cent for the week. Interestingly the stock gained a whopping 15 per cent just on Friday, following robust performance in 3QFY23. The company reported 92 per cent jump in revenue to ₹2,246 crore, versus ₹1,169 crore in the same period last year.

Thanks to the moderation in raw material costs, the company reported a 2 percentage point improvement in the operating profit margin to 13 per cent. Interestingly this is the first quarter, after the company has put its Germany forging unit for sale, and it managed to pull it off well, helped by its India business and improving Europe market. The stock currently trades 25.6 times its tailing twelve-month earnings and about 3.3 times its book value.

Other top performers

Other stocks that bettered the market last week included Olectra Greentech (13.6 per cent), Star Health (10.9 per cent), Bharat Dynamics (9.8 per cent), Zensar Technologies (9.25 per cent) and Hitachi Energy (9 per cent) to name a few.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.