The Indian power sector has been seeing good momentum, such as all-time high peak power demand and the power ministry inviting bids of about 50 GW to develop installed renewable energy capacity annually for the next five years — to achieve the 500 GW non-fossil fuel target. Tata Power, being an integrated power utility company with renewable-based plans, appears to be a beneficiary here.

The stock of Tata Power is up around 23 per cent on a YTD basis, trading at a one-year forward P/E of around 24 times i.e. around 45 per cent premium to its historical five-year average P/E of 17 times. The company benefits from the regulatory-based earnings from a portion of its generation, transmission and distribution along with presence across the renewable energy value chain. However, concerns remain over dip in Indonesian coal realisations and uncertainty over its Mundra plant tariff. While Tata Power has been having higher leverage compared to peers such as JSW Energy, the company has brought it down from its earlier levels.

There are positives such as better industry prospects now compared to five years ago on account of strong players like Tata Power getting stronger and weak ones getting weeded out, government policy support, renewable energy transition and deleveraging by the company. But these are countered by the valuation premium and uncertainty over Mundra issue. Nevertheless, on account of risk-reward being balanced out, investors can hold the stock of Tata Power.

Business

Tata Power is an integrated private power utility with presence in power generation (30 per cent), power transmission and distribution (56 per cent), renewables (13 per cent) and other businesses.

Its power generation segment comprises thermal (9.3 GW) and hydro based generation (0.9 GW). It got into coal mining by acquiring stakes in certain Indonesian coal mines which supply coal for its plants based on international coal; for its other domestic coal-based thermal plants, the company has fuel supply agreements with Coal India and its subsidiaries. Majority of the company’s power generation capacity is linked with long-term power purchase agreement (PPA), providing revenue visibility.

There have been under-recoveries from its Mundra UMPP of around 4 GW (around 28 per cent of total installed generation capacity) owing to the mismatch between the bid tariff of the PPA and the contracted fuel cost. This happened on account of aggressive tariff bidding by the company followed by the change in Indonesian law for coal supply in 2012 — under which all sale contracts were compulsorily linked to a benchmark market-determined coal price, thus nullifying all fixed-price coal supply agreements entered into by companies.

Tata Power’s transmission and distribution business comprises managing 3531 ckms and six distribution companies across India, including discoms based out of Maharashtra, Odisha, Delhi and Ajmer. The company has a history of turning around loss-making discoms by reducing the aggregate, technical and commercial losses (AT&C) via investment in technology such as smart-metering. For instance, Tata Power has managed to bring down the AT&C losses of Delhi Vidyut Board from around 53 per cent in 2002 to around 11 per cent in 2023.

The renewables business comprises power generation from wind and solar energy (4.1 GW) and EPC space. Its EPC business focuses on the execution of utility scale projects, cell & module manufacturing, rooftop solar, solar water pumps, and operational & maintenance services wherein customers include power gencos such as NTPC, NHPC and SJVN.

Performance

Tata Power earns over 40-45 per cent from its regulated businesses under power generation, distribution and transmission in terms of EBITDA. Such arrangement, being on a cost-plus basis, translates into strong earnings visibility. However, the losses due to under-recoveries from imported coal-based Mundra plant have been a drag on the company’s financials over the years. Post invoking of Section 11 in May 2022, the plant is selling power to Gujarat and Maharashtra discoms on a full cost pass-through basis, an arrangement that has been extended till September 30, 2023.

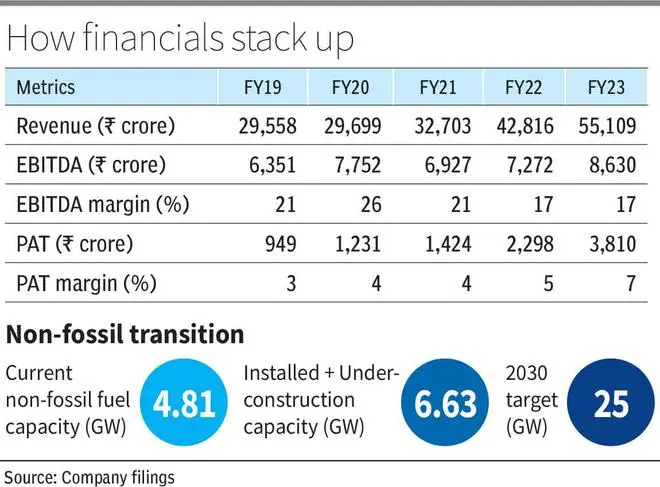

The company saw operating revenue grow 29 per cent y-o-y to ₹55,109 crore, driven by higher generation in Mundra Plant, higher sales across the distribution business and higher capacity addition in renewable business. EBITDA margin remained stable at around 17 per cent. The company has seen gradual decline in the leverage as its net debt to EBITDA, around 5.7 times in FY18, has reduced to 2.8 times as of Q1FY24. The management guidesnet debt to EBITDA remaining within a ceiling of 3.5 times.

Outlook

Going forward, the company plans to retire its thermal plants in line with the PPA expiry, which means that renewables, transmission and distribution will be the main growth drivers. The project of building 4 GW of solar modules and solar cells manufacturing facillity bodes well for the company amid the government’s renewable energy targets and the imposition of basic customs duty on import of solar cells and modules.

The production of modules is expected to commence by end of September 2023 andof cells is end of Q4FY24. The management has given a capex guidance of ₹12,000 crore for FY24, including ₹3,000 crore for its manufacturing plant, ₹4,500 crore towards renewable portfolio (captive and utility), ₹3,000 crore towards transmission and distribution, and the balance towards flue gas desulphurisation installation.

The company targets adding 2 GW of renewable energy per year to reach 25 GW by 2030. However, one needs to keep a track on the developments at Mundra. Though the invoking of Section 11 which remains till September 30, has improved the economics of the plant, uncertainty remains until there is a permanent resolution. The company is pushing for supplementary PPA with Gujarat and Maharashtra at revised tariffs, which comprise 65 per cent of the plant capacity. It remains to be seen when that happens, and at what tariff arrangements.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.