After closing flat for two consecutive weeks, the Indian market ended the week on a positive note, with bellwether indices gaining over 1.5 per cent last week.

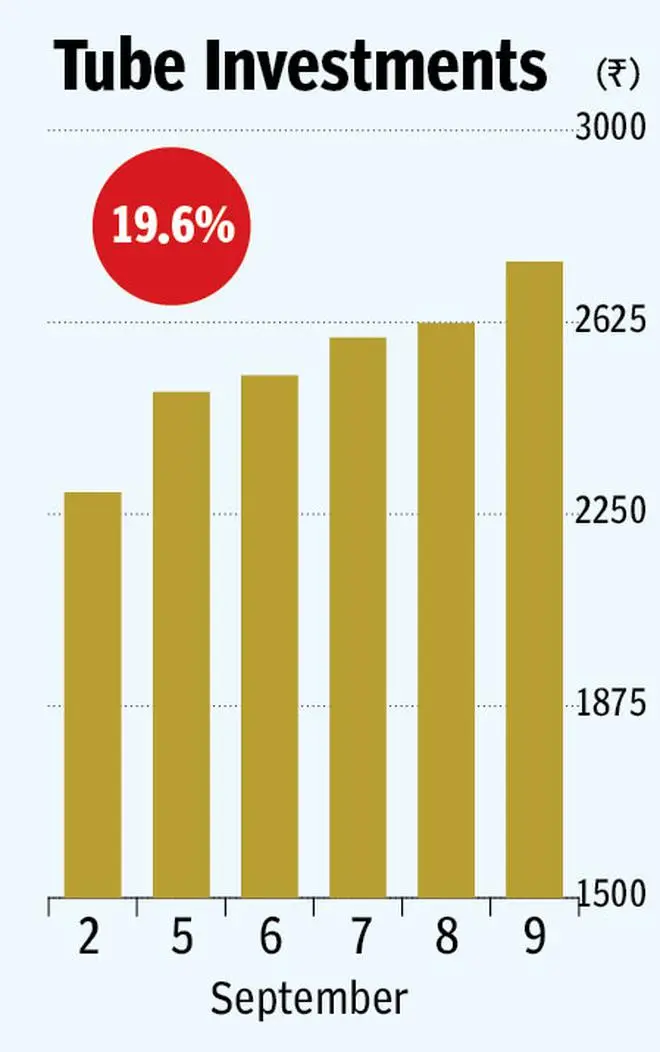

Featuring in the top 5 winners’ list this week is the stock of auto component maker Tube Investments of India. The stock has gained almost 20 per cent gain over the past week. Last week, TI Clean Mobility (TCM), a subsidiary of Tube Investments of India, a Murugappa Group company, launched Montra Electric three wheeler Auto in Chennai, marking their foray into the EV market. The management has also detailed plans to invest ₹1,000 crore towards four platforms for EV segment.

For the June quarter, the company reported sales of ₹3,799 crore, implying a 56 per cent year-on-year growth. TI’s net profit grew 83 per cent to ₹247 crore, compared to the same period last year. The stock currently trades about 64 times and 50 times its FY23 and FY24 estimated earnings. JK Lakshmi Cement is the other stock that returned neat gains for its investors last week, rising 18 per cent over the last five sessions. The company launched its premium brand earlier last week - JK Lakshmi Pro. High energy costs which The moderation in energy prices will benefit cement manufacturers given the energy intensive nature of the industry. Interestingly other cement stocks Birla Corporation and Shree Cement also figured in the list of gainers for the week.

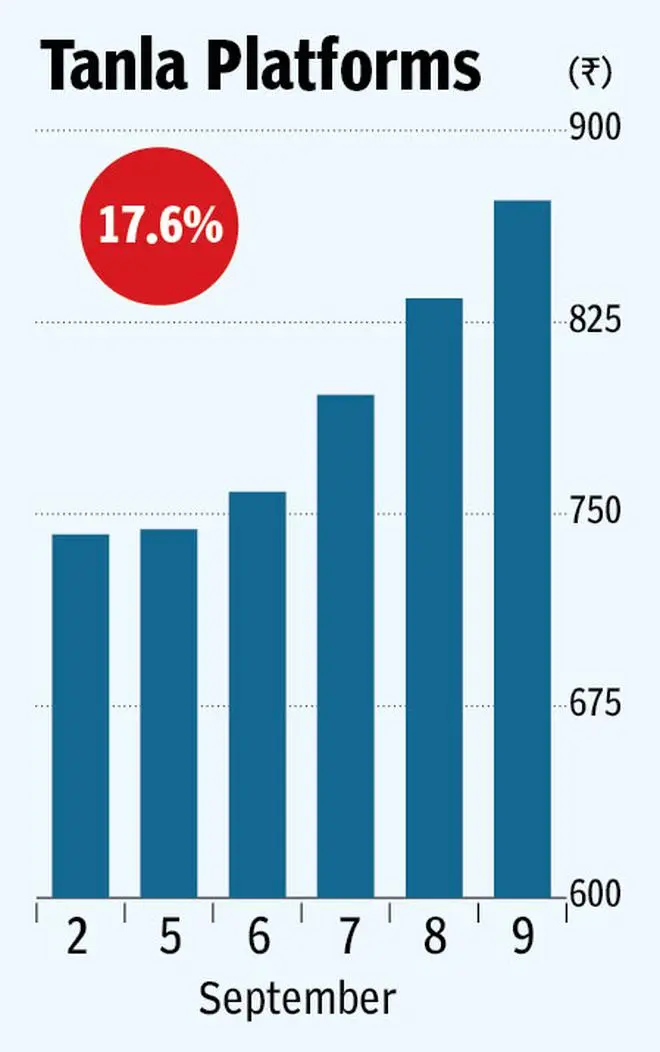

The company reported revenue growth of 25 per cent to ₹1,654 crore, compared to the same period last year. However, Net profit declined 15 per cent during the June quarter to ₹115 crore, on the back of higher taxes, in addition to higher operational costs due to skyrocketing power and fuel costs. The stock currently trades about 15 times and 12 times its FY23 and FY24 estimated Bloomberg consensus earnings. The stock of cloud communication provider Tanla Platforms soared 17.6 per cent for the week. The rise comes on the back of board approval for the ₹170 crore buy back offer, at a price of ₹1,200 a piece. The stock closed the week at ₹873, implying a premium of 37 per cent to the current price. The company also reported stellar results for the June quarter, posting revenue growth of about 28 per cent, to ₹800 crore, compared to the same period last year.

However, the operational costs were higher during the quarter, impacting operating profit and net profit, which remained flat at ₹100 crore, compared to the April-June 2021 quarter. This is despite a 500 basis point decline in the operating profit margin to 16 per cent in the June 2022 ended quarter. The stock currently trades about 23 times and 18 times its estimated FY23 and FY24 estimated Bloomberg consensus earnings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.