Indian equities staged a good recovery early part of this week, after the steep correction witnessed last week. However, benchmark indices Sensex and Nifty, shed some of the gains, on Friday, closing the week about 1.6 per cent higher than the week ended December 23.

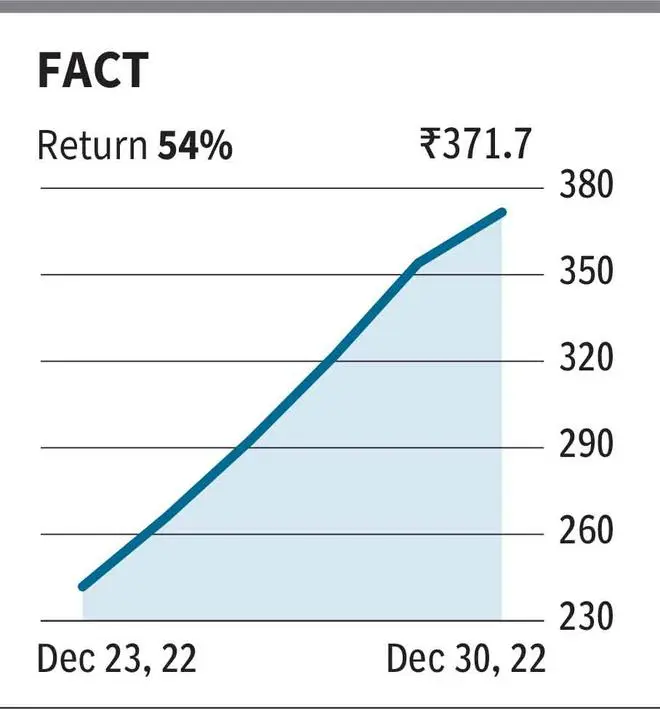

Several stocks outperformed the market by a large margin this week too. Interestingly, two PSU fertiliser makers topped this week’s gainers’ list. Fertilisers and Chemicals Travancore (FACT) topped with a whopping 54 per cent. The stock has gained over 155 per cent in the past month and leads the one-month performance chart.

While there is no confirmed news or development in the company to justify the massive rally in the stock, it could possibly be fuelled by two reasons. First, FACT, which sported a turnaround in the last three years, has reported healthy profit growth since FY20. This was aided by the sharp increase in the production of Factamphos 20:20 product, whose volume rose from about an average of 6.5 lakh tonnes up to FY19 to an annual average production of over 8.4 lakh tonnes over the FY20-FY22 period. Higher realisation and margin on this product possibly aided the overall improvement in profitability. In FY22, the company reported operating profit of ₹596 crore, as compared to ₹279 crore in FY20 and ₹10 crore in FY19. In the latest September quarter, FACT reported operating profit of ₹237 crore, compared with ₹105 crore in the same period last year, implying an over 125 per cent growth year-on-year.

Second, the surge in investor interest in PSU companies across sectors such as power, industrial commodities, defence, banking, etc — with many of them offering attractive dividend yield, higher than their private sector peers — and expectation of divestment by the Government have also fuelled the interest in PSUs as a category. The stock currently trades at an expensive 36 times its trailing twelve-month earnings, implying a significant premium to efficient private sector peer Coromandel International, which trades at 13.6 times.

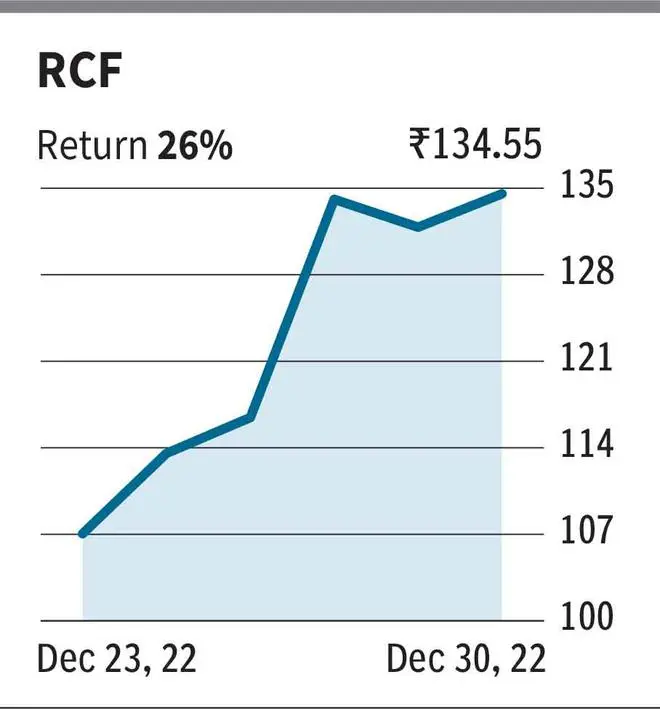

The other fertiliser stock that saw significant price upmove this week was that of state-owned Rashtriya Fertilisers and Chemicals, gaining an impressive 26 per cent in the last five sessions. The company recorded highest ever profit in FY22, helped by higher realisation on its chemicals’ portfolio and phosphatic fertilisers. In FY22, RCF reported operating profit of ₹992 crore versus ₹754 crore in FY21, implying a 32 per cent growth. The net profit rose 83 per cent to ₹702 crore, compared with ₹384 crore in FY21. In the September 2022 quarter, the company almost doubled its operating profit to ₹316 crore, versus ₹160 crore in the September 2021 quarter. Net profit more than doubled from ₹118 crore in July-September 2021 period to ₹262 crore in the July-September 2022 period. The stock currently trades about 8 times its trailing twelve-month earnings.

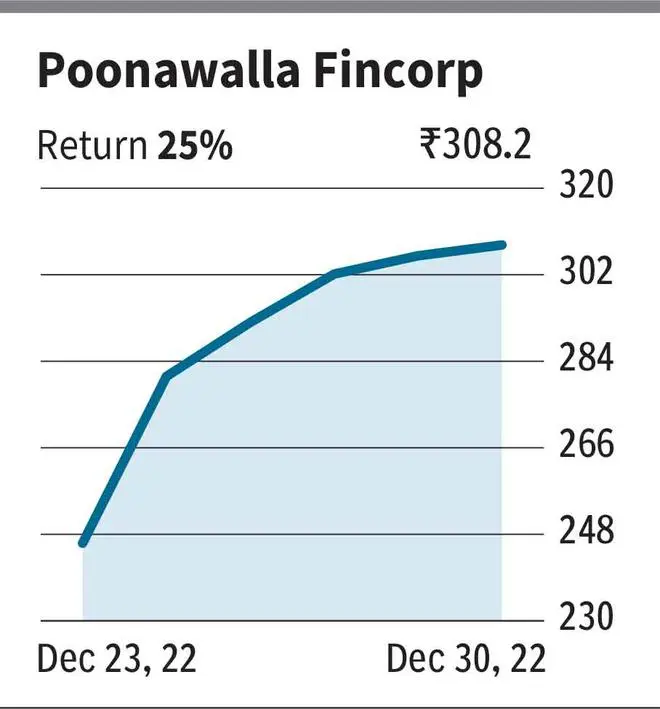

Poonawalla Fincorp, erstwhile Magma Fincorp, a non-deposit taking NBFC, ranked third in the list of winners with a 25 per cent return over the last five days. The strong rally in the stock came was likely aided by three reasons. First, Investment by Rising Sun Holdings in the company to the tune of Rs 124.9 crore. Second, the management’s optimistic comment regarding the long-term business prospects, and target loan book of Rs 50,000 crore over the next five years, would have also added to the interest in the stock. Finally, domestic brokerage Motilal Oswal initiated coverage on the stock with a buy recommendation and target price of Rs 350 a share. At the current price of Rs 308, the stock trades about 3.7 times its book value.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.