UltraTech Cement, the largest cement manufacturer in India, is set to get even larger in the next three years. The cement industry is consolidating and expanding its capacity at the same time, and UltraTech is at the forefront of the growth. The company is complementing its capex programme with investment in cost efficiencies as well, which can improve profitability of the larger cement enterprise. With a positive macro outlook, the case for UltraTech is strong, limited only by its current premium in valuations. We recommend investors hold the stock, which can deliver high earnings growth in the next two years.

UltraTech Cement aims to take its installed capacity from the current 150 million tonnes (mt) to 200 mt by FY27-end. The company seems to be on track to deliver on its targets. The company added 15 mt (commercialised and contributing to revenues) in the last one year and expects to add similarly in the next three years.

UltraTech has built close to half its current capacity via acquisitions. This includes 21 mt from Jaypee Cements ($110 EV/tonne in July 2016), 6.2 mt from Binani ($140 EV/tonne in November 2018) and consolidated 14.6 mt from Century Textiles ($95 EV/tonne in May 2018).

In the last six months, the company has completed two more — Kesoram Cements was acquired in a share-swap deal (at an implied valuation of $80 EV/tonne) in November 2023; in two transactions starting June this year, UltraTech acquired a controlling stake in India Cements at an average of $110 EV/tonne for 14.7-mt capacity in South India.

Overall, the 200-mt capacity target implies a volume CAGR of 11 per cent till FY27, if delivered. Compared with industry capacity utilisation of 70 per cent, UltraTech has operated at 85 per cent in FY24 and is expected to maintain the same.

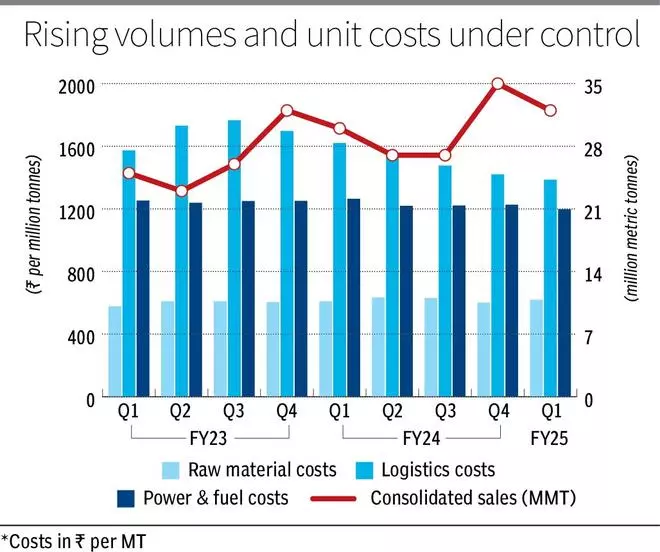

Primary costs in cement production relate to raw materials, power and fuel, and logistics. The company is set to improve the two controllable factors, power and logistics, significantly in the next two years. Lead distances are targeted for controlling logistics costs. The lead distance has decreased 15 km in Q1FY25 to 385 km for the consolidated operations. This resulted in 5 per cent/2 per cent year-on-year and quarter-on-quarter improvement in Q1FY25 logistics costs on a per tonne basis. The company has a target to reduce by 25 km in next two years and is positioned to positively surprise on that front, going by the Q1 performance. The recent acquisitions play a part in volume growth and also add to the geographical spread in the country, which is the basis for improvement in lead distances.

Compared with ₹7 per unit cost of traditional power, WHRS (waste heat recovery system) costs a fraction and green power costs ₹4 per unit. The company aims to have 60 per cent power from WHRS and green power by FY27 and 85 per cent by FY30. The company has improved from 25.7 per cent green power in Q4FY24 to 29.4 per cent in Q1, which resulted in 2 per cent improvement in fuel cost per tonne in the quarter.

The company has a high volume growth target combined with profitability improvement. The consensus estimates expect revenue and PAT growth of 12 per cent and 25 per cent CAGR in FY24-26 owing to dual impact. This is reflected in the valuation premium accorded at 35 times one-year forward EPS compared with 10-year average of 28 times.

But there are headwinds facing the company too. The realisations have been declining at 3 per cent in the last two quarters. This could be attributed to election-related pull back in demand and higher competitive intensity. While the election impact is a one-time phenomenon, the latter will be a structural factor. Raw material costs, too, have been benign as crude costs have softened. This could be expected to inch up in the coming quarters even if a sharp rise is not expected.

The primary drivers for the industry are overall demand and efficiency improvement, and UltraTech is well placed on both the fronts. The rising demand in India has been met with increased supply (resulting in flat prices). India’s cement industry added 7 per cent capacity in FY24 to reach 626 mt and the overall demand is expected to sustain in the 6-8 per cent growth range in FY25. A bounce-back in rural housing is expected to take the lead from urban housing demand, on the back of strong monsoons, and come out of sustained weakness in rural economy in the last two years. The ambitious national infrastructure plan has sustained its momentum post-elections with capex outlays maintained at higher levels.

On expected industry growth of 6-8 per cent in volumes growth, UltraTech can deliver a 200-basis point premium along with improvement in cost metrics. But the valuations should restrain investors to holding the stock at the moment.

Published on August 24, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.