The top five cement stocks (in terms of capacity), except ACC and Ambuja, have given decent YTD returns. Ultratech, Shree Cement and Dalmia Bharat have given returns in the 9-16 per cent range, whereas the Nifty 50 has gained only 4 per cent in the same period.

Ambuja and ACC gave good returns in 2022, but have not done well in 2023, as the stocks were impacted by the Hindenberg report on Adani. The industry was under pressure in FY23, particularly since onset of the Russia-Ukraine war, which jacked up energy prices. This put a lot of pressure on industry margins. However, raw material prices have started declining in the second half of FY23, and are expected to come down further in the coming period. This, combined with the government’s consistent infra spending thrust, appear to have driven outperformance in cement stocks. Here we analyse key metrics pertaining to the sector/ stocks

Input costs cooling down:

The main hindrance to the profitability of cement companies in FY23 was increased fuel costs and the inflation that followed. Energy prices hit a peak in the September 2022 quarter when the average price of imported coal was $417.5 per tonne, which was around 152 per cent higher YoY, Brent was at $97.7 per barrel, which was around 34 per cent higher YoY and imported petcoke at $224, which was close to 58 per cent higher YoY. The cost of these commodities started to cool in Q3 and Q4 FY23 and in the March 2023 quarter, costs seem to have reached close to or lower than that of the March 2022 quarter. However, the decrease in fuel costs does not seem to be reflect in the Q4 FY23 numbers due to the lag effect and is expected to be visible in Q1 and Q2 of FY24.

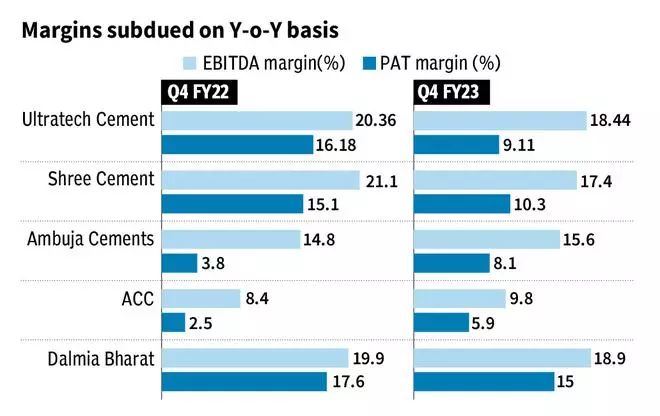

Results of the top five cement players in the March 2023 quarter were weaker in terms of profitability on a YoY basis. The EBITDA margins ranged from 8 to 22 per cent, and PAT margins from 5-12 per cent. The power and fuel costs of Ultratech Cement and Shree Cement remained elevated and were up by 34 per cent YoY and 47 per cent YoY in the March 2023 quarter, whereas the power and fuel cost for Dalmia Bharat remained flat YoY for the March 2023 quarter. However, ACC cut its power and fuel costs by around 9 per cent for the March 2023 quarter YoY, on the back of fuel mix optimisation, synergies with group companies and waste heat recovery system.

Pricing and volume growth

Volume growth in most companies was decent enough (average growth of 9.2 per cent YoY for March 2023 quarter for top five cement players), but the cement price per bag, instead of rising or staying flat, seems to have corrected. The price of one 50kg cement bag in March 2023 was ₹385, whereas it was ₹393 in December 2022 (Crisil data), which suggests an up to 2 per cent price decline in the March 2023 quarter. The demand prospects for the cement sector are healthy, with the increased focus of the government on infrastructure development and capital expenditure.

According to Crisil, cement prices are expected to correct 1-3 per cent in fiscal 2024 as reducing energy prices will reduce the input cost of manufacturing. In addition to this, the competitive intensity among players to gain market share will also be a major factor in deciding the trend of cement pricing.

Although the demand outlook for cement is positive the increasing capacity of the players is another variable, which must be considered. Ultratech has commissioned 2.2 million tonnes per annum in April 2023 and intends to increase capacity to 160 million tonnes by FY26. ACC and Ambuja Cement’s capacity is expected to grow by 11 million tonnes in the next 2-3 years, whereas Dalmia Bharat plans to add 5.5 million tonnes capacity by FY24.

Outlook:

The reduction in energy prices is good news for the industry and consumers as it would rein in the input cost. The reduction in input costs is expected to boost the margins of the cement producers. This seems to be the reason for the increased valuations and estimates of the cement companies as can be seen from the tables below. Expectations for improvement in profitability are quite strong, with EBITDA growth estimated to significantly outpace revenue growth.

The interplay of reducing energy and cement prices will be crucial in determining profitability in FY24. Companies that adopt strategies like a better fuel mix and waste heat recovery system . may have an edge over their peers. However, with most cement stocks having delivered good returns YTD and valuations trading at premium to historical averages, the optimism from a rebound in profitability appears largely priced into the stocks already.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.