Waaree Energies, the largest solar PV module manufacturer in India in terms of installed capacity has come out with its IPO. Waaree Energies is the parent of Waaree Renewables Technologies, the listed EPC arm of the Waaree group, holding 74.4 per cent of its outstanding shares. The offer is a combination of fresh issue to the tune of ₹3,600 crore and an offer for sale of ₹721 crore, totaling to around ₹4,321 crore.

The Company proposes to utilize around ₹2,775 crore for partially funding a planned 6-GW vertically integrated ingot, wafer, solar cell and solar module manufacturing facility while the remaining use of funds is tagged under general corporate purposes.

Waaree Energies is primarily a solar module manufacturer alongside solar gadgets and portable solar kits such as batteries, solar bags, solar street lights and solar mobile chargers. The Company has a 13.3-GW solar PV module manufacturing capacity as on date and is bigger than the next three competitors in line, in terms of installed capacity. And in the next three years, the company proposes to be backward integrated into solar cells, wafers and ingots, and forward integrated into power production and green hydrogen. This slew of capex planned is largely aligned with the industry trends.

At the upper price band, the IPO is valued at 33.9 times its FY24 earnings and 32.3 times its trailing 12-month earnings (till Q1 FY25). For comparison, Premier Energies, a direct competitor, was priced at a TTM PE of 50.9 times at the time of its IPO (currently trading at a TTM PE of 113 times). But, while Premier Energies was in the midst of a ramp-up of new manufacturing lines, Waaree Energies, at this point, seems to be near the top-end of the utilization curve with its existing manufacturing lines, as witnessed from its tepid Y-o-Y revenue growth of 2.4 per cent in Q1FY25. Nevertheless, better gross margins resulted in sustained EBITDA and PAT growth at a reasonable 15.5 per cent and 18.6 per cent respectively. Revenue growth from here will hinge largely on the capacity expansion currently underway. Module manufacturing capacity is expected to increase by 75 per cent between end FY24 and FY27.

Long term investors with high risk appetite can consider subscribing to the IPO, given the track record of the company in leading the industry amidst notable players like Adani (Mundra Solar), and its growth prospects as new capacity comes on stream.

Business expansion

The backward integration undertaken by Waaree Energies is into solar cells, wafers and ingots. A 5.4-GW solar cell manufacturing facility in India and a 1.6-GW solar module manufacturing facility in the USA are under construction and expected to come online by the end of FY25. The cell capacity is split between two technologies - TOPCon and monoPERC in the ratio of 4 GW and 1.4 GW respectively. These solar cells will be captively consumed in the manufacturing of solar modules.

The PLI-backed, 6-GW vertically integrated facility planned, would bring the solar module/ cells/ wafers and ingots capacity up to 20.9 GW/ 11.4 GW/ 6 GW, by the end of FY27. To put it short, ingots to wafers to cells to modules is the crude manufacturing flow.

The manufacturing technology for producing solar cells and modules evolves periodically and at present, the transition is from the existing Passivated Emitter and Rear Contact (PERC) technology to a more efficient Tunnel Oxide Passivated Contact (TOPCon) technology. HeteroJunction Technology (HJT) is also making rounds in the industry, which is touted to be superior than TOPCon, but it is yet to prove cost economics for the manufacturers. Important to note that Waaree is one of the earliest manufacturers to come out with its HJT modules in its latest road show.

The utlisation of the manufacturing facilities, according to the management, is the range of 45-55 per cent and this is around the peak utilization levels the company expects to function at, considering the downtimes in the course of regular operations, on account of configuration of manufacturing lines to the appropriate technology as needed. The company boasts of totally fungible manufacturing lines which could be configured to HJT/ TOPCon/ monoPERC/ multicrystalline technologies.

Waaree also has in place, a signed agreement to acquire a yet-to-be-commissioned 36 MWp solar power project, through which the company plans to venture into power generation.

With respect to green hydrogen, the Company has a PLI tender to set up manufacturing capacities to the tune of 300 MW for electrolysers, and apart from that, it is also in the planning phase to set up a gigawatt scale electrolyser manufacturing facility. Waaree is currently in discussions with several foreign players for a technology tie-up for local manufacturing in this space, and the arrangement is expected to be firmed up before the end of FY25. This project is in nascent stages and it is primarily a nudge in this direction at this point in time, with investments in this space quoted to be insignificant when compared with the investments made in solar projects.

Solid growth

Waaree has four revenue verticals – One, direct sales to enterprises comprising domestic sales. Two, export sales. Three, retail sales such as rooftop installations, which is primarily handled through a strong network of franchisees (369 franchisees as of Q1 FY25 against 284 in Q1Fy24). Four, other operating income from EPC, O&M, trading in ancillary products and others. Revenue contribution from these verticals on an average since FY22 is at 36 per cent, 50 per cent, 13 per cent and 1 per cent respectively.

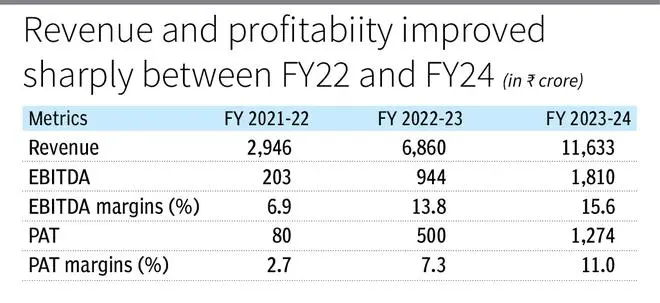

Revenue has grown 4x between FY22 and FY24 growing from ₹2,854.3 crore to ₹11,397.6 crore. EBITDA and PAT grew 9x and 16x respectively during the same period, as operating leverage kicked in. The growth was primarily on the back of a rapid capacity expansion (from 2 GW and 4 GW capacity as of FY21 and FY22 respectively). And this profit boom was backed up with healthy cashflows with CFO greater than PAT in all the years since FY22.

The company has a strong balance sheet with current net cash of around ₹3,580 crores, which will go up to ₹7,120 crores post IPO, putting it in a comfortable position to fund its capex plans.

The orderbook stands at 16.66 GW as on June 30, 2024, which offers revenue visibility for around 15 months. The orderbook includes a 3.75 GW order of its American subsidiary.

Key monitorables

While the backward integration into cells will help Waaree join a small list of integrated solar cell and module manufacturers in the country and one of the earliest venturers into wafers and ingots, it comes with huge capex (the integrated facility is expected to cost around ₹9,000 crore) and significant execution and regulatory risks. A recent F&S analysis observed that achieving high cell efficiency and high yields typically take anywhere between 6 months to 12 months. Parallel diversification into power generation and green hydrogen, raises concerns that it may be overextending itself.

Over the past three FYs, approximately over 50 percent of Waaree’s revenue has consistently come from exports, with nearly 99 percent of its export revenue being concentrated in the US markets. Waaree is a beneficiary of the current US sanctions against Chinese products. Any increase in tariffs for imports from India into US can impact revenues. However, the company’s plans to set up a 1.6-GW solar module manufacturing facility (which could be further expanded upto 5 GW) in Texas, US, might insulate the company to some extent in the above regard. Though the costs of a supply chain sourced outside of China (which is the cost leader in both solar cells and modules) is relatively expensive, export customers to a major extent and for government projects in India, there are strict requirements norms to be largely independent of China. And Waaree has a good track record in these compliances seen via its rapid increase in exports and being on the Approved List of Models and Manufacturers (ALMM) in India respectively.

The inherent risk in this industry is that the players are prone to technological obsolescence with constant investments needed to stay relevant. And there is a risk of supply overhang because of the China factor.

These risks as compared against the growth prospects, given the strong thrust for renewables/solar energy globally and Waaree’s established presence, make this IPO suitable for long term investors but only for those with high risk-appetite.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.